What is Series B Funding?

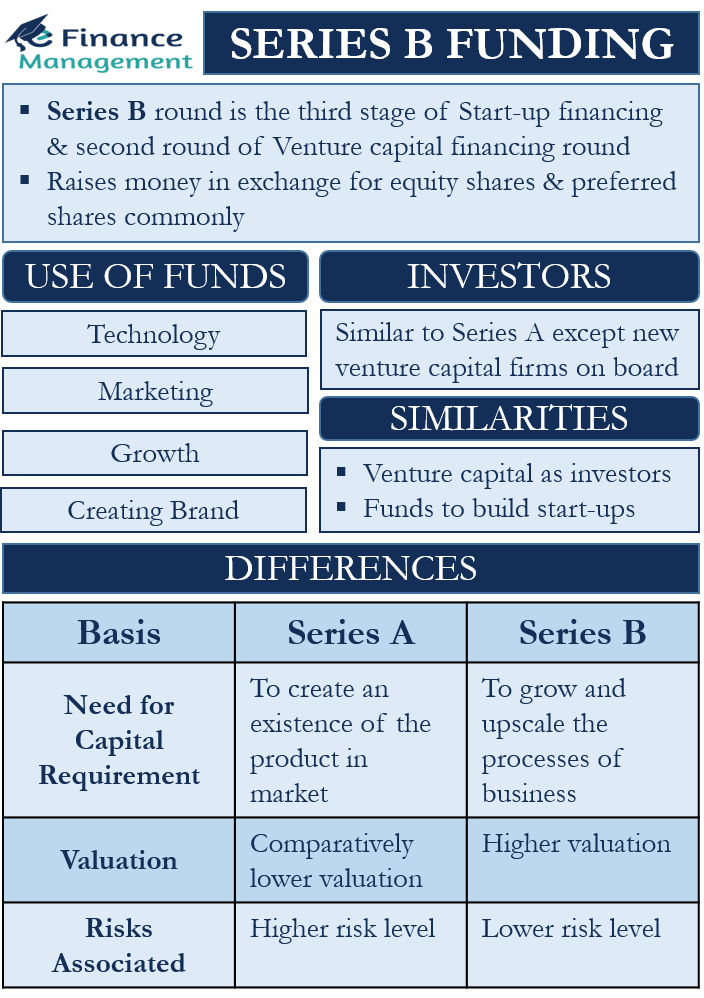

Series B financing is the round of finance after Series A Round of Financing. Series B round is the third stage of Start-up financing and second round of Venture capital financing round. As done in the seed funding and Series A round, the firm is raising money in exchange for equity shares, preferred shares commonly. Issuing preferred shares is an anti-dilution technique, as there are no voting rights in preferred shares. The issued preference shares sometimes also include the option of convertibility, to common stock.

Use of Funds

The companies entering the Series B round are developed with stable or growing revenues and are also earning some profit. The purpose of raising the funds vary from industry to industry, but the common reasons are:

Technology

To increase the expertise of technology and enhance the current practices with better technology.

Marketing

Advertising and marketing are crucial in creating a brand of the business. A high budget of advertising will be used in marketing the product through costly mediums like television, hoardings, etc. Today, digital marketing, google ads, and influence marketing also play a crucial role in creating a digital presence of the brand. This also includes making a creative ad that can start a trend or buzz in the market.

Growth

The growth can be understood as expanding the capacity to meet the increasing demand. Growth can also include diversification as the firm might want to increase its range of products or add new products to the line. The important point here to note is that the firm is already at a developed stage, making sales and hence to grow the funds will require help.

Creating Brand

A great product or service plays are the factors that drive sales, but the main aim is to retain loyal customers, making them brand conscious. To grow and become successful as a business, one should know how to create a brand. It represents the story of the entrepreneur or team.

Valuation of Series B Funding

Companies acquiring this funding are already well established with a smooth revenue model. Firms need funds to get hands-on business development, technology, and mentorship. In 2020, the median for valuation of the firms acquiring Series B funding was $26 million. In 2021, the pre-valuation of firms raising Series B funds was $40 million, an indication that firms are doing well in the market.

Investors of Series B Funding

The characters and players in the Series B funding stage are similar to Series A, except there are new venture capital firms on board. Firms and investors who specialize in later-stage investing are prominently present at this stage. The same old rule, equity in form of preference shares, convertible preference shares in exchange for equity.

Difference between Series A and Series B?

Need for Capital Requirement

The main difference lies in the need for capital requirements. Series A funds firms that are in need of that push to blow the market, create an existence of the product, attach consumers to it. While Series B funding is more inclined towards the later stage. That is to grow, scale and invest more to upscale the processes of business.

Valuation

Valuation is another difference between Series A and Series B. Mainly, the valuations of companies acquiring Series B funding are higher than companies acquiring Series A funding. As the Series B firm is well established and has given out equity in previous rounds, the capital requirement is higher with less equity in return. Many firms are cautious and want to avoid down round, that is raising money in exchange for more equity than previous rounds.

Risks Associated

For both the series the risk perceived varies to the investor. Firms in Series A are at high risk as the start-up is at a nascent stage and there is a negligible record of success. While firms raising Series B funding are well established and pose a lower level of risk to the investors.

Similarities

Along with differences, there are two similarities between both the stages of funding. Firstly, venture capital as investors is common investors in both the rounds of raising funds. Another similarity is that both are raising funds to build their start-ups to move to the next round of growth.