Due to the limitations of the sole proprietorship, many decide to enter into a partnership. Not everyone has everything. Some may have the capital, or some may have skills but not capital or resources, managing or administering skills, etc. Hence, the partnership comes into existence when two or more persons from different edges, having different capacities and criteria, come together with a motive to earn profits and carry on the lawful business together.

Partnership – Meaning

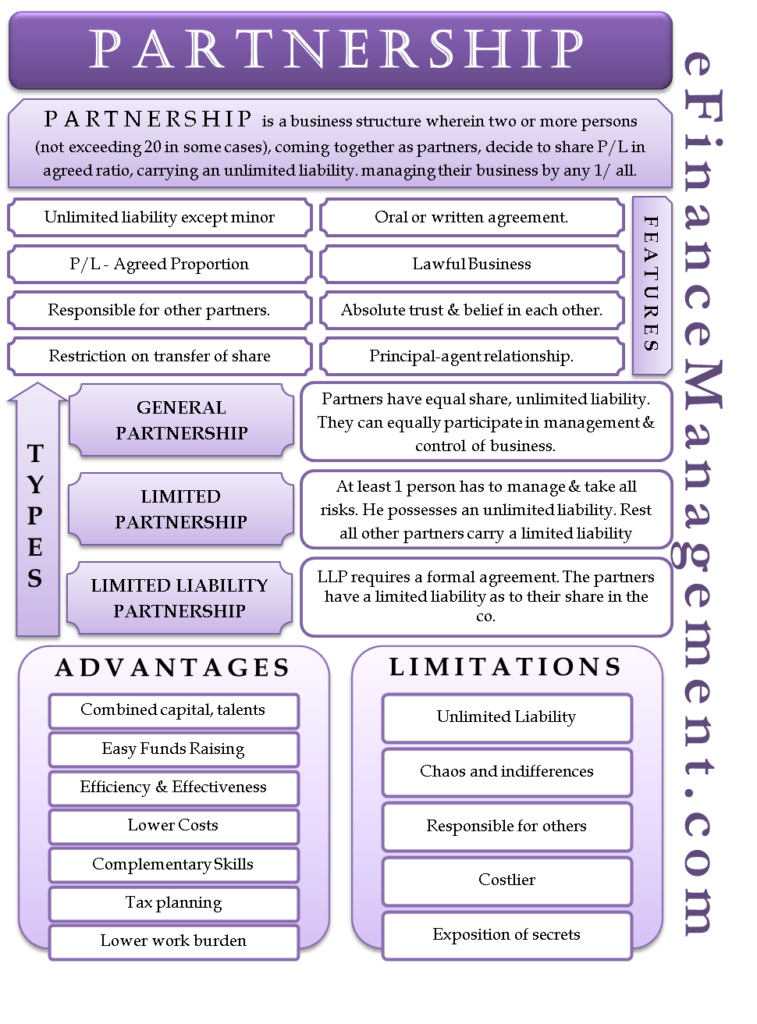

A partnership is a business structure wherein two or more persons (not exceeding 20 in some cases), coming together as partners, decide to share profits or losses in an agreed proportion, carrying an unlimited liability and managing their business by any one or all of them. But the term partnership is too wide. The involvement of all the partners may or may not be necessary. Also, there are some exceptions to the carriage of unlimited liability.

Types of Partnership

General Partnership

General Partnership is a mutual, formal, or informal agreement between different persons. Herein, the partners have an equal share in the profits and debts, carrying an unlimited liability. They can equally participate in the management and control of the business. Besides this, is no requirement for business structure formalities. It is fully the choice of the partners to run the business in their way. Each partner assumes their full responsibility towards the business and can act independently on behalf of the company without the other partner’s consent.

Limited Partnership

At least one person has to manage and take all the risks in a limited partnership. He possesses an unlimited liability. Rest all other partners carry a limited liability and specific rights and responsibilities mentioned in the agreement deed.

Also Read: Advantages and Disadvantages of Partnership

Limited Liability Partnership

Limited Liability Partnership requires a formal agreement. The partners have limited liability as to their share in the company. Also, they have protection from the other partners’ legal and financial faults and actions. They are allowed to take part in the management and decision-making.

Features of Partnership

- More Persons have an unlimited liability except for minors.

- Profit and loss in an agreed proportion.

- Oral or written agreement.

- Lawful Business. For instance: carrying on a charitable trust would not fall under the partnership.

- Absolute trust and belief in each other.

- Restriction on transfer of shares without the consent of the other partners.

- The principal-agent relationship.

- Responsible for other partner’s deeds.

Advantages of Partnership

- There will be combined capital, talents, skills, and opinions.

- The ability of funds raising becomes easier as two or more persons will contribute towards the capital. Also, their borrowing capacity will increase.

- Due to the combination of complementary skills, all the partners with different skills will work efficiently in their own way. So this will result in higher profits and greater sustainability and productivity.

- Start-up costs and reporting requirements are generally low.

- Everyone shares control and management. So, the working will be efficient and effective in generating higher incomes.

- There will be more opportunities for tax planning as one can split their incomes between their family members to avoid tax payments.

- Above all, the distribution of the risks leads to lower tension and burden

Disadvantages of Partnership

- Since the partnership is not a separate legal entity, liabilities are unlimited for the partners except minors which means that the debts and liabilities are to be paid off from their pockets once the business assets and cash are done up with.

- The differences in the opinion and thoughts of one or more partners for either, the profit-sharing ratio, decision making and its implementation, direction, control, administration, etc., may lead to chaos. Therefore, frequent disputes may also lead to the dissolution of the partnership.

- There is a burden of implied authority. So, if the other partner has committed a blunder, the other partners will also have to face the consequences. As a result, even though the partners are careful and efficient enough, due to some partners may face some problems.

- At the time of admission, retirement, etc., of the partners, there is a valuation of the assets and the liabilities. This will lead to cost increment.

- The people are highly dependent on the products. Therefore, there is a loss to the firm and society as a whole if the partnership closes abruptly.

- Due to the unlimited liability, even after the retirement of the partners, they are liable for the acts done when they were the partners. In a limited partnership, the liability ceases on the transfer of shares.

- In partnership, the ideas, thoughts, and secrets are confidential. They are generally not shared with anyone. So, once the partnership dissolves, the secrets expose, creating a problem when one starts a new business.

To know more, you can read our article Advantages and Disadvantages of Partnership.

Great work indeed