What is Series A Funding?

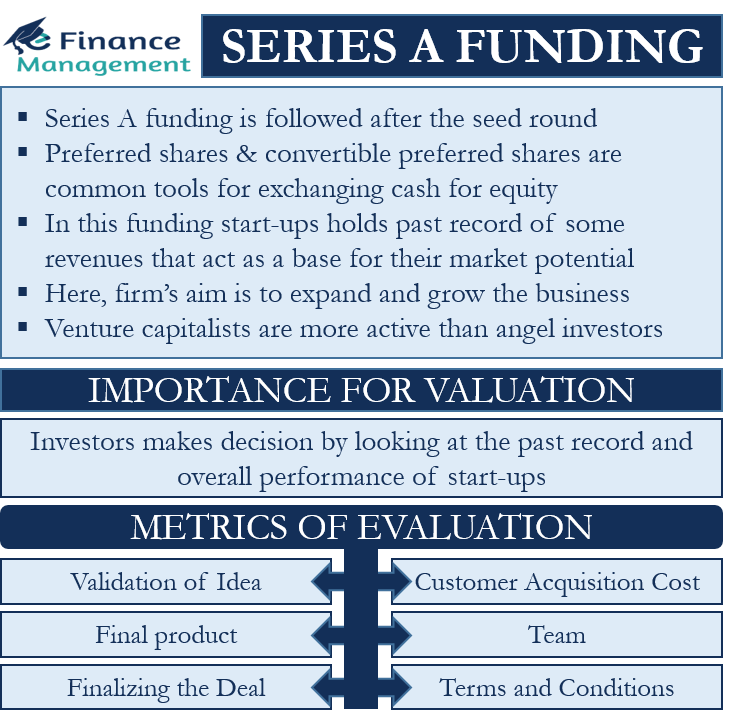

Start-up begins their funding at the pre-seed and seed stages. Firms use the seed funding to develop business plans and other initial operations. Series A funding is then followed after the seed round. In, Series A funding, preferred shares and convertible preferred shares are common tools for exchanging cash for equity. Start-ups acquiring Series A funding holds a past record of some revenues that act as a base for their market potential. Here, the firm’s aim is to expand and grow the business.

Venture capitalists are more active in Series A funding than angel investors. Another way for entrepreneurs is the use of crowdfunding after securing seed funding. Start-ups are raising money through SeedInvest and Onvest which are the online platforms for raising funds in the US. The investors who participate in equity crowdfunding, i.e crowdfunding in exchange for equity, are mostly angel investors, strategic investors, customers, and even venture capital investors.

Statistics say only 10% of companies that acquired seed funding go on to raise Series A funding. Though with technology soaring, and increased valuations more firms are resorting to this type of funding. In the year 2020, firms have acquired Series A funding from $2 – 15 million, an average of $10 million.

Importance of Valuation

In Series A funding the role of valuation is critical. The investors will get information on the past records of the firm, track the management of funds raised in the seed funding stage, and the overall decision and strategy of the firm. So investors coming on board takes a detailed look into the overall value of the firm.

Metrics of Evaluation

Though it is difficult to secure Series A funding, it is not impossible. With the right pitch and indicators, a start-up can increase its possibility of getting the deal for Series A funding. The parameters to be considered are:

Validation of Idea

The Venture Capitalist at this stage will analyze your idea, how well accepted it is now, and what can be improved. If the idea is well accepted, it validates future success.

Customer Acquisition Cost

Marketing a product and then converting the leads to actual consumers is beneficial. If the firm is promoting the product well but fails to acquire customers then the cost of acquiring one consumer is high. Venture capitalists look out for the customer acquisition cost to see how much the start-up is spending to acquire consumers.

Final product

Features, the product line, diversity are important features for future growth and potential. Venture capitalists put importance to the product quality, size and other parameters decided based on industry to industry.

Team

People or the human resource of the firm is critical factor in driving the success of the firm. Even with every resource, many firms fail because the people driving the business are either not competent or lack the strategic approach that prospers the business. A competent team that is open to feedback with prior experience is what many look for. In the pitch, one should also include plans for hiring people in the future and the requirements that will arise.

Finalizing the Deal

It is better to always be prepared. When the Venture capitalist agrees to invest, it will still take 3-6 months to close the deal, finish the paperwork. So it is beneficial to be ready with a lawyer so that the process becomes quick and smooth.

Terms and Conditions

It’s a big deal to raise funds and investment but one should choose deals that fit his/her vision of the business. Getting too excited and not thinking can create problems in funding future rounds.

For a business, it is very important to choose the right venture capital who understands the goals and aspirations of the business. A venture capitalist with the right skills who is a leader and mentor can do wonders for the business.

Example

Chaossearch, a Boston-based Analytics company raised $9 Million in a Series A funding round. Chaossearch is a Boston-based log-search and analytics platform which secured funding by investors including .406 Ventures and Glasswing Ventures. The main aim of raising funds is to expand their log and event retention data. Many technological start-ups are raising funds to grow and expand their operations.

RELATED POSTS

- Venture Funding

- Exploring Different Types of Venture Capital and How they different from Angel Investors

- Series C Funding – Meaning, Advantages, Disadvantages, and Trends

- Pre-seed Funding – Meaning, Importance, Requirement, Challenges and Opportunities

- Angel Investors

- Advantages and Disadvantages of Venture Capital