Capital Infusion: Meaning

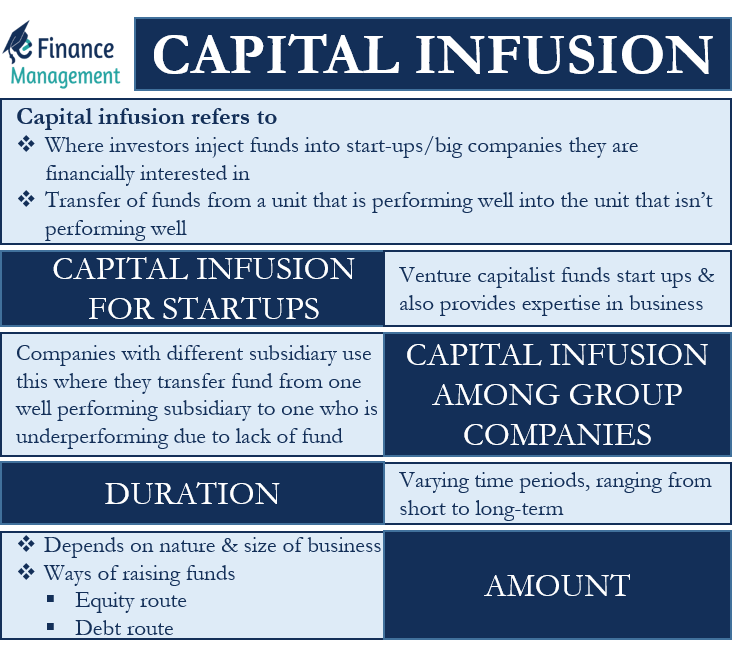

Lack of capital could result in low inventory, limit the reach of the business, as well as unhappy staff and constant operational bottleneck. These are the primary reasons why a business needs an infusion of capital. In the world of finance, Capital Infusion refers to two things.

The first is the process where investors inject funds into the startups or big companies with a financial interest.

And the second process refers to the transfer of funds from a subsidiary or unit that is performing well into the unit or subsidiary that is not performing well. |Or we can say the transfer of capital within a group of firms. The objective of transferring funds is to inject new life into the unit or subsidiary.

Capital Infusion for Startups

Generally, many startup firms show potential, but they are unable to grow due to the scarcity of funds. Venture capitalists, however, could help to address this issue of startup companies. The capital infusion could help startups to fund their future growth either by buying machines and equipment, hiring employees, and more.

VCs as we know are not only the providers of funds but they are also involved and provide their technical and managerial expertise to these start-ups. Or we can say that they are strategic investors with vast experience across businesses. Thus, they can help startups with operations, as well as marketing arrangements. The venture capitalist may be a benefactor or a business associate with the startup. In such a case, investors will work harder to recover their capital investment.

Separately, venture capitalists could infuse funds into the companies witnessing financial crises. Usually, such an investment aims to gain a stake in the company to acquire shares, as well as management positions. Let us not forget that venture capitalist are shrewd businessmen as well. So they will only invest money in an ailing company if they believe the turnaround is possible. And going ahead with this ailing company will offer them a reasonable return on their investment.

Capital Infusion Among Group Companies

Usually, big organizations take up the second type of infusion of funds. Such organizations generally have different subsidiaries that work towards the common objective of making the organization more profitable.

For example, Company A deals in selling mobiles, TVs, Computers, laptops and ACs. All products are under a different unit. And each unit is independently responsible for the production and marketing of its product. Now, if the TV unit is unable to generate profits, then the management could decide to inject funds from other units into the TV unit. Such infusion of funds would allow the TV unit to stand up against the competition. This type of infusion of funds is an internal capital infusion within a group of firms.

How, How Much and For What Duration?

Capital infusion can be for varying periods, ranging from short to long-term. Moreover, the amount of funds that a company needs depends on its nature and size. For infusion of funds the company may adopt mainly one of the following two routes:

Also Read: Sources of Equity Financing

First is the equity route. Under this, an investor gets shares in exchange for the capital infusion. The investor becomes the shareholders. And he may even be offered a seat on the board depending upon the quantum and terms of investment.

And, in the debt route, the company may issue debentures or bonds to investors. Or take debt in exchange for its immovable and moveable property. These debt raising could be from the public, financial institutions, banks, or private investors.

A point to note is that the above two methods of infusing capital generally hold in the case of startups and not when an organization provides funds to its non-performing or underperforming subsidiary. In the second case, the organization mainly uses the profits of its other units to provide capital to the other unit.