What is Seed Funding?

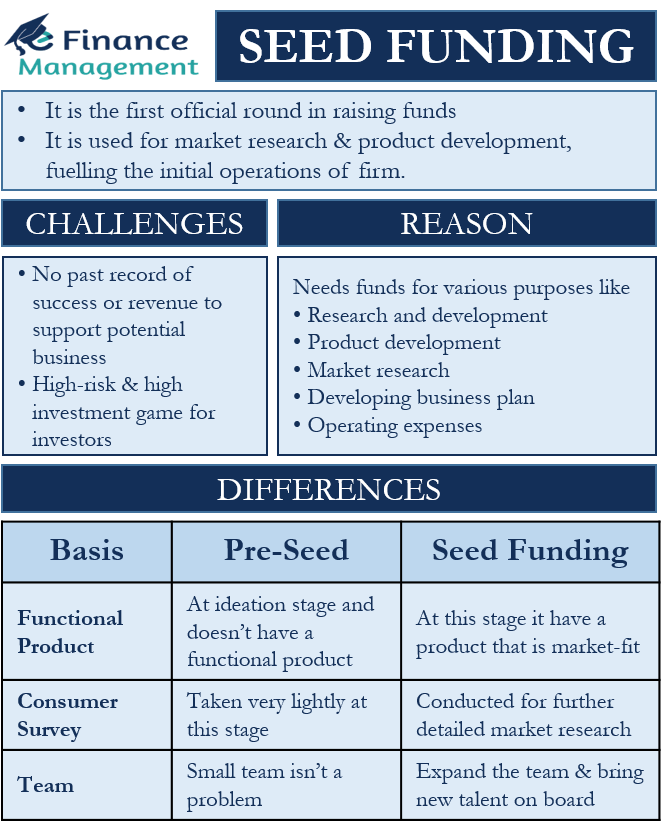

Seed funding is the first official round in raising the funds. As the name of the round ‘seed stage’ suggests the analogy of start-up as a seed that is ready to grow in a tree. Seed funding is used for market research and product development, fuelling the initial operations of the firm. Seed funding is important for kickstarting the business. The main investors are angel investors who are looking for risky, high-potential businesses that can revolutionize the market.

Start-up funding is a process that varies from one business to another. You may see one start-up raising funds exceptionally well while few other firms are searching for investors for years. The former case is backed by either a solid product that is ready to change the world or a competent team that has a history of achievements and strong credentials as well as necessary technical knowledge. It is either the product or people or the idea that the investor always invests in. There are different stages for businesses to raise funds. In the early stage when the business has not yet commercialized its product and it is in the ideation stage, this type of funding is known as pre-seed funding.

For a business, there are usually two sources of funding, internal and external. Internal funding is when the company utilizes its own funds to fuel its growth. This internal funding can be from the promoter, teammates. In external funding, there are many options, either the firm can borrow money, raise capital by exchanging equity, or resort to family and friends. But as a firm grows and expands, the family and friends option becomes irrelevant for the kind of funding requires. Hence, the firm needs to look beyond this small circle.

How many Seed Funding Rounds can be Raised?

A firm usually can go to n number of funding rounds, as per the requirement and scalability. But, as a firm acquires funding in the seed round, it can then further raise money from the Series A round. It depends on the firm, whether they want to opt for a series A round or want to go either public or continue growing on its own.

Reason for Seed Funding

The question is why do firms raise capital in exchange for equity at such an early stage of business. The firm needs funds for various purposes like Research and development, product development, market research, developing a business plan. A firm also uses the seed capital to fund initial operating expenses like insurance, rent, electricity, purchase orders, etc.

This stage varies from firm to firm, as revenue is different. A firm may or may not have revenue depending upon the industry it is venturing into. But, the investors do look for social media numbers, consumer surveys, prototype test results, and financial forecasts to understand the business better.

Challenges

For Business

When a firm is moving ahead to secure seed capital, there is no past record of success or revenue numbers that will support the potential of the business. The success of a business is dependent on the idea and people in the business.

For Investors

For the investor, it is a high-risk and high investment game, which can lead to earning great rewards, if it works out well or either there can be a heavy loss.

Average Seed Funding

The average seed funding amount is now equivalent to what it was for the Series A round a decade ago. With the onset of technology, the world has changed and people are bringing new ideas and ventures. Most seed rounds have $1-4 million as the average amount raised. In 2020, in the seed stage, firms raised on an average $4 million, ten times the amount raised in 2012.

Pre-Seed Vs Seed Funding

The line between pre-seed and seed funding is not clear at times, especially for technology companies. There are certain standards or milestones a firm at the seed stage should have achieved, these include:

Functional Product

In pre-seed funding, the firm is in its ideation stage and does not have a functional product that can be readily sold in the market. At most, there is a prototype. While in seed funding, it is otherwise. At the seed fund stage, a firm should have a product that is market-fit and ready to roll in the market.

Consumer Survey

This step is often taken lightly in pre-seed funding. The question to be asked is that the true picture is created by conducting surveys and understanding. A consumer survey helps an entrepreneur understand the market better. At the seed stage, with the funds received he/she can also conduct further detailed market research. And that survey gives the confidence and extent of the potential of the business plan. It also details the areas and segments, the tentative strategy to approach, the feedback of the distributors and consumers, and the status of the demand curve.

Team

A small team is not a problem, in the beginning, that is the pre-seed stage. The team should be credible, understands the nitty-gritty of the business, and be competent and reliable. After a certain stage of growth, the business can use funds to expand the team. This team expansion helps to bring new talent on board as well as distribution of work in a proper manner amongst the team members to dedicate resources in a focussed manner.

Example

Hypothetically, Starcross Ltd. is currently looking for funds to ramp up its marketing, create a presence in the market, make a business plan and kick start initial operations. The owners are confused and want to raise funds but are reluctant in choosing the debt market because of high-interest rates. Thus, the owners chose to raise funds from angels investors and venture capitalists. Venture capital or private equity firm will connect the Starcross to relevant investors. The exchange of equity with cash from investors will take place, and the firm will be benefited from the mentorship of investors.