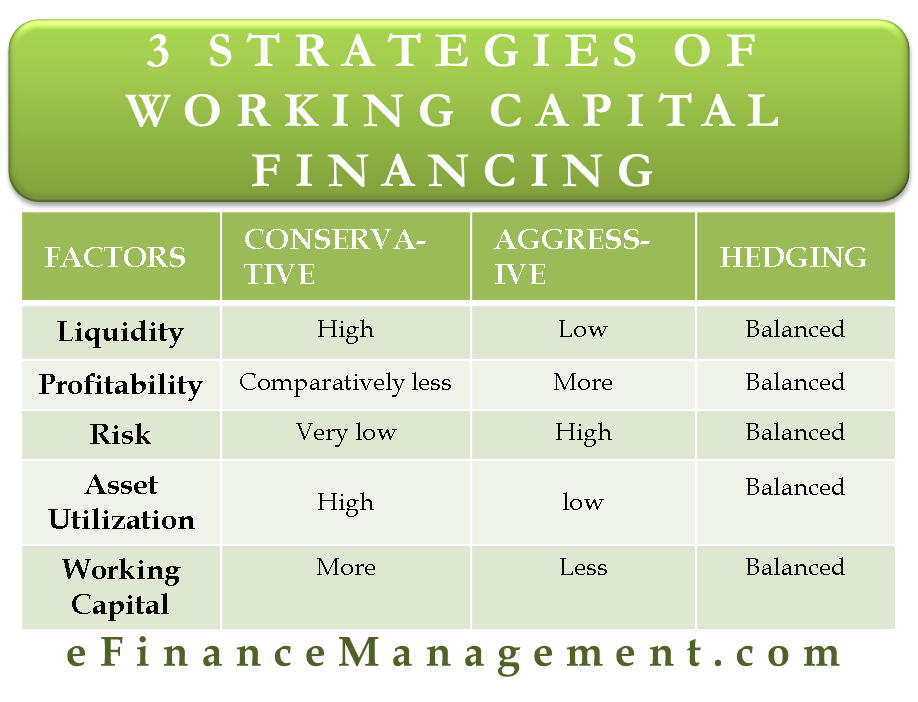

There are three strategies or approaches or methods of working capital financing – Maturity Matching (Hedging), Conservative and Aggressive. The hedging approach is an ideal method of financing with moderate risk and profitability. The other two are extreme strategies. The Conservative approach is highly conservative with very low risk and, therefore, low profitability. An aggressive approach is highly aggressive, having high risk and high profitability. Let’s know more about the working capital financing strategies.

We will compare these three approaches on 5 parameters: liquidity, profitability, risk, asset utilization, and working capital.

Three Approaches – 5 Parameters

Factors |

Term Significance | Conservative | Aggressive | Hedging |

Liquidity |

It is extremely important in business for smooth operations of the day-to-day business activities and to grab occasional opportunities thrown by the business. | Liquidity is high because of the heavy usage of long-term funds. It can take advantage of sudden opportunities. | Liquidity is low due to greater dependability on short-term funds, even for a part of long-term assets. It does not keep idle funds and therefore saves interest costs on them. | Liquidity is balanced, i.e., neither high nor low. It attempts to strike a balance between liquidity and the cost of idle funds. |

Profitability |

Profitability is the final goal of any business. Every step of a manager should finally boil down to profitability. | Under normal circumstances, profitability is less in this strategy because of too much idle and costly funds. Higher rates and a bigger magnitude of interest costs reduce the profitability. | Higher profitability is obtained since the interest cost is minimized in this approach. | Because of cut to cut management, a balance is achieved between interest cost and loss of profitability. Moderate profitability is maintained here. It is greater than conservative and lesser than aggressive. |

Risk |

The risk here refers to the risk of bankruptcy. | There is a very low risk of bankruptcy as this approach maintains a higher level of liquidity in the business. | There is a high risk of bankruptcy due to maintaining an extremely tight liquidity position. | The risk is balanced here. The firm will bow down to bankruptcy only in an extremely bad situation. |

Asset Utilization |

Asset utilization here is the utilization of current assets. | Too high level of current assets makes its utilization ratio low. | Similarly, too low a level of current assets makes the utilization ratio high. | Moderate |

Working Capital |

Working capital fills the gap between current assets and current liabilities. | There is a requirement for more working capital to execute the conservatism. Higher working capital avoids all risks. | Very low working capital is maintained. Low working capital increases risk but saves the interest cost. | Moderate working capital is maintained to stay somewhere between conservative and aggressive strategies. |

Continue reading – Working Capital Policy – Relaxed, Restricted, and Moderate

Quiz on 3 Strategies of Working Capital Financing

This quiz will help you to take a quick test of what you have read here.

thank you, that was helpful

thanks

Really helpful, thank you.

Helpful, Thanks!!

Thank u

It is very helpful. Thanks.