What is GAAP?

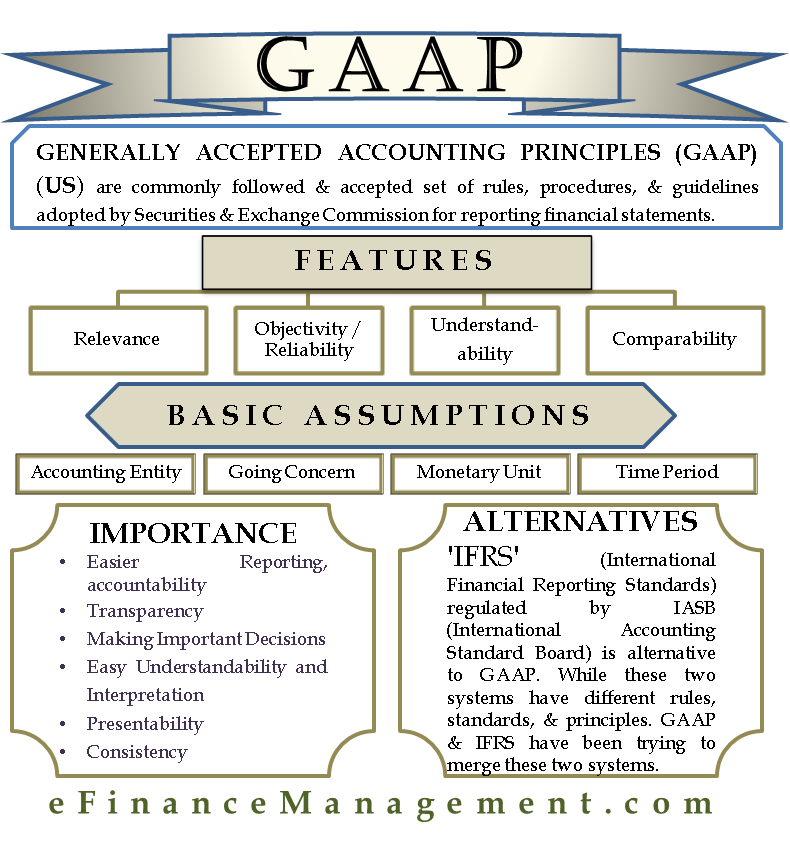

Generally Accepted Accounting Principles (US) are the commonly followed and accepted set of rules, procedures, and guidelines adopted by SEC (Securities and Exchange Commission) for reporting the financial statements. The pronunciation of the acronym is ‘Gap.’ The term is confined to the US, and hence, it is called US GAAP. But the term includes the whole accounting field rather than the only US. GAAP gives clarity and ensures the minimum level of consistency one should follow while reporting the financial statements. It helps the investors and management analyze the information and helps in decision-making. It helps in comparing the financial statements of two different companies.

GAAP varies from region to region, industry to industry, and country to country. The Financial Accounting Standard Board (FASB) sets down GAAP overall, whereas the Government Accounting Standard Board (GASB) sets down the same only for the local and state government.

History behind GAAP

Generally Accepted Accounting Principles were primally established as a response to the Stock Market Crash of 1929. The US government sought ways to regulate the practices of the publically traded companies and many other market participants. Securities Exchange Commission (the authority to set standards) decided to delegate this responsibility to a private sector auditing community. In 1939, the American Institute of Accountants created the Community on Accounting Procedures (CAP). 20 years later, there was a replacement of the CAP by the Accounting Principles Board (APB).

APB then started issuing opinions on accounting topics, which the accountants could follow, which could later be imposed on the publically traded companies. Later in 1973, APB gave away the FASB (Financial Accounting Standard Board). Since then, FASB has been the major policy-making body.

Also Read: Importance of GAAP

Features of GAAP

Relevance

Generally Accepted Accounting Principles need to be relevant to the ones who use them. It needs to provide required, useful, and meaningful information to the users and the readers. All the necessary information should be presented, and nothing should be over or understated as it will lead to misinterpretation of the information. Also, if the readers don’t understand the information, such principles will have no acceptance, and hence, it is of no use also.

Objectivity / Reliability

Generally Accepted Accounting Principle should be one that is objective in nature and not influenced by a person. It should not be personally biased as that will decrease its utility and should be error-free. Also, the information stated therein must be verifiable. A Generally Accepted Accounting Principle is one that is entirely based on facts and figures.

Understandability

Readers should understand the information present in the financial statements and reports properly. This is the reason why annexures accompany the financial statements. Annexures (Notes) are the attachments at the end of the financial statements, which give clarity to a particular fact/figure.

Comparability

The financial statements should be comparable from one year to another. Generally, everyone prefers printing the past year’s financial statements with the present year’s. It should also be comparative with that of the other countries.

Also, read – GAAP Financial Statements

Objectives of GAAP

The information provided should be helpful to the investors, creditors, and all the other users for making strong decisions regarding investments, credit, and other financial policies. The information should be helpful to the creditors and the potential investors in evaluating the amount, timing, certainty, or uncertainty of their expected cash receipts. It should be helpful in making financial, long-term, and important decisions.

Basic Assumptions of US GAAP

There are four basic assumptions of US GAAP. They are:

- Accounting Entity: The owner is separate from his business and other businesses. Also, the maintenance of the books of the owner’s and the business is also separate.

- Going Concern: The presumption is that the business will run for an indefinite period with no intention of dissolution.

- Monetary Unit: There has to be a stable monetary unit (for example, ‘$’ in the US) to record any transactions. One can record only those transactions which carry a monetary value and can be stated in terms of a currency.

- Time Period: There has to be a standardized time period for reporting the financial statements, which is usually monthly, quarterly, or annually.

Importance of GAAP

Since everyone commonly accepts and follows the GAAP, its importance is increasing day by day. It becomes easier to report the financial standards as there is transparency by following GAAP. The GAAP principles are a benchmark. These principles help the investors and creditors in making important analyses, making long-term decisions, etc. Gaap is quite useful not only to the top-level management but also to the readers and the common people. It helps them in understanding and interpreting the financial statements, hence making accurate judgments.

GAAP is also looking forward to making the non-profit and government entities honestly record their transactions and be accountable. The frame of GAAP is to ensure the transparency, accountability, consistency, and presentability of the financial statements, especially for the readers to get a clear understanding of the information contained therein.

Read the Importance of GAAP in its detailed article.

Alternatives to GAAP

Basically, the usage of the term GAAP is of the US. But what about the other countries? Well, there is another alternative, ‘IFRS’ (International Financial Reporting Standards), used in most countries. IASB (International Accounting Standard Board) regulates the same. At the same time, these two systems have different rules, standards, and principles. GAAP and IFRS have been trying to merge these two systems.

Continue reading – GAAP Accounting.

Very useful information. Thank you,