What do you mean by Financial Globalization?

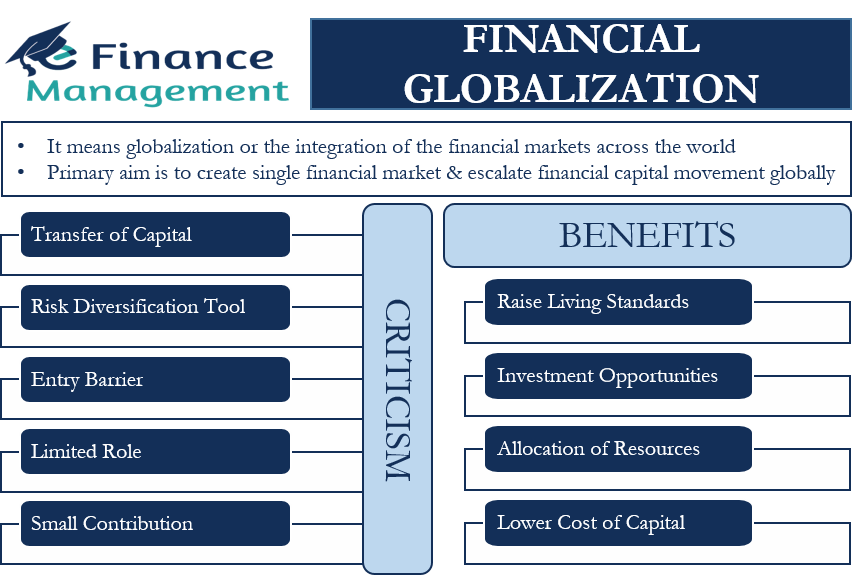

Financial Globalization means the globalization or the integration of the financial markets across the world. The primary aim of this globalization is to create a single financial market and facilitate the smooth movement of financial capital globally. This will also give investors opportunities to invest and earn returns on their investments anywhere in the world.

The primary factors that have made immense contributions to the rise of financial globalization are:

- The deregulation of national financial markets,

- The growing presence of global banks and financial institutions, and

- The development of new financial instruments.

Stock markets are a very good example of this type of globalization. For instance, if one major stock market is on a decline, it could impact other stock markets as well.

Financial Globalization: Benefits

Raise Living Standards

Financial experts see this globalization as a tool to raise the standard of living across the globe, especially in developing nations.

Investment Opportunities

Also, it helps to diversify risks and significantly raise the investment opportunities available to the investors.

Lower Cost of Capital

Moreover, such globalization also assists governments and businesses in lowering their cost of capital of getting funds from abroad.

Allocation of Resources

Many also believe such globalization could result in a more efficient resource allocation across the globe. Such globalization also makes it easy to access foreign financial resources. Also the access gets easier to technology and information. It also facilitates global mergers and acquisitions.

Financial Globalization: Criticism

Transfer of Capital

The very first criticism against financial globalization is that the transfer of capital from developed economies to underdeveloped is less than expected. The movement of capital from developed to developing and underdeveloped nations was expected to boost growth and standard of living. However, the limited transfer of capital was not enough to bring about a total global change.

Risk Diversification Tool

Many believe that this globalization has mainly become a tool of risk diversification. There is also a belief that there are now more chances of a country facing banking and currency crises because of this interlinking of the markets.

Entry Barrier

Another criticism is that the integration of global financial markets is slower than expected. Initially, the belief was that over time, capital markets would eliminate barriers to entry and thus, would allow all types of investors to participate, irrespective of their location. But, international markets still offer several benefits to their investors in comparison to the domestic markets. These benefits are in terms of cost, information, corporate governance, etc. Additionally, only a few firms from each country have access to the international markets. These firms are usually the biggest ones in that