What do we mean by Liabilities in a Balance Sheet?

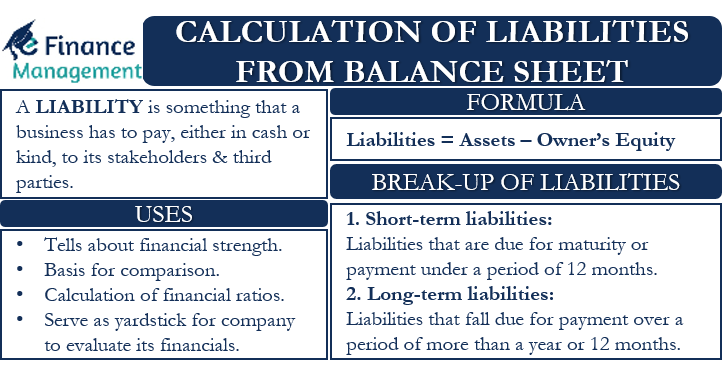

A liability is something that a business has to pay to its stakeholders and third parties, either in cash or kind. It has to pay for them and settle in the near future. Usually, we measure a liability in monetary terms, and they give some sort of economic utility to a business. Some common examples of liabilities of a business are accounts payable, interest payable, salaries and wages payable, taxes payable, loans and debt payable, premiums payable, etc. A liability can be short-term or current if it is due in less than a year, or it can be long-term or non-current if it is due any time over a year. The calculation of liabilities from the Balance Sheet can be done by breaking them up and looking at them in detail.

A balance sheet gives us the financial position of a business at a particular point in time. We report the company’s total assets on one side and the shareholders’ equity and total liabilities on the other side. Both sides should always be equal and match for a Balance Sheet to be correct. Therefore, it is a summary of what the business has of its own, what it owes and has to pay, and the shareholders’ investment in the company.

How can we Calculate the Liabilities from a Balance Sheet?

On the basis of the double-entry accounting system, we have a basic formula that states that Assets in a business are equal to the sum total of the liabilities of the business and the shareholders’ equity. As a formula, we put it as:

Assets = Liabilities + Owner’s Equity

In order to calculate the liabilities from the Balance Sheet, we can also state the above formula as:

Liabilities= Assets – Owner’s Equity

But for using this equation, we first need to know the complete break-up of our liabilities portion in the Balance Sheet.

A Detailed Break-Up of Liabilities

Liabilities in a Balance Sheet are broadly categorized into two headings- Short-term and Long-term.

Short-Term Liabilities

Short-term liabilities are the liabilities that are due for maturity or payment within a period of 12 months. They are also known as current liabilities. Accounts payable or the money a business owes to its sundry creditors against receipt of goods and services are a part of current liabilities. Some other examples of current liabilities are rent payable, salary payable, unearned revenue, as well as accrued revenue, short-term debt, and interest payments. It also includes the portion of the long-term debt that is due for payment in the next accounting year (within a year from the date of the balance sheet),

Also Read: Balance Sheet – Definition and Meaning

A company should always have enough liquidity so that it can pay off its short-term liabilities easily. It should have sufficient working capital arrangements to deal with such liabilities. We can determine the working capital available with a business by deducting current liabilities from current assets.

Current liabilities help in the calculation of the Current ratio. It is the ratio of current assets to current liabilities. It measures an organization’s liquidity status and its capability to meet its short-term liabilities. A current ratio of 2:1 is ideal; however, it may vary from industry to industry. An acid-test ratio is a similar ratio that does not consider the value of the inventory as a part of the company’s current assets, the denominator again being the current liabilities. This ratio of 1:1 is the ideal one.

Long-Term Liabilities

Long-term liabilities are the liabilities that fall due for payment beyond a period of a year or 12 months. A company may have issued debentures to the general public with a maturity period of several years. They will form a part of long-term liabilities. Similarly, the company may have issued bonds that need to be shown as “bonds payable” under the non-current liabilities. Long-term debts such as loans from banks and financial institutions or mortgaged loans have a repayment period of 5-10 years. Hence, they are also non-current liabilities for a company.

A company may have made an assessment of the probable taxes due/payable over the next financial year(s). They can make provisions for it in the form of deferred tax liability. This provision will also be treated as a long-term liability. Then there are pension liabilities or “defined benefit schemes” wherein a company makes a promise to pay a specific amount as a pension after an employee’s retirement. This is a future obligation that the company will have to fulfill. Hence, we account for it regularly under the long-term liabilities.

Also Read: Meaning and Types of Liabilities

Uses of Calculating Liabilities from a Balance Sheet

Total liabilities go a long way in telling about a company’s financial health and strength. It can be a basis for comparisons with the competition. Also, it can be an indicator of goodwill and how credit-worthy the company is. Any business with fewer liabilities will enjoy a good reputation in the market. They will be able to garner credit easily at a relatively low-interest rate and favorable terms of repayment.

Total liabilities are an important metric for the calculation of a number of financial ratios. We can measure a company’s financial leverage by using the debt-to-equity ratio. We divide the total liabilities of a business with its shareholders’ equity to calculate this ratio. Suppose the business fails to perform; the ratio measures if the shareholders’ equity will cover all its dues or the total liabilities. We can call it gearing ratio too.

Then we have the Liabilities to Assets Ratio. It tells us what portion of a company’s assets is made up of liabilities. It is a solvency ratio that shows whether a company has sufficient assets to back its liabilities or not. Similarly, the Debt Ratio is a ratio of a company’s total debt to its total assets and measures the leverage of the company.

These are some of the important financial and leverage ratios that help us to compare companies by making use of the liabilities and debt figures. Also, they serve as an important yardstick for any company to regularly evaluate its financials. It can rectify its course in case the financial performance of the company is not going in the correct direction.

Frequently Asked Questions (FAQs)

For calculating liabilities, we use the following equation:

Liabilities= Assets – Owner’s Equity

Liabilities are basically classified into two categories:

1. Short-term liabilities

2. Long-term liabilities

Yes, Short-term liabilities are the liabilities that are due for maturity or payment within a period of 12 months. They are also known as current liabilities.

Yes, Short-term liabilities are the liabilities that are due for maturity or payment beyond a period of 12 months. They are also known as current liabilities.

Calculation of liabilities can be used in the following ways:

1. Tells about the financial health and strength of a company.

2. It can be a basis for comparisons with the competition.

3. An important metric for the calculation of a number of financial ratios.

RELATED POSTS

- Assets vs Liabilities – All You Need To Know

- Current Liability – Meaning, Types, Accounting And More

- How to Calculate Debt from Balance Sheet?

- Debt vs Liabilities – All You Need to Know

- Classified Balance Sheet – Meaning, Importance, Format And More

- 10 Strategies for Managing Business Debts and Liabilities