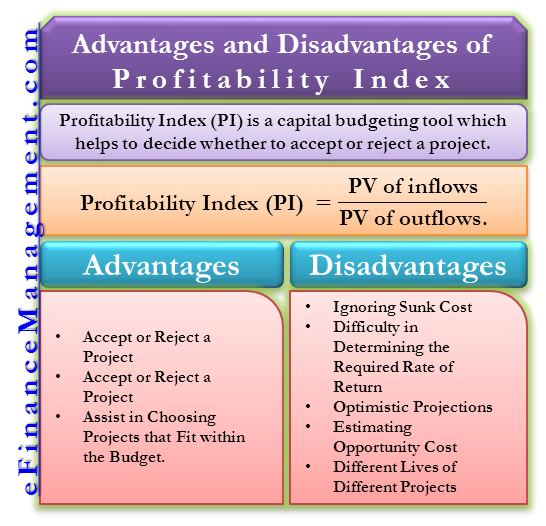

The profitability index (PI) is a capital budgeting tool that helps decide whether to accept or reject a project. The formula of PI is PI = Present values of inflows/ present values of outflows. Let us see about the advantages and disadvantages of the profitability index.

Advantages of Profitability Index

Accept or Reject a Project

Let’s consider that you are dealing with mutually exclusive projects where you have to undertake one project among many. In that case, the profitability index is one of the tools which will let you know which project to accept or reject. If PI is greater than 1, then accept the project, and if less than 1, then reject the project. The idea behind accepting the project having PI greater than one is that the present values of inflows (Inflows from the business activities after considering the time value of money) must always be greater than the present value of outflow (Present value of outflow is simply the initial outlay normally). This makes sense because a company, on a totality basis, must be earning more than what it has invested.

We will now look at an example –

A company has two alternatives for investment, project A and project B. Project A has an initial investment of $10000, and present values of inflows from the project are equal to $ 8000. Project B has an initial investment of $15000 and present values of inflows equal to $ 25000. Then the PI will tell us to accept the project B over project A

PI for project A = $8000/10000 = 0.8

PI for project B =$25000/15000 = 1.667.

Accounts for Risk

To calculate the present value of inflows, you need to discount the cash flows with an appropriate discount rate. This discount rate is the project’s rate of return. That is the minimum rate of return that is needed from the project. Therefore, by discounting at the appropriate rates, cash flows reflect the risk involved in the business.

We will cover this point with the help of an example –

Assuming two scenarios where the project XYZ is risky in the 1st scenario and comparatively less risky in the 2nd scenario. Since this project is assumed to be risky in the 1st scenario, the discount rate will be higher. Let’s assume that the discount rate is 20% and cash flow in year one is $ 1500 than the present value of cash flow in year one = $1500/1.20 = $1250

In the 2nd scenario, the project is assumed to be less risky than in the 1st scenario, and hence the discount rate used will be lower than in the 1st scenario. Let’s assume the discount rate is 15% and cash flow in year 1 is $1000. Present value of cash flow in year one = $1000/1.15 = $869.56.

Higher risk carries a higher discount rate and vice versa.

Assist in Choosing Projects that Fit within the Budget.

Example –

| Project A | Project B | |

| NPV | $1000 | $2000 |

| The present value of inflows | $5000 | $1002000 |

| The present value of outflows | $4000 | $1000000 |

If you have unlimited access to funds, choosing project B will be the right choice because it has a higher NPV. In the real world, we do not have unlimited access to funds, and therefore we have to choose projects that fit our budget. PI is used when you are dealing with limited access to funds (Capital rationing)

PI for project A = $5000/4000 = 1.25

And, PI for project B = $1002000/1000000 = 1.002

Project A is to be accepted because with less capital, you are able to achieve a higher PI (1.25 >1.002).

Disadvantages of Profitability Index

Ignoring Sunk Cost

In the capital budgeting world, sunk costs (costs incurred before you start a project. E.g., R&D costs) are not included in estimating the outflows. Hence, these costs might be huge, and ignoring these costs might sometimes become very difficult for the corporate finance team.

Also Read: NPV vs IRR vs PB vs PI vs ARR

Difficulty in Determining the Required Rate of Return

Determining the rate at which the cash flows are to be discounted might be tough for the corporate finance team. A firm should not use the overall WACC of the company as a whole as a discounting rate. Why so? Refer to Project WACC. Inappropriate discounting rates may lead to higher or lower PI. Remember, the cash flows of a high-risk project should not be discounted at WACC but at the project’s specific required rate of return due to the fact that the risk profile of different projects is different.

Optimistic Projections

The corporate finance team needs to sit with the management of the company to take into account the business scenario. Management might be too optimistic about their project, and therefore cash flow projections might be too high. Thus, there can be an upward bias in estimating the PI.

Estimating Opportunity Cost

In order to determine the exact cost of starting a project, we need to account for the opportunity costs. Opportunity costs are incurred by not accepting other alternatives, which may generate positive inflows. Estimating these alternatives and their costs might be difficult and might distort the result.

Different Lives of Different Projects

PI of those projects cannot be compared, which have different lives.

E.g., project A has a useful life of 5 yrs, and Project B has a useful life of 8 years. PI of these 2 projects cannot be compared.