What are Treasury Inflation-Protected Securities (TIPS)?

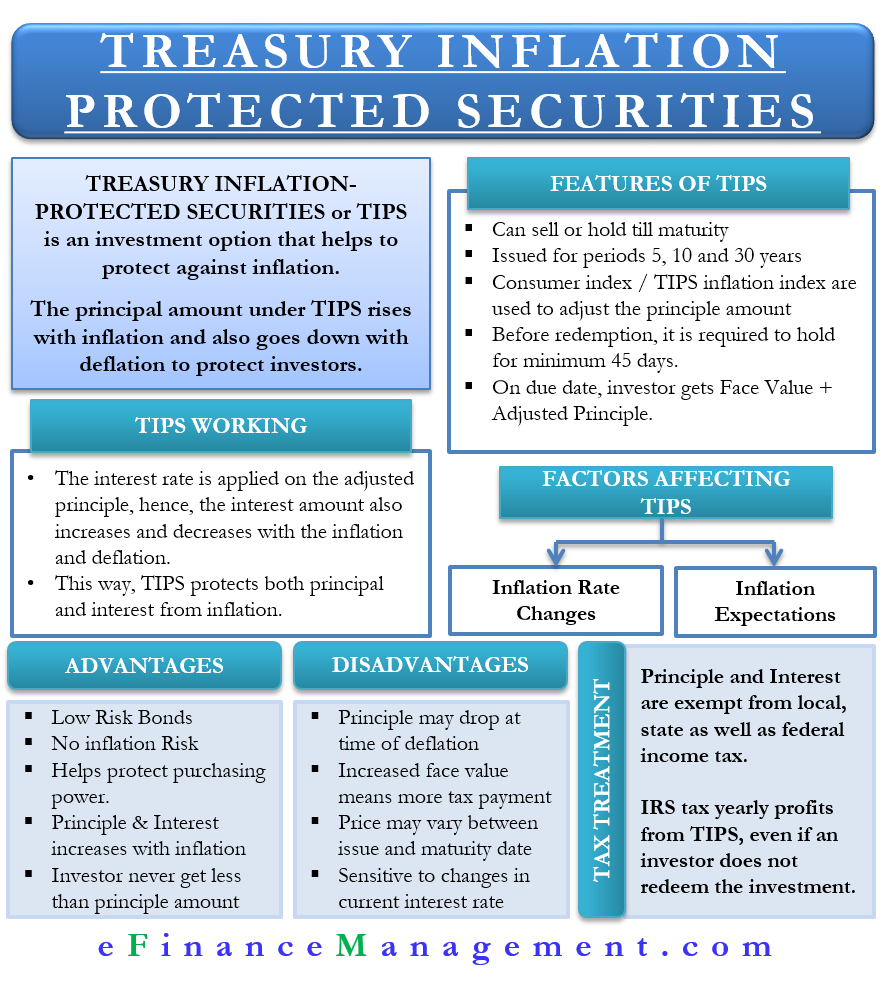

Treasury inflation-protected securities or TIPS is an investment option that helps to protect investors against inflation. The principal amount under TIPS rises with inflation and goes down with deflation. However, at the time of maturity, investors are eligible to get the face value or the adjusted face value, whichever is more.

Treasury Inflation-Protected Securities – Features

Inflation Protection

TIPS are designed to protect investors from the erosion of purchasing power caused by inflation. The principal value of TIPS is adjusted based on changes in the Consumer Price Index for All Urban Consumers (CPI-U). As inflation rises, the principal value of the bond increases, providing investors with a hedge against inflation.

Adjusted Principal Value

The principal value of TIPS is adjusted semiannually to reflect changes in inflation. This means that the face value of the bond will increase if there is inflation and decrease if there is deflation. The adjusted principal value is used to calculate interest payments and the final payment at maturity.

Fixed Coupon Rate

TIPS pays interest semiannually at a fixed coupon rate, which is determined at the time of issuance. Unlike the principal value, the coupon rate remains constant throughout the life of the bond. However, the actual interest payments will vary based on the adjusted principal value.

Protection of Real Return

At maturity, TIPS investors receive the greater of the adjusted principal value or the original principal value. This ensures that investors receive a real return above inflation. If there has been deflation during the life of the bond, the original principal value will be returned.

Backed by the U.S. Government

TIPS are issued by the U.S. Department of the Treasury and are backed by the full faith and credit of the U.S. government. This makes them considered low-risk investments.

Various Maturities

IPS is available in different maturities, ranging from 5 to 30 years. Investors can choose the maturity that aligns with their investment goals and time horizon.

How Treasury Inflation-Protected Securities Work?

- Basically, treasury inflation-protected securities are bonds that are indexed to the consumer index or TIPS Inflation Index to give protection against inflation as well as safety of principal amount even in times of deflation.

- These bonds enjoy the backing of the US government and hence are low-risk instruments.

- However, in comparison to other securities from the government and corporate, the rate of interest on TIPS is lower.

- Investors earn interest twice a year at a fixed rate.

- Though the interest rate is fixed, actual interest inflow varies as interest payment on TIPS also goes up and down with inflation and deflation, respectively, since the interest rate is applied to the adjusted principal.

- TIPS protect both principal and interest from inflation, as in between, the interest rate is applied on the adjusted principal.

Example

Let’s understand this variation in actual interest inflow for TIPS with the help of a simple example. Suppose you buy TIPS with a face value of $1000, having a coupon rate of 2%, and at the time of the interest payment date, the inflation rate is 4%. In this scenario, the face value of the security will be considered a $1040 (1000+4% inflation rate). And this new security value will be used for calculating the interest payment.

Also Read: Treasury Bills

Similarly, if there is negative inflation or deflation at the end of the year, say 2%. Then, the interest calculation will be $980 (1000-2%), which means a lower interest rate. So, though the interest rate is fixed, the actual outgo would vary at the time of each payment date.

However, with regards to face value/principal, it is to be noted that even if deflation persists till maturity, the investor will still get the face value originally invested at the time of issuance of the security, which in this case is $1000, and not the adjusted lower value. And so, in case of inflation, only the original face value will only be paid, and no adjusted higher value.

The face value adjustment concept remains only for the purpose of interest calculation,

TIPS are not just a good investment during rising inflation but also at times of rising-interest rate environments. This is so because inflation and interest usually move in the same direction. So, at a time when the already issued bonds would be losing value due to inflation and give less interest than the newly issued bonds, TIPS will continue to provide the investor with comparatively more interest and safeguard the basic value.

Factors Affecting TIPS

Investors need to be aware of the factors that impact the price and yield of treasury inflation-protected securities. This would allow the investors to make better decisions on when to buy, sell, or whether or not to hold it till maturity. Two significant factors that influence TIPS are:

Interest Rate Changes

Like other bonds, changes in the interest rate do affect the price of TIPS. In traditional bonds, expectations regarding inflation are already part of the yield. TIPS, however, gives additional yield if there is an upward change in the real interest rates.

Inflation Expectations

Increasing inflation rate expectations is a major reason why people buy TIPS to generate additional yield in such times. However, such expectations remained priced in conventional bonds.

Advantages

The following are the advantages of investing in TIPS:

- They are low-risk investments backed by the US government.

- Inflation rate risks are well covered, as these bonds are indexed to the inflation rate.

- They help to protect purchasing power.

- The principal amount and interest payment increase with a rise in inflation.

- Investors never get less than the principal amount, even if the economy is witnessing deflation.

Disadvantages

Even though TIPS appears to be an attractive investment, there are a few risks that you should know about:

- The principal amount may drop at the time of deflation or when CPI is falling.

- If there is an increase in the face value of the bond, you will also have to pay more tax. This may nullify any benefit you may receive from investing in TIPS. Thus, TIPS is perfect for those with a non-taxable account.

- Though there is no default or credit risk, the TIPS price may vary during the period between the issue and the maturity date.

- Also, TIPS are sensitive to any change in the current interest rates. So, you may lose some money if you sell your investment before maturity.

Pros and Cons of Investing in TIPS via ETF or Mutual Fund

Following are the cons of investing in TIPS via ETF or a Mutual Fund:

- If you invest in TIPS via a mutual fund or exchange-traded fund (ETF), which invests in TIPS, then fluctuations in the principal amount could prove a more significant issue. In such a scenario, a climb in the interest may result in a significant drop in the fund value.

- Also, since there is no set maturity date with mutual funds, there is no guarantee that you will get back the full value of your principal.

The following are the advantages of investing in TIPS via a mutual fund or ETF.

- These funds are less risky when the interest rates are volatile.

- With little investment, you get bonds with a range of maturity dates.

- Buying through a mutual fund allows you to diversify your investment in TIPS.

- MF route does not require a considerable sum of money.

Tax Treatment

Following is the tax treatment of the interest and the principal amount under TIPS:

- Principal and interest on TIPS are exempt from local and state income taxes.

- Federal income tax does apply to both – interest and principal.

- IRS taxes yearly profits from TIPS, even if an investor does not redeem the investment.

Due to the tax implications of TIPS, many investors buy it via mutual funds or deferred retirement accounts.

Final Words

Even though these securities offer protection against inflation, they lose popularity at times when the inflation is less or during a period of deflation. Nevertheless, they are still an excellent option to diversify your portfolio and get protection from inflation in the long term. Investors, however, must know that TIPS does not work as typical mutual funds. Thus, investors should not depend solely on them to diversify their portfolios.

An investor can buy TIPS from a bank or a broker or directly from the government through TreasuryDirect. Buying from Treasury Direct is the least expensive way to buy TIPS.

Kudos to relaunching the expert’s view on Financial Management. Please keep continuing the efforts.