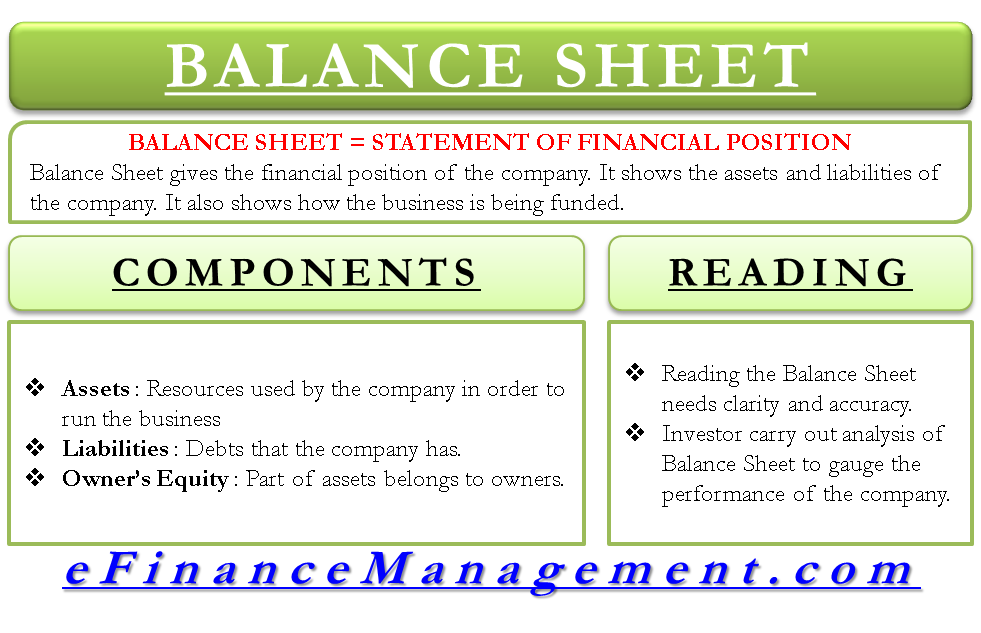

The balance sheet, also known as the statement of financial position, represents a given company and its financial position at a given date (generally the last date of an accounting period). The balance sheet, along with the income statement, cash flow statement, statement of stockholder’s equity, and notes comprises of financial statements of a company. It provides the investor with insight into a company’s financial and operational health. It shows the company/firm’s liabilities and assets individually and shows how the business is being funded. This balance sheet bifurcated into specific components is known as a classified balance sheet—the balance sheet (B/S), which is divided into two sides always tallies. Technically speaking, the accounting equation represents the balance sheet, i.e., “Owners’ Equity = Assets – Liabilities.”

Components of a Balance Sheet

Every B/S has three main components:

Assets

Assets are any resource used by a company in order to enable it to do business. This could be cash, buildings, equipment and machinery, inventories, accounts receivable, etc. Assets can be either current (short term) or non-current (long term).

Liabilities

Liabilities are the debts the company has. The company owes this to its creditors or other external parties. It is legally obliged to clear off its debts. This could be in the form of accounts payable, borrowings, deferred tax liabilities, etc. Liabilities, too, can be either current (short term) or non-current (long term).

To know more about what will fall under liabilities, refer to our article: Calculation of Liabilities from Balance Sheet.

Owners Equity

Owners equity is a part of assets that belongs to the owner(s) of the company. This means that part of the assets after the creditors have had their claim is the owners’ equity.

What Does a Balance Sheet Look Like?

A sample format is represented in the below format

Balance Sheet as at 31st March (All figures are in million USD)

| Particulars | Note | Current Year | Previous Year |

| EQUITY AND LIABILITIES | |||

| Shareholders’ Funds | |||

| Share Capital | A | 95 | 90 |

| Reserves and Surplus | B | 1000 | 900 |

| Total | 1095 | 990 | |

| Non-Current Liabilities | |||

| Long Term Borrowings | C | 50 | 60 |

| Deferred Tax Liability | D | 30 | 40 |

| Total | 80 | 100 | |

| Current Liabilities | |||

| Short Term Borrowings | E | 10 | 10 |

| Accounts Payable | F | 10 | 20 |

| Total | 20 | 30 | |

| Total : | 1195 | 1120 | |

| ASSETS | |||

| Non-Current Assets | |||

| Fixed Assets | G | 800 | 750 |

| Capital Work in Progress | H | 100 | 50 |

| Total | 900 | 800 | |

| Current Assets | |||

| Inventories | I | 200 | 250 |

| Accounts Receivable | J | 95 | 70 |

| Total | 295 | 320 | |

| Total : | 1195 | 1120 |

How to Read a Balance Sheet?

Reading the B/S needs clarity and accuracy. As seen from the above sample, for the financial year 11-12, the total assets match the total of owners’ equity + liabilities, viz. USD 1195 Million. The same can be observed for the financial year 10-11.

Investors can carry out an analysis to gauge the performance of the company. E.g., one can observe that owners’ equity has risen from USD 990 Million to USD 1095 Million, which gives a positive signal to the investors. At the same time, borrowings have been reduced by USD 10 Million. Similarly, accounts receivable have dropped by USD 10 Million as well. This again sends positive signals in the market that the company is able to meet its liabilities.

Also read – Assets vs Liabilities to learn more.

Insight on Balance Sheet Analysis

When a company’s balance sheet is analyzed over several periods, one can find a trend in the company’s financial position. It gives insight into a company’s capital structure and helps to analyze its liquidity risk, credit risk, and financial risk. Different financial ratios reflect the financial stability and liquidity of the company. In this manner, it plays an important role in investment decisions and management decisions by providing a snapshot of an entity’s financial strength.

Continue reading – Trial Balance vs Balance Sheet.

Excellent sir, In this format, every one should would easy learn and understand quickly.

Thanks Mallika for the complement.

I simply must tell you that you have an excellent and unique web that I kinda enjoyed reading.