A budget is a projection of any expense or income for a particular period of time. The time frame may be a month or a year. A budget is a tool that is helpful for individuals or any organization. It indicates the business owners’ goals and where they want to take their company in the upcoming period. For instance, if the operating budget is for a period of a year, the same is sub-divided into further parts such as a quarter or a month.

Meaning of Operating Budget

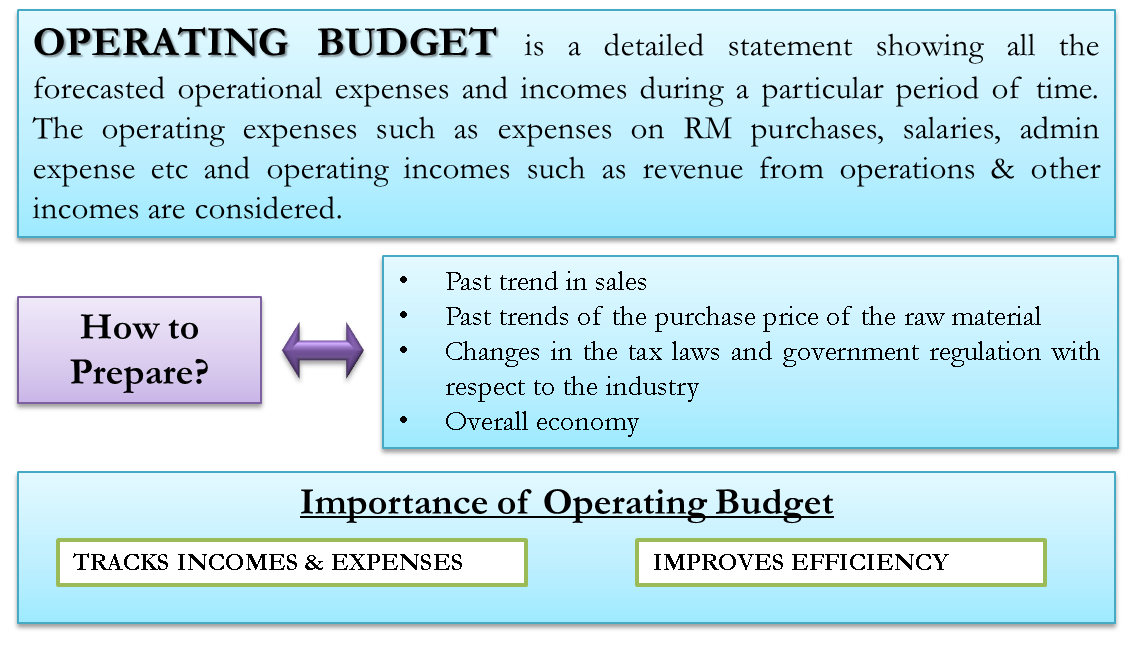

The operating budget, a type of master budget, is a detailed statement showing all the operational expenses to be incurred and incomes to be generated during a particular period of time. Operating expenses such as expenses on raw material purchases, processing costs, interest on a loan, the salary of the staff, maintenance of the office, and administrative expenses are considered for the purpose of the operating budget. The operating income, such as revenue from operations and income by the sale of the by-product, is considered for the purpose of the operating budget.

Depending on the size, structure, and nature of the organization, the operating budget may be sub-divided for the purpose of a detailed understanding of the budget.

How is the Budget Prepared?

The operating budget is prepared by considering many factors and assumptions. Below are some of the factors used for preparing a budget for the organization.

Also Read: Types of Budget

- The past trend in sales

- Past trends of the purchase price of the raw material

- Changes in the tax laws and government regulation with respect to the industry

- Overall economy

Based on the above factors, a sales or income budget is developed at first. The reason is all the expenses shall be based on the sales projection made by the organization.

Once the budget for sales or income is developed, the expense budget is prepared. The expenses have to be estimated based on the sales and, the past trends in the tax regulations, interest rates on borrowing. There are three types of expenses;

- Variable cost – these cost changes with the change in sales.

- Fixed cost – the fixed overheads which remain fixed, such as rent of factory or machinery is fixed irrespective of the production.

- Semi-variable cost – these are the cost which is fixed for a certain level. However, it becomes variable after reaching a certain point. For example, the minimum wage of the marketing staff is USD 2,000, and if the sales increase above a certain limit, the commission shall be based on a percentage of sales.

Financial Accounting helps in developing the operating budget in many ways.

Types of Operating Budgets

There are mainly three types of operating budgets. These are:

Example of Operating Budget

| Code | Description | Actual Expenditures 2016 | Actual Expenditures 2017 | Operating Budget 2018 |

| Operational Income | ||||

| 1000 | Revenue from operations | 79,31,285 | 88,05,063 | 97,79,995 |

| (Total : A) | 79,31,285 | 88,05,063 | 97,79,995 | |

| Operational Expense | . | . | . | |

| 5082 | Cost of Goods Sold | 39,65,643 | 44,02,532 | 48,89,998 |

| 2012 | Employee Benefit Expense – Salaries and Wages | 24,84,144 | 28,18,135 | 30,81,575 |

| 2022 | Staff Welfare costs | 1,17,411 | 1,18,488 | 1,13,843 |

| 2032 | Rent-Building | 4,11,324 | 4,21,607 | 4,32,147 |

| 2043 | Professional Fees and Services | 3,45,781 | 3,83,451 | 3,51,157 |

| 3052 | Rent-Machine and other | 41,324 | 42,357 | 43,416 |

| 4064 | Travel | 1,51,132 | 1,53,188 | 1,54,345 |

| 4075 | Marketing Expenses | 50,305 | 53,123 | 54,054 |

| (Total : B) | 75,67,064 | 83,92,881 | 91,20,535 | |

| Profit before tax (A-B) | 3,64,222 | 4,12,182 | 6,59,460 |

Notes:

- The budget is, for example, purpose only.

- The actual and operating revenue and various expenses are assumed figures only.

- The actual expense and revenue may vary from industry to industry and for all the companies.

Importance of Operating Budget

Let us discuss why it is important to have an organization’s operating budget for an organization? The two important reasons are below:

Tracks Incomes and Expenses

The operating budget helps in keeping track of the income and expenses. It controls the expenses while it also encourages working hard and achieving the ambitious target of sales.

Improves the Efficiency

The operating budget improves the overall efficiency of the organization. It helps in operating the plant at its optimal capacity. It also guides the staff to have better and more efficient planning in performing the business functions apart from making them accountable. The operating budget may be categorized as a deficit budget, a balanced budget, surplus budget based on the actual performance for the period.