What is Solvency?

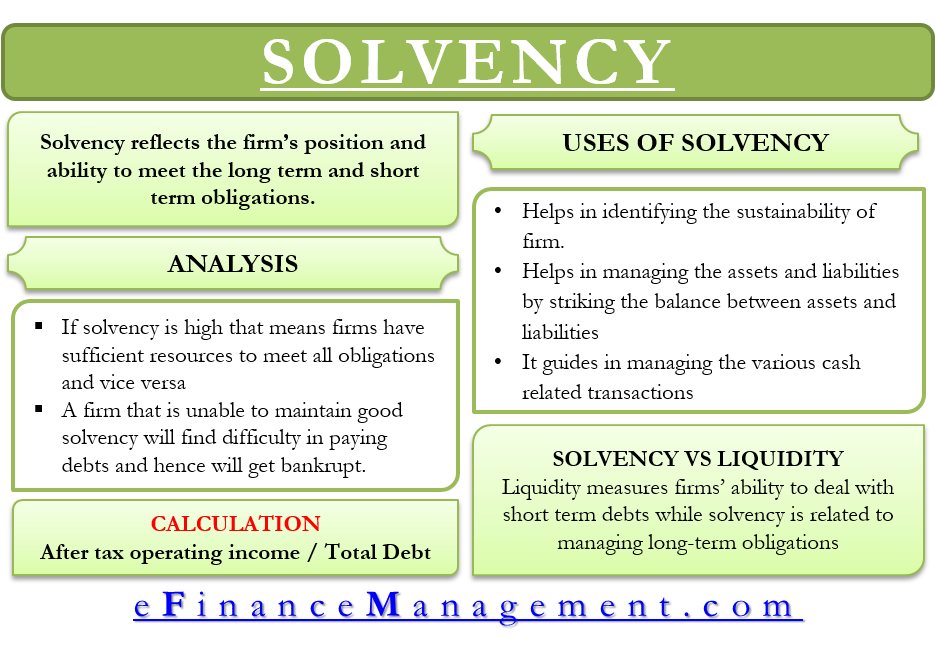

Solvency reflects the firm’s position and ability to meet long-term and short-term obligations. It is known as the long-term stability from the financial aspect to cover various obligations as and when they become due to the firm. It also depicts the firm’s ability to continue and grow the business in the future. If it is high, that means firms’ have sufficient financial resources to meet all the obligations, and if solvency is low, the firm will struggle to meet or fulfill the debt obligations on time.

It is very important to maintain solvency as it helps continue operations into the foreseeable future. It is different from liquidity and should not be confused with it. Liquidity is associated with short-term obligations, while solvency is associated with long-term obligations. In order to be solvent, the company’s assets must be higher than all of its debt.

What does it Explain?

It identifies the capacity of a firm to manage its debts and attain the goals of the organization by managing profitability. A firm that cannot maintain good solvency will find difficulty in paying debts and, hence, will go bankrupt.

What are its Uses?

- It helps identify the sustainability of a firm and the ability to continually grow in longer tenure. As it reflects the firm’s capacity to meet the obligations on time and attain the required growth and development.

- It also helps a firm manage the assets and liabilities that contribute to attaining the required level of debts by striking an effective balance between assets and liabilities.

- It also guides in managing the various cash-related transactions to maintain the cash flow as required, which will directly affect a firm’s liquidity.

Stakeholders for the Firm’s Solvency

Investors and creditors check their solvency. They are concerned with checking the financial standing and evaluating the growth and profitability aspects of the organization. Investors, before investing, should analyze all the financial records to find out the solvency. Even creditors, before giving the credit, consider this to find out the ability of the firm to repay debt. A firm having low solvency finds difficulty in managing revenues to pay off obligations, and hence they will not be able to timely pay back the new debts.

Also Read: Solvency Ratios

Solvency Vs Liquidity

These two concepts help in determining the financial health of an organization. But these two are distinct from each other. Liquidity measures firms’ ability to deal with short-term debts, while solvency is related to managing long-term sustenance and continued operations in a longer duration.

Assessing the Solvency of a Business

The balance sheet and cash flow reflect the solvency to some extent.

- The balance sheet shows the assets and liabilities. The firm is considered to be solvent if the realizable value of all assets is greater than liabilities.

- Cash flow shows the cash transactions that help identify the firm’s capacity to meet short-term obligations.

Altman Z Score is a tool for assessing the solvency of a company.

How to Calculate?

The solvency ratio measures whether the cash flows are sufficient to meet short-term and long-term obligations. The higher the ratio, the better the firm’s position with regard to meeting obligations, whereas a lower ratio shows the greater the possibility of default by the firm.

The formula is:

Net after-tax income= Net income + non-cash expenses

A ratio higher than 20% is considered good, but it varies from industry to industry.

Example

Let’s say that Mr.X is planning to invest in a company. He doesn’t know how to make the decision. He asked one of his planners, and he suggested considering the solvency of the company. So The planner, on behalf of Mr. X, checks the net worth. The company’s net worth is positive, and it signifies that the company has sufficient assets to meet its obligations.

Conclusion

Thus, the solvency evaluated the firm’s capacity to manage the long-term obligation and timely fulfill all the debts. In order to judge the firm’s ability to grow and sustain itself in the market, a solvency check is one of many good parameters. The better the solvency of the firm is, the better it will meet all the obligations timely. The prospective lenders should use solvency to judge the creditworthiness of a firm before lending the credit.

RELATED POSTS

- Financial Distress – Meaning, Reasons, and Tips To Overcome

- Liquidity Ratios

- Current Ratio – Meaning, Formula, Calculation, and Interpretation

- How to Analyze and Improve Debt to Total Asset Ratio?

- Advantages and Disadvantages of Current Ratio

- 10 Strategies for Managing Business Debts and Liabilities

Please post Content on treatment of goodwill