If you are thinking about taking a federal loan for education, then there are two options to select from: subsidized or unsubsidized. As the word suggests, a subsidized loan offers some subsidy to students by way of interest. And the unsubsidized ones do not have any such feature. In addition to this, there are many more differences between Subsidized vs Unsubsidized loans. Those planning to go for a federal student loan must consider these differences to decide on the type of student loan they should go for.

Before we detail the differences between subsidized vs unsubsidized loans, let us understand what the two loans mean.

Subsidized and Unsubsidized Loan: Meaning

Subsidized loans are available only to undergraduates. The objective of subsidized loans is to support students who need more financial backing. And this is why students applying for this loan have to demonstrate financial need. No interest accrues on such loans during the period the student is in school. Also, no interest accrues during the deferment period.

However, unsubsidized student loans are available for all, whether they are pursuing graduate or undergraduate programs or a professional degree. The interest on these loans starts accruing immediately on disbursement. Moreover, the interest that remains unpaid before the grace or loan deferment period is capitalized. Further, students applying for this loan do not need to demonstrate any financial need as well.

Subsidized vs Unsubsidized Loan: Differences

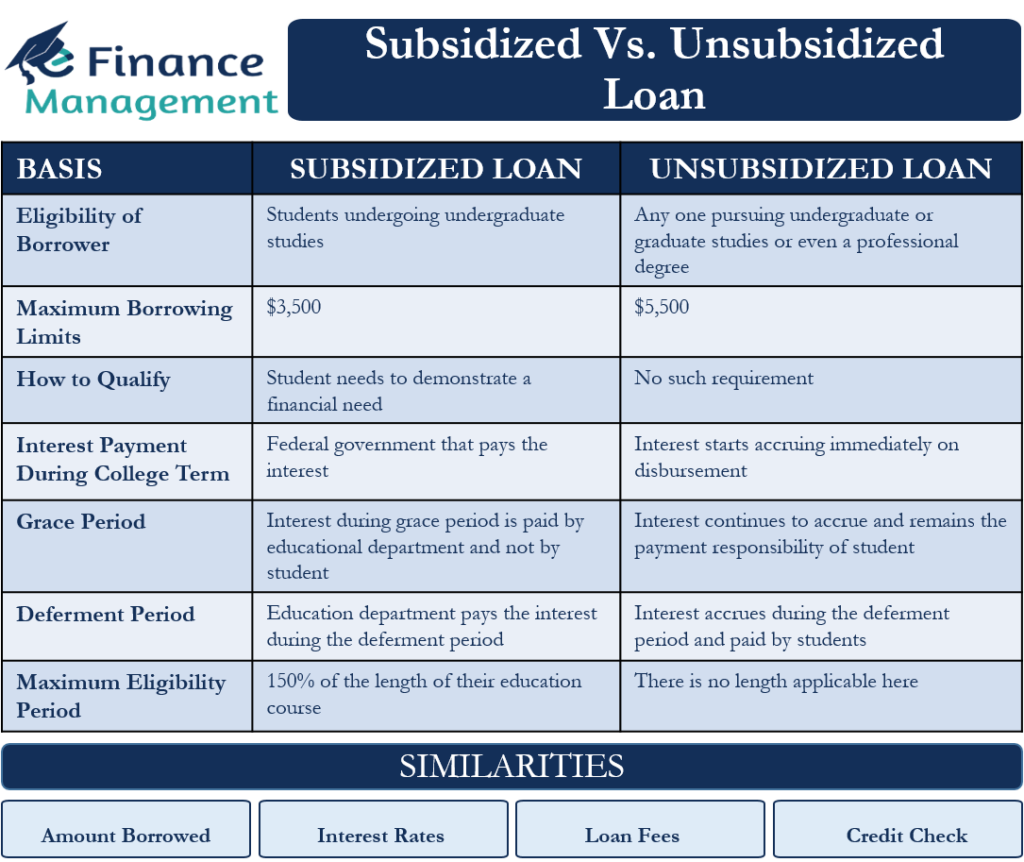

Below are the differences between subsidized vs unsubsidized loans:

Who can Borrow?

The students undergoing undergraduate studies are only eligible to apply for subsidized loans. Whereas any student, whether pursuing undergraduate or graduate studies or even a professional degree, is eligible to get unsubsidized loans. Of course, in both cases, the student must be enrolled at least for half time.

Maximum Borrowing Limits

Subsidized loans have lower loan limits in comparison to unsubsidized loans. In contrast, unsubsidized loans have relatively higher loan limits. For instance, a first-year undergraduate student can borrow up to $3,500 in a subsidized loan, but the limit is $5,500 for an unsubsidized loan.

What You Need to Qualify?

To qualify for a subsidized loan, a student needs to demonstrate a financial need. The borrower needs to provide the financial information demonstrating the need when submitting the FAFSA (Free Application for Federal Student Aid). In contrast, there is no such requirement for unsubsidized loans.

