Warrants and Convertibles are a type of derivative investment securities. Both these types of options give investors a right to further invest in certain securities of the company. Specifically, a warrant gives investors a right to buy an underlying security at a certain rate in the future. On the other hand, Convertibles allow investors to convert their security into the common stock in the future. Thus, both these securities help investors maximize their returns and are the available investment options. But both these are not the same. Hence it is important how these two instruments should be used and the purpose thereof. Therefore, investors should know and appreciate the difference between warrants and convertibles.

Before we detail the difference between warrants and convertibles, it is important that investors understand what the two terms mean.

Warrants and Convertibles – Meaning

Warrants

It gives investors a right to buy the underlying share, bond, or any other security at a certain future date and at a specific price. However, investors have no obligation to buy the underlying security at that time and at that price. Moreover, if an investor decides to exercise the warrant, then they need to pay the pre-decided money to buy the stock or security, or the instrument. Many features of a warrant are the same as that of options.

Every warrant carries the information on the number of underlying security an investor can buy and at what price, and at what date. The time period of a warrant varies and could be of several years. Investors can trade warrants as well, and their value depends on two things – time and intrinsic value. The value of a warrant will be more if the time left until expiration is more. Similar will be the situation of the warrant value if the market price of the underlying security is more than its exercise price.

Convertibles

On the other hand, Convertibles give investors an option to convert bonds or preferred stocks into common stock in the future again at a specified date and price. Usually, companies that want to raise quick capital or do not have access to traditional financing options use this type of security. A company uses a conversion ratio to determine the number of common shares an investor would get in place of the bond or preference shares. Further, the instrument can be fully convertible, the entire bond will get converted, and the existing security will stand discharged. Or it can be partially convertible; thereby, a portion will get converted to common stock, and the leftover value will continue to remain as a bond. The total value of the bond stands reduced to the extent of conversion.

Also Read: Warrants

Difference Between Warrants and Convertibles

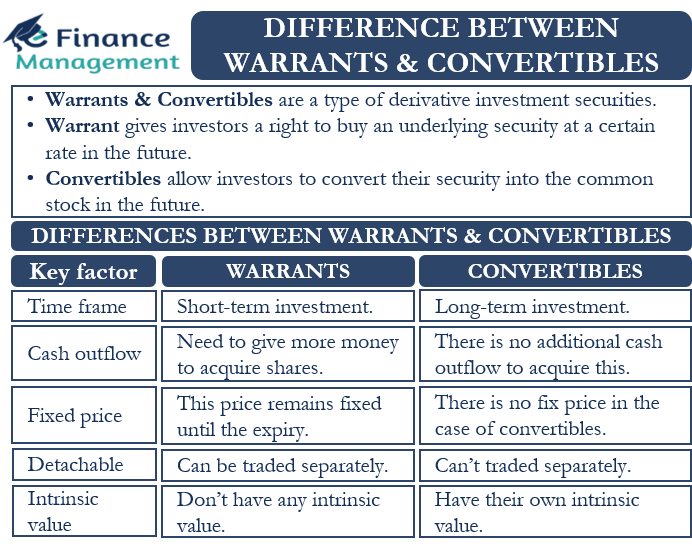

Following are the differences between warrants and convertibles:

Time Frame

Warrants come with an expiry date, and thus, many view them as a short-term investment. On the other hand, Convertibles have a longer duration and, thus, are long-term options.

Cash Outflow

When an investor exercises a warrant, they need to give more money to acquire the shares. Hence, the company gets additional money from the instrument holder in this situation. At the same time, there is no additional cash outflow from investors’ perspectives in the case of convertibles. The same security converts to common stock using the conversion ratio.

Fixed Price

The price at which an investor will be able to buy the underlying security in the future is detailed in the warrants at the time of issuance itself. And this price remains fixed until the expiry. However, there is no such fixed price in the case of convertibles. Instead, the issuer uses a conversion ratio to determine the number of common shares that an investor would get on converting the bond or preference shares.

Detachable

Warrants have a unique characteristic. They are detachable, which means one can trade them separately from the underlying security. Convertibles, however, are not detachable, and thus, investors can not trade them separately.

Accounting

In the case of warrants, whether or not the investor exercises the warrant, the underlying security remains on the company’s books of accounts. However, if an investor uses convertibles and converts the bonds or preference shares, then the bonds or preference shares are removed from the company’s books of accounts.

Ownership

A warrant does not give the investor ownership of the underlying security when we talk about ownership. The ownership starts only after the investor uses the warrant to buy the underlying security. On the other hand, Convertibles give investors ownership of the security from the very beginning.

Worthless

A warrant will become worthless for exercise if the market price of the underlying security drops below the exercise price. Convertibles, on the other hand, become worthless only and only if the company goes bankrupt. Even if the share price of the issuer drops, the investor will not exercise the option and would still have the ownership of the bond or preference shares.

Intrinsic Value

Warrants do not have any intrinsic value of their own and depend on the value of the underlying asset. Convertibles, however, have their own intrinsic value even before and after using the option.

Final Words

Both warrants and convertibles can have an important place in a company’s capital structure. These are also equally important in the investor portfolio. Warrants and convertibles, both have some common features. However, they are very different, and hence their market price also fluctuates, not exactly in the same proportion. And this is what makes them appeal to different sets of investors. Generally, more risk-averse investors prefer warrants, while those who prefer some security go for convertibles.

Frequently Asked Questions (FAQs)

A warrant gives investors a right to buy an underlying security at a certain rate in the future. In contrast, a convertible allows investors to convert their security into the common stock in the future.

Some of the points of difference between warrants and convertibles include time frame, cash outflow, fixed price, detachability, accounting, ownership, etc.

Warrants become worthless if the market price of the underlying security drops below the exercise price. Convertibles become worthless only if the company goes bankrupt.

RELATED POSTS

- Warrant vs Call Option – All You Need To Know

- Convertible Bonds – Features, Types, Advantages, and Disadvantages

- Hybrid Financing and Various Such Instruments

- Convertible Preference Shares –Meaning, Advantages, and More

- Convertible Debentures

- Payer vs Receiver vs Bermudan vs European vs American Swaption