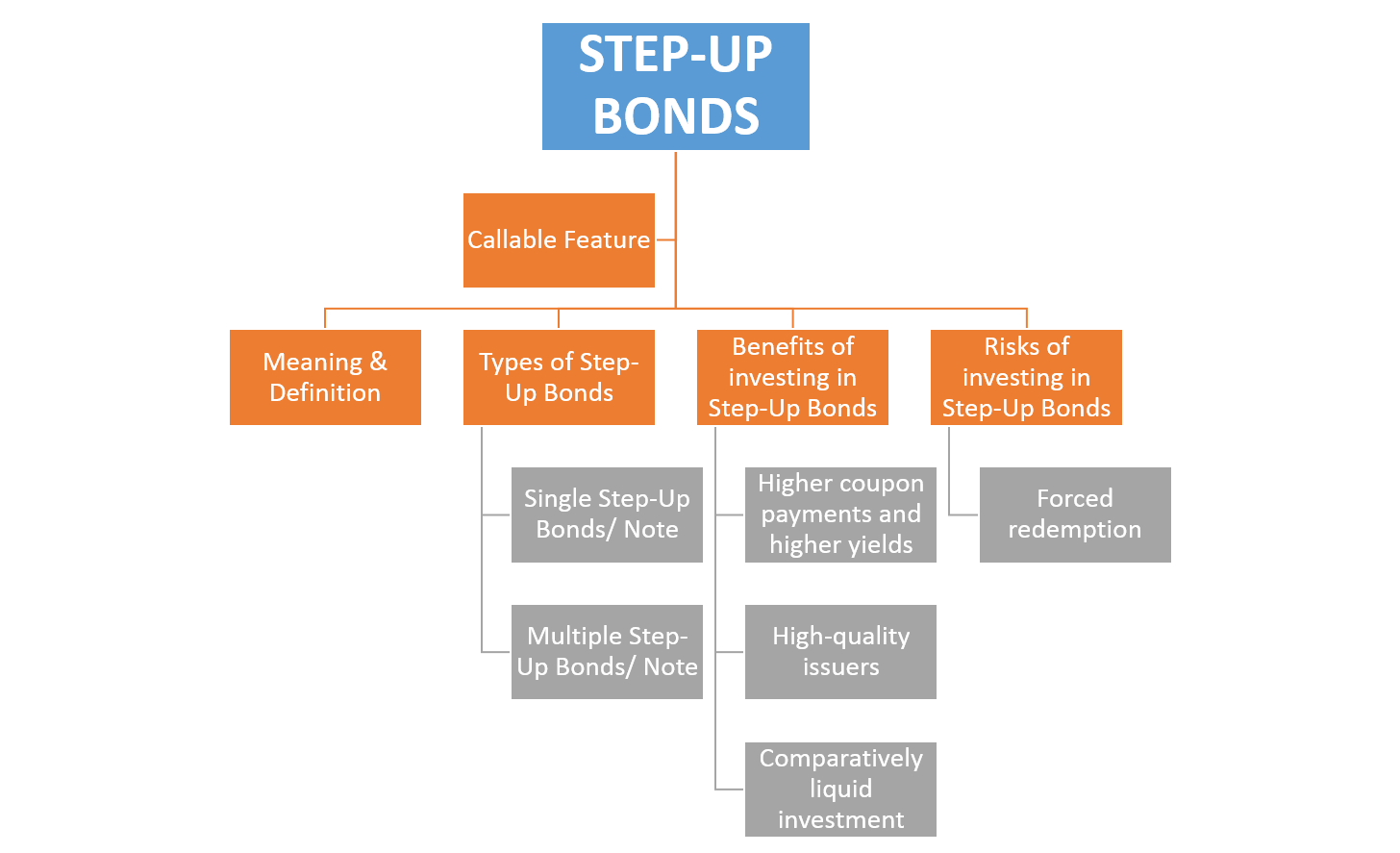

What are Step-up Bonds?

Step-up bonds or notes are a type of bond with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate “steps up” over time. For example, a step-up bond has a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

Advantages of Step-up Bonds

There are many benefits of step-up bonds for investors as well as issuers.

For Investors

Investors usually purchase step-up bonds as they want to invest in securities similar to Treasury Inflation-Protected Securities (TIPS) and take advantage of higher interest rates. The various reasons why people invest in step-up bonds are:

Higher Income

The step-up feature allows investors to earn higher income as the interest rate on the bond increases over time.

Protection against Rising Interest Rates

With interest rates expected to rise in the future, step-up bonds provide investors with a degree of protection against this risk. As the interest rate on the bond increases, investors can benefit from higher income without having to reinvest their money at higher rates.

Comparatively Liquid Investment

Step-Up bonds are fairly liquid as they trade in a primary and a secondary market. An investor can convert his bond into cash as per his convenience and liquidity requirements. Because of such a liquid market, the investors will also get the best prices for their investments.

Also Read: Plain Vanilla Bonds

For Issuers

Various reasons why a company issues step-up bonds are as follows:

Ease in Attracting Investors

Companies issue bonds in order to raise finance. But many may have a question why the company is willing to pay more interest by issuing such type of bonds when it can raise funds by issuing normal bonds too. The main reason is to attract investors.

High-quality Issuers

The issuers of step-up bonds are monitored and governed by the Securities and Exchange Commission. Because of this, only high-quality creditworthy entities may be able to issue these bonds. This reduces the default risk for investors.

Feature of Callability

Since there is a risk of high-interest payment, these bonds also come with the feature of callability.

Callable Step-Up Bonds

The issuer of bonds recognizes that the interest rates in the market may fall below the bond’s coupon rate at some time in the future. Thus redeeming these high coupon-rate bonds & replacing them with low coupon-rate bonds will be beneficial cost-wise. This is especially applicable for step-up bonds as, with the passing of time, the coupon rate on these bonds increases, and if the interest rates in the market fall, it would be a loss to issuers. For this reason, most step-up bonds come with a callable feature. This means when the interest rates fall; the issuers use the callable feature to call back (redeem) the step-up bonds to avoid future losses.

Types of Step-Up Bonds

There are mainly two types which are as follows:

Single Step-Up Bonds/Note

When there is only one increase (or step-up) in the coupon rate over a bond life cycle, we call such bonds single step-up bonds or notes. For example, a 5-year step-up bond might have a coupon rate that is 5% for the first two years & then increases to 6% for the last 3 years.

Also Read: Callable Bonds

Multiple Step-Up Bonds/Note

When there is more than one change (or multiple step-ups) in the coupon payments over the bond’s life cycle, such bonds are multi-step-up bonds or notes. Taking into account the previous example, it can be a multi-step-up bond where the bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

Risks of Investing in Step-Up Bonds

As discussed earlier, most of these bonds come with the callable feature. This means the issuer will force the investors to redeem the bonds during falling interest rates. Thus it is hard to determine whether investors will get the advantage of higher interest rates or not.