Meaning of Hard Currency

Hard currency is the currency of those countries that are relatively more stable economically, socially, and politically than the rest of the countries of the world. Due to this reason, there is little chance of a sudden fall in the value of their currencies. This makes them a good safe-haven asset. Investors have confidence in them and use them as a preferred means of exchange in international trade.

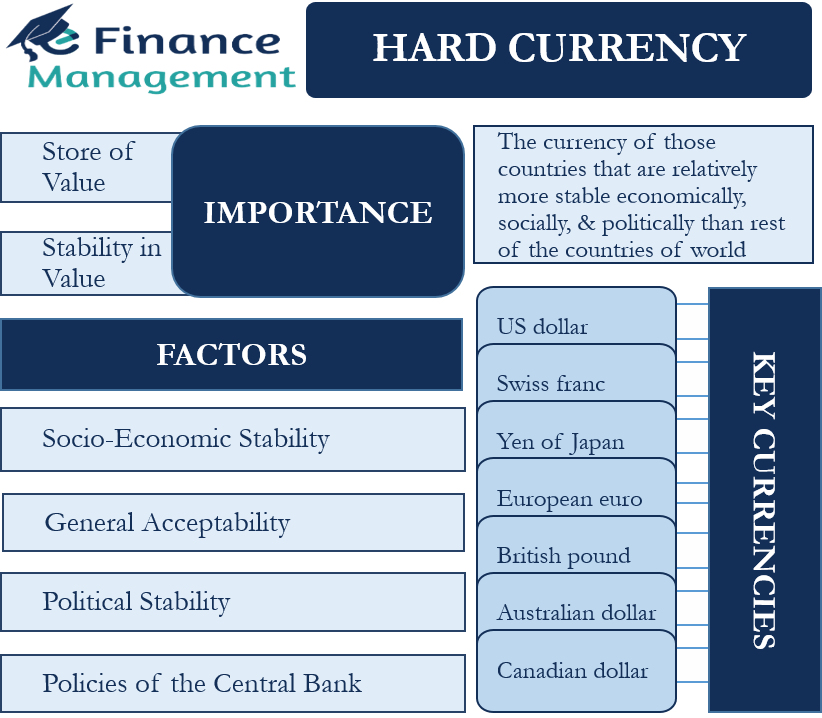

Importance

These currencies play an important role in the financial world. Let us see them in detail.

Store of Value

Other currencies may lose value as per the prevailing economic or political scenario, but they will not be majorly affected by them. During unfavorable situations such as an economic downturn or political chaos in a country, people may dump their local currency and rush towards obtaining more of them.

Stability in Value

Such currency also has the characteristic of being highly liquid. We can easily convert them into any other currency in the foreign exchange market at the ongoing market rate.

Key Hard Currencies of the World

- US dollar

- Swiss franc

- Yen of Japan

- European euro

- British pound

- Australian dollar

- Canadian dollar

Why are they Consider as Hard Currencies?

All of them never fluctuate in value wildly in the usual course of trade and business. The world investor community has full confidence with regard to their economic as well as fiscal strength. As a result, they act as a dependable means of exchange in international trade as well as a perfect store of value. In fact, investors and businessmen that do not even belong to any of the above countries may also prefer to accept them to settle off a trade rather than doing it in their local currency.

What are the Main Factors that Create a Hard Currency?

Socio-Economic Stability

The socio-economic stability of any country is by far one of the main determinants of this currency. The country should have a relatively high Gross Domestic Product (GDP) in comparison to other nations. Also, the economy should be powerful enough to sustain and survive the various economic downturns and crises as they come. Employment numbers, public services, and infrastructure facilities, and law and order situation in the country should be top-notch. This gives confidence and thus lures the investors to make more and more investments in those countries. They can plan and invest without any fear of losing their money. This will make its currency strong, stable, and “hard.”

General Acceptability

A currency has to compulsorily be generally accepted as a means of payment globally to be eligible for this category. A country may have a strong economy and a high GDP. Still, if its currency is not accepted by the majority of countries worldwide as a means of exchange of value, it will not be eligible to be included in the list.

Political Stability

The political stability in a country also affects its currency value. This, in turn, decides if it is hard or not. There should be zero or negligible chances of the collapse of the government in power in the country. Also, the political situation in the country should be stable and reliable. Every now and then, a change of government at the center disrupts the growth bandwagon. The political stability and economic development of any country go hand-in-hand. They are a must for making it strong and hard.

Policies of the Central Bank

The policies of the Central bank directly affect the exchange rates of a country’s currency. This, in turn, affects its position as being hard or soft. The Central bank should make sure that the exchange rates of the country’s currency with regard to others of the world are real. It should not be over-valued. Also, it should constantly monitor and update its policies to keep its purchasing power stable. It should not vary much due to cycles of inflation or deflation. This is a necessary requisite for making this currency.

Also Read: Types of Exchange Rates

Which Currencies do not Qualify as being a Hard Currency?

Apart from the hard currencies that we have discussed above, all the remaining currencies of the world fall in the category of “soft currency.” However, in this category too, each varies according to their performance. Also, it depends upon the respective country’s economy and state of affairs.

It will be surprising to note that even though the yuan of the second biggest economy in the world, China does not qualify as a hard currency. China is a socialist market economy. The primary ownership of all the major facilities is with the government. However, investors around the world prefer to accept a mature currency as a means of exchange. Also, they want an economy that is fairly transparent in nature. By transparency, we mean that the country’s exchange rate mechanism, as well as the bureaucratic system, should be easily comprehendible as well as flexible. Unpredictable policies of the government, as well as the Central bank of the country, hurt the chances of any currency being hard.

Worst Performing Currencies of the World

There are many more “soft currencies” that perform more poorly than the yuan. Some of the worst-performing currencies in the world are the Zimbabwe dollar, the pound of Syria, the Turkish Lira, the bolivar of Venezuela, the Argentine peso, the Peruvian Sol, and the Chilean peso. We can add many more to this list from time to time as it is dynamic in nature. The performance of any currency, as well as its respective economy, keeps on changing. Hence, it may lose its value significantly in one fiscal in comparison with others. Still, it can make up for it in the coming years.

The main reasons for the poor performance of any currency can be a war, a global pandemic like the Covid-19, excessive inflation, corruption, and poverty, or a situation of political crisis and turmoil. A country suffers badly due to any of the above reasons. Its economy and Gross Domestic Product falter, resulting in the weakening of its currency. Thereafter, investors decline to accept it as a global means of exchange or a store of value. There is no more demand for it, resulting in a further fall in value and instability.