Welcome to the captivating realm of venture capital, where pioneering ideas are nurtured and transformed into groundbreaking businesses. For those seeking funding, different types of venture capital (VC) is a fascinating domain that holds immense potential. In this article, we will learn about venture capitalists, who are people that invest money into businesses. We will understand how they work and get some useful information about what they do.

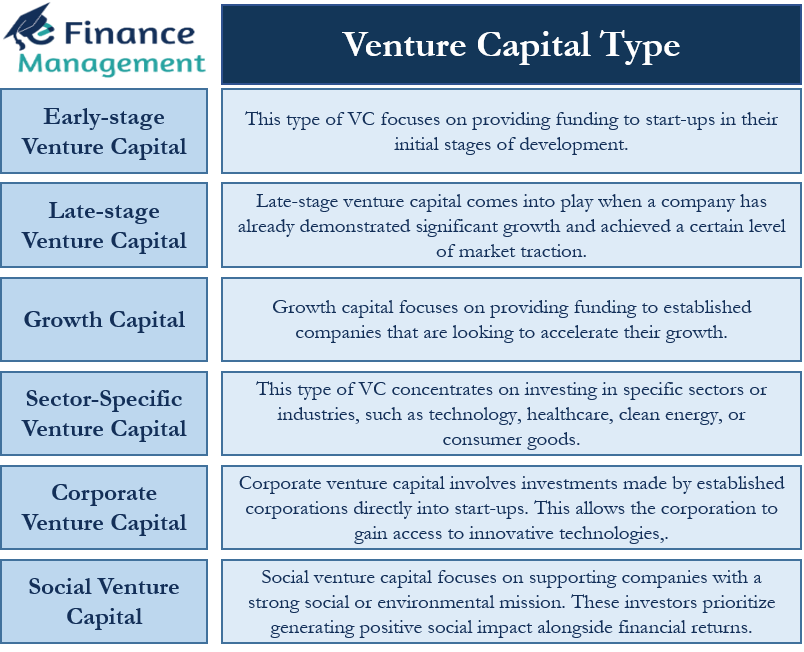

Venture Capital Type

Venture capital serves as a catalyst for innovation and growth, providing vital financial support to early-stage or high-potential companies. It’s sort of like the fuel that gives startups the energy they need to succeed. It helps them grow and become successful. There are different types of venture capital, and they are different from angel investors. Entrepreneurs need to know about these things to get funding and understand how the financial side of startups works. Here are some common types of venture capital:

Early-stage Venture Capital

This type of VC focuses on providing funding to startups in their initial stages of development. Early-stage venture capitalists typically invest in companies that have promising ideas or prototypes but lack the resources to bring their products or services to the market. They take on higher risks but also aim for substantial returns if the startup succeeds.

Real-life example

In its early stages, Airbnb received funding from venture capital firms such as Sequoia Capital, Greylock Partners, and Andreessen Horowitz. This early-stage funding allowed Airbnb to expand its platform and disrupt the traditional hospitality industry.

Late-stage Venture Capital

Late-stage venture capital comes into play when a company has already demonstrated significant growth and achieved a certain level of market traction. Investors at this stage provide financing to support scaling operations, expanding into new markets, or enhancing existing products or services. Late-stage venture capital carries a lower risk compared to early-stage funding, as the company has already validated its business model.

Real-life example

SpaceX, the aerospace manufacturer and space transportation company founded by Elon Musk, has raised significant late-stage venture capital funding. Companies like Google Ventures and Fidelity Investments have invested in SpaceX to support its ambitious goals of revolutionizing space travel and exploration.

Growth Capital

Growth capital focuses on providing funding to established companies that are looking to accelerate their growth. These companies have typically surpassed the early-stage phase and have a proven business model. Growth capital investors aim to fuel expansion, increase market share, and drive further revenue growth.

Real-life example

Uber, the ride-hailing giant, has secured growth capital from investors such as SoftBank Vision Fund and TPG Growth. This funding has enabled Uber to expand its operations globally, invest in new technologies like self-driving cars, and diversify into other areas such as food delivery with Uber Eats.

Also Read: Venture Funding

Sector-Specific Venture Capital

This type of VC concentrates on investing in specific sectors or industries, such as technology, healthcare, clean energy, or consumer goods. Sector-specific venture capitalists possess expertise and deep industry knowledge, allowing them to identify and capitalize on emerging trends and disruptive innovations within their chosen field.

Real-life example

Moderna, a biotechnology company specializing in mRNA-based therapeutics and vaccines, received sector-specific venture capital funding from firms like Flagship Pioneering. This funding supported Moderna’s research and development efforts, leading to breakthroughs in mRNA-based COVID-19 vaccines and other medical advancements.

Corporate Venture Capital

Corporate venture capital involves investments made by established corporations directly into startups. This allows the corporation to gain access to innovative technologies, products, or talent that can enhance its existing business or diversify its operations. Corporate venture capitalists often seek strategic partnerships or acquisition opportunities with the startups they invest in.

Real-life example

Intel Capital, the investment arm of Intel Corporation, has made numerous investments in startups aligned with its strategic interests. For example, it invested in companies like Cloudera (data management and analytics) and DocuSign (electronic signature technology) to enhance its technology portfolio and foster synergies with its core business.

Social Venture Capital

Social venture capital focuses on supporting companies with a strong social or environmental mission. These investors prioritize generating positive social impact alongside financial returns. Social venture capital plays a crucial role in funding startups that tackle issues such as poverty alleviation, sustainability, healthcare accessibility, and education.

Real-life example

Acumen is a social venture capital firm that supports businesses focused on addressing poverty and social challenges. One of their investments includes d.light, a company that provides affordable solar lighting solutions to underserved communities in developing countries, enabling access to clean and sustainable energy.

Venture Capital vs Angel Investors

The following is the difference between venture capital and angel investor.

| Difference | Venture Capital | Angel Investors |

|---|---|---|

| Source of Funds | Venture capital funds are pooled investments from various institutional investors, such as pension funds, endowments, and corporations. They typically have substantial capital to invest and are managed by professional fund managers. | Angel investors are typically individuals who invest their own personal funds into startups. They may have a background in entrepreneurship or specific industries, and they invest based on their own personal criteria and interests. |

| Investment Size | Venture capital investments are generally larger in scale. VC firms typically invest millions of dollars in startups and early-stage companies, and they may provide multiple rounds of funding as the company grows. | Angel investments are typically smaller in scale compared to venture capital. Angel investors may invest anywhere from a few thousand dollars to a few million dollars, depending on their personal financial capacity and the specific opportunity. |

| Funding Timeline | Venture capital firms have a structured investment process and due diligence criteria. They may take several months to evaluate and negotiate investment terms before finalizing a deal. The funding process can be lengthy and involve multiple rounds of negotiations. | Angel investors can often make investment decisions more quickly compared to venture capital firms. They have more flexibility in their decision-making process, and funding can be secured within weeks or even days. |

Conclusion

In conclusion, exploring the different types of venture capital and understanding how they differ from angel investors is essential for entrepreneurs and investors alike. Venture capital encompasses a range of investment firms that provide funding, mentorship, and support to startups at various stages of growth. From early-stage venture capital to late-stage funding, growth capital, sector-specific investing, corporate venture capital, and social venture capital, each type brings its own investment focus and expertise to the table.

On the other hand, angel investors play a distinct role in startup financing. These individuals bring their personal funds, industry experience, and networks to invest in early-stage companies. Their investments often come with more flexibility, quicker decision-making, and a personal touch.