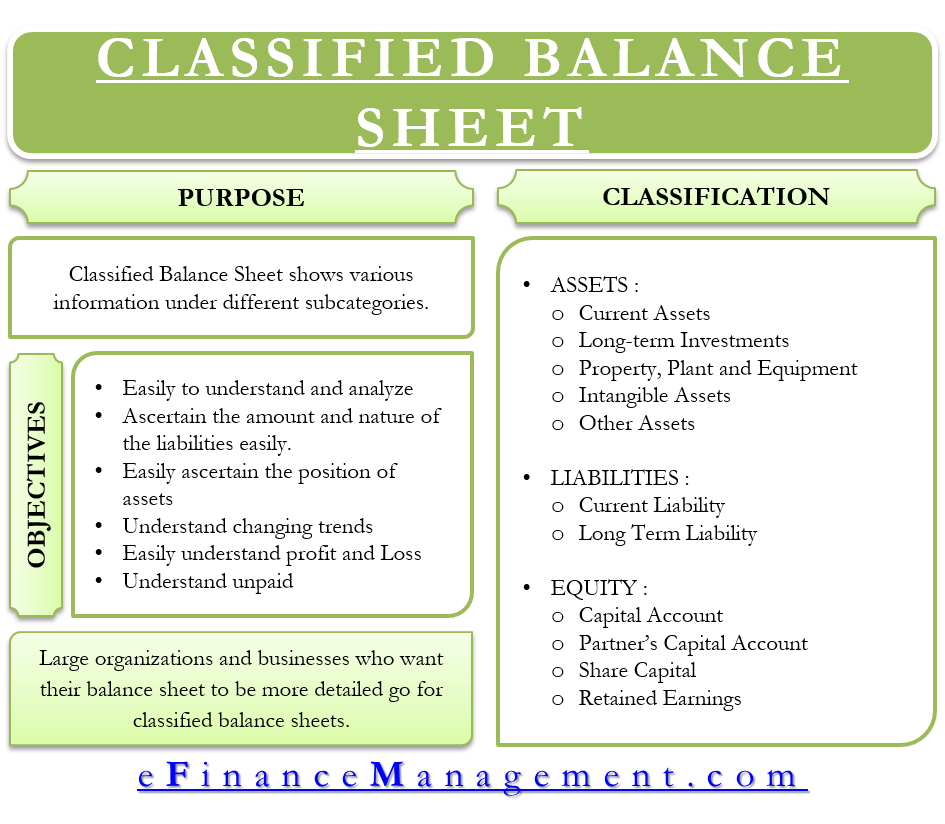

The classified balance sheet shows various information under different subcategories. In simpler terms, the major items such as assets, shareholders’ equity & liabilities, and so on are further sub-categorized. The organizations do that to make it more easily readable than the usual listing of all the accounts on the balance sheet. Someone looking at the classified balance sheet for the first time can find information more easily and extract the exact information required.

Objective of Classified Balance Sheet

- Easily understand and analyze the financial position of the business.

- Ascertain the amount and nature of the liabilities easily.

- Easily ascertain the position of assets to pay for the current liabilities.

- Understand changing trends in assets and liabilities.

- Easily understand the profit and loss trend of the business.

- Understand unpaid and prepaid expenses easily.

- Easily understand the debt position of the company.

Advantages

- Offers a crisp and crystal clear view of the business to anyone.

- It makes it easy to calculate ratios.

- Instills confidence and trust in the investors and creditors.

- Easy for regulators to analyze the financial health of a company.

Common Classifications

There is no set format for a classified balance sheet. Management can decide on the classifications to use based on what’s important to them and the stakeholders. However, some of the common classifications in the classified balance sheet are:

Assets

The term asset in the balance sheet represents both long-term and short-term assets. However, this classification is further broken into five different assets as follows:

Current Assets

These are the assets that one can quickly convert into cash and use for paying the near-term liabilities. Under this category, the assets that one can convert into cash within one year or within one operating cycle come. While listing the assets on the balance sheet, the most liquid assets or the ones that one can easily convert into cash should come first. For instance, cash, receivables, short-term investments, and so on. After these listings, inventories and prepaid expenses should come.