While demonstrating the need in the case of subsidized loans, all sources of funding are taken into account. For example, family contributions, grants, scholarships, etc. After adjusting all this, if there is still a gap with regard to the total expenses then and then only the student would be eligible for a grant of subsidized loans. If these sources are enough to meet the expenses of the student, then no subsidized loans will be there. However, this is not so in the case of unsubsidized loans, and the student can still apply and can get the unsubsidized loan.

Example

Let us try to understand this aspect of loan eligibility by an example. Suppose Mr. A is a first-year dependent undergraduate student. His total eligible expenses for the first year are $18,600. Mr. A’s EFC (expected family contribution) is $10,000, and for other grants, he is eligible for the amount of $9,000.

In this case, Mr. A will not be eligible for a subsidized loan because the EFC and other financial aid are more than the cost of his attendance/expenses for the first year of undergraduate. So, there is no financial need.

Mr. A, however, is eligible for an unsubsidized loan. Even though Mr. A needs a loan of $9,600 ($18,600 less $9,000), he would get only $5,500, which is the maximum available for a first-year dependent undergraduate student.

Who Pays Interest During College Term?

In a subsidized loan, it is the federal government that pays the interest during the college term. The interest on these loans starts accruing immediately on disbursement. And it also continues to accrue.

Grace Period

In both subsidized and unsubsidized loans, there is no requirement to make a payment in the first 6 months after a student leaves school. But during this moratorium period, the interest on subsidized loans is paid by the education department. Thus the interest during the grace period is on account of the department and not on the student.

Whereas no such payment comes from the education department for all unsubsidized loans. And the interest continues to accrue and remains the payment responsibility of the student even for the grace period. At the end of the grace period, such interest will get capitalized or added to the original loan amount. And thus, this would increase the total loan amount to the extent of the grace period interest.

Interest Treatment during Deferment

Deferment means temporarily pausing the payment. The education department pays the interest during the deferment period. But, in an unsubsidized loan, interest accrues during the deferment period, and again the payment is ultimate to be made by the student only.

Maximum Eligibility Period

In the case of a subsidized loan, the borrowers can take a loan for up to 150% of the length of their education course. This means if the academic program is for four years, then the maximum eligibility period is of six years. In contrast, such an extended period is not applicable for unsubsidized loans.

Subsidized vs Unsubsidized Loan: Similarities

Along with the differences, there are many similarities between subsidized vs unsubsidized loans as well. These similarities are:

Amount Borrowed

It is the school that determines the final loan amount that the student will get. Once the applicant gives the application and other documents, the affiliated school will detail the financial aid package. This package will reveal the amount that the student can get under both types of loans.

Interest Rates

The interest rate for undergraduate students is the same under both types of loans. Currently, the interest rate is 2.75% for undergraduate students. The rate of interest is 4.30% on unsubsidized graduate degree loans.

Loan Fees

Both these types of loans carry the same fee. Presently, the loan fee for both types of loans is 1.057% (for loans between on or after October 1, 2020, and October 1, 2022).

Credit Check

This is another similarity between these two types of loans. In both types of federal loans, there is no credit check for the borrower, whether he is applying for a subsidized or unsubsidized loan.

Subsidized vs Unsubsidized Loan: Which to Repay First?

If the student has both subsidized and unsubsidized loans, then it is a better idea to first repay the latter. This is because the interest on the unsubsidized loan continues to accrue during the course period. So, the total outstanding balance gets bigger in the case of an unsubsidized loan. Thus, by prioritizing this loan, the borrower will be able to save on interest more than in the case of a subsidized loan.

For example, suppose the student took a subsidized and unsubsidized loan of $2,000 each in the final year (at 2.75%). Once the course is completed, the outstanding balance in the case of the subsidized loan will remain at the original level, i.e., $2000. This is because the education department will bear the interest cost during the grace period. But, the balance of the unsubsidized loan would rise by the interest amount, i.e., $2,055.

So if one does not start repaying it as early as possible, this loan will continue to get bigger.

Which is Better?

Generally, both types of loans would carry the same interest rate. However, in the case of a subsidized loan, the outflow is less over time due to the interest subsidy that one gets. This means the interest will not accrue when the student is in college. For this reason, it is better to go for a subsidized loan first. And at the same time, it is better to pay off the unsubsidized loans first.

RELATED POSTS

- Federal Perkins Loan – Meaning, Eligibility, and Benefits

- Parent PLUS Loan – Meaning, Eligibility, Interest Rate, Benefits and Drawbacks

- Unsecured Personal Loans – Meaning, Benefits, Criteria, and Application

- Types of Personal Loans – These Are The Options You Have

- Differences between Loan and Line of Credit

- Sources of Loan