Off-Balance-Sheet Financing, as the name suggests, is a practice of keeping certain items away from the balance sheet. Usually, there are certain liabilities that a company tries to keep away from the balance sheet. One reason for doing this is to maintain; and sustain various financial ratios, such as the debt-to-equity ratio, debt service coverage ratio, working capital, quick ratio, etc.

For instance, if a business aims to take on a big loan but believes that a portion of the debt may not look financially sound on the balance sheet. Then it may decide to take that debt off-balance sheet. Moreover, a balance sheet that does not carry too much debt looks good to the investors and lenders. Also, lenders charge more interest from a firm that already has too much debt on its balance sheet. Thus, to address such concerns, companies resort to such practice of Off-Balance-Sheet Financing.

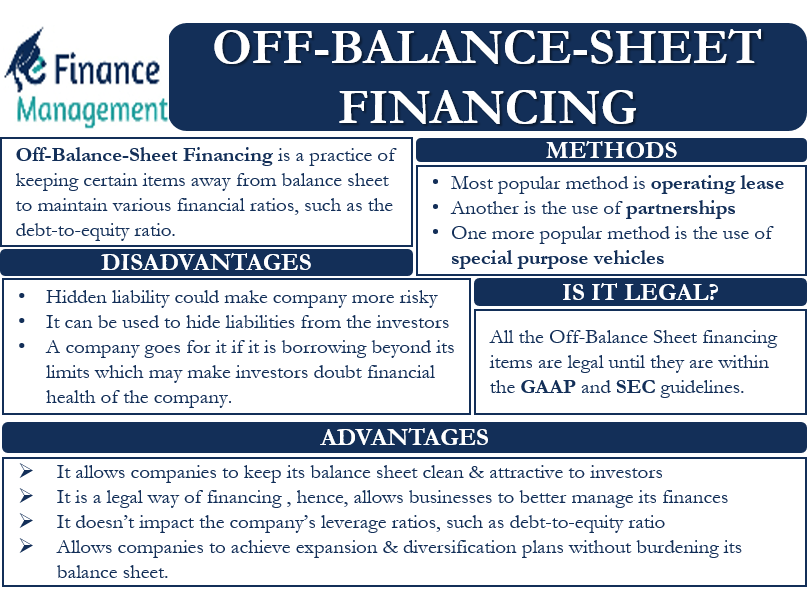

Off-Balance-Sheet Financing – Methods

There are several ways in which a firm can go for Off-Balance-Sheet Financing, but the most popular one is operating leases.

If a company wants to buy new equipment, then rather than buying it, the company can take it on lease. Later, at the end of the lease period, the company can buy that equipment at the minimum residual value.

Under such a method, the company just needs to report the lease cost. That lease cost hits the profit and loss account or income statement rather than having any impact on the balance sheet. This eventually leads to a reduction in liabilities on the balance sheet.

Another method is the use of partnerships. So if a company enters into any sort of partnership arrangement, then the liabilities of that partnership venture do not need to reflect on the balance sheet of the company as per the reporting rules and regulations. This reporting requirement is not there even if the company has a majority or controlling interest in that partnership. Hence, partnerships are another very convenient method to keep liabilities off the balance sheet.

On the lines of partnership arrangement, the company can use the other popular route of Special Purpose Entities (SPEs) or Special Purpose Vehicles. A company may buy some stake in the SPVs or SPEs, who report their own independent balance sheet. In this way, a company may be able to put some of its balance sheet items onto the balance sheet of the SPVs or SPEs.

Other methods are creating shell companies, providing guarantees or letters of credit, joint ventures, and more.

Is Off-Balance Sheet Financing Legal?

Yes, this is a totally legal and permissible accounting method. Generally accepted accounting principles (GAAP) recognizes this method as long as it is within its guidelines. SEC (Security Exchange Commission) also recognizes this method. Both GAAP and SEC require firms to disclose off-balance-sheet financing items in notes to accounts.

Generally, a company shows its investment in a partnership as a net figure on the balance sheet. If any investor wants to know more about this investment, then they could write to the company. The company will then need to make relevant documents available per its norms.

Also Read: Balance Sheet – Definition and Meaning

So, all the off-balance sheet financing items are legal as long as they are within the GAAP and SEC guidelines.

Advantages and Disadvantages of Off-Balance-Sheet Financing

Following are the advantages of Off-Balance-Sheet Financing:

- It allows the company to keep its balance sheet lean, clean, and attractive to investors.

- This way of financing is legal, and thus, it allows businesses to better manage their finances.

- Such a type of financing carries little risk in comparison to direct financing methods.

- This type of financing does not impact the company’s leverage ratios, such as the debt-to-equity ratio.

- It allows companies to achieve their expansion and diversification plans without burdening their balance sheet.

- A company does not need the permission of the stakeholders to carry with its Off-Balance-Sheet Financing. This ensures that the company’s relationship with investors, suppliers, and other stakeholders does not get affected.

Following are the disadvantages of Off-Balance-Sheet Financing:

- Such a type of financing could make the company riskier because of its hidden liability.

- The company’s reputation may get spoiled if it is unable to pay its off-balance sheet items. Also, this may make the company less attractive to its investors.

- Generally, a company goes for such financing if it is borrowing beyond its limits. So, this may make investors doubt the financial health of the company.

- A company may use this method to hide its liabilities from the investors.

Example

Company A has a $3 million line of credit with a bank. This credit line comes with a requirement that Company A must maintain its debt-to-equity ratio below 0.5 all the time. Company A, however, wants to buy a new piece of equipment costing $1 million, but it does not have enough money to fund it on its own. So, to buy the new equipment, as well as maintain its debt-to-equity ratio below 0.5, Company A goes for Off-Balance-Sheet Financing.

Company A forms a new entity, which will buy the equipment and then lease it to Company A. This is the operating lease. Now, Company A will just need to report the monthly lease payment on its income statement. So, it not only gets the asset but also maintains its debt-to-equity ratio.

Energy company Enron is a good real-world example of a company using this type of financing. This Texas company used SPVs to take on massive debt and toxic assets. Moreover, it did not disclose these to its investors as well.

Though the company revealed it in its financial documents, not many investors knew how to look for it or how to interpret it. After the energy company failed to deliver on its promises, its stock started to drop, and the company went bust in 2001. Resultantly it was left with no option but to file for bankruptcy in the year 2001.

Final Words

Off-Balance-Sheet Financing is an indirect way to get financing. Like with any other thing, it also has its advantages and disadvantages both for the companies as well as for investors. Some companies may use this to hide their liabilities. However, with disclosure requirements in place, knowledgeable investors and analysts may be able to find the information related to such transactions.

Frequently Asked Questions (FAQs)

It is a practice of keeping certain items away from the balance sheet.

– It allows the company to present a lean, clean & attractive balance sheet to investors

– To take on big loans

– It allows businesses to better manage their finances

– Expansion & diversification can be achieved without burdening the balance sheet

– To maintain & sustain various financial ratios