Also Read: Balance Sheet – Definition and Meaning

Long-term Investments

This includes the speculative purchase of the land, a fund for plant expansion, a redeemable fund from the insurance policies, and investment from other entities.

Property, Plant, and Equipment

Under this, the companies put buildings, land, and the machinery that a company buys and uses for the business operations.

Intangible Assets

As the name suggests, these assets do not have any physical existence. Such assets are patents, goodwill, copyrights, and similar items.

Other Assets

Assets that don’t fit anywhere else come under this category. For example, special long-term receivables.

Liabilities

The liability section is classified into:

Current Liability

Just like Current Assets, current liabilities include items that would mature for payment or liquidation within one year. A company maintains current assets to pay for the current liabilities.

Long Term Liability

Obligations that are not currently come under long-term liability. For example, bank loans, mortgage notes, and deferred taxes. However, there might be cases where some long-term notes could be partially current and partially long-term. For example, the principal amount of the loan due next year will come under current liability, and the rest will come under long-term liability.

Equity

Classification of equity in the financial statement depends on the type of business. Usual types of business are a partnership, sole proprietorships, and corporations. In a sole proprietorship, a single capital account comes, while a partnership business maintains a separate capital account for each partner.

In the case of a corporation, the company divides the owner’s equity into share capital and retained earnings. Retained earnings are the profits that a company invests back in the business for its expansion and development.

Classified vs. Unclassified Statement

Large organizations and businesses who want their balance sheet to be more detailed go for classified balance sheets. Big organizations have a large number of accounts. Therefore an unclassified balance sheet would increase the confusion leading the management to make subpar decisions.

On the other hand, smaller companies that do not have many items to show on the balance sheet use unclassified balance sheets. Since such companies don’t have many accounts to show, the classification does not make any sense. The balance sheet for these companies follows the same format but without subsections. However, even in an unclassified balance sheet, an account manager considers the liquidity and durability of the assets and liabilities, respectively. Durability means short and long liabilities, and liquidity applies to assets, i.e., fixed and current assets.

Format

In a classified balance sheet, assets are shown first. The first head is current assets, followed by investment, Property, plant, equipment, and then intangible assets. After the assets, liabilities with several sub-classifications are shown, including long-term liabilities, owner’s equity, and current liabilities. As always, the total of assets must be equal to the total of liabilities and owner’s equity.

| Particulars | Amount |

| ASSETS | |

| Current Assets | |

| Cash and cash equivalents | |

| Inventories | |

| Other Current assets | |

| Trade receivables | |

| Total Current Assets | |

| Property, Plant, and Equipment | |

| Furniture and fixtures | |

| Office equipment | |

| Total Property, Plant, and Equipment | |

| Other Assets | |

| Trademarks | |

| Accumulated Amortization | |

| Total Other Assets | |

| Total Assets | XXX |

| LIABILITIES | |

| Current Liabilities | |

| Accounts Payable | |

| Accrued Expenses | |

| Total Current Liabilities | |

| Long-term Liabilities | |

| Mortgages Payable | |

| Notes Payable | |

| Total Long-term Liabilities | |

| Owner’s Equity | |

| Common Stock | |

| Retained Earnings | |

| Total Owner’s Equity | |

| Total Liabilities and Owner’s Equity | XXX |

Final Words

In short, classification in a balance sheet may vary by industry and thus may be different from the classification shown above. For instance, a manufacturing company will have more plant and equipment than a service firm. Nevertheless, you may adopt any system of classification, but once you adopt it, apply it consistently. This will ensure that your balance sheet is comparable over multiple accounting periods.

It was fantastic. Classified Balance Sheet as posted was lucid, very informative and educative. Thank you, Sir.

Classified Balance Sheet as posted is very informative and educative too. Thank you, Sir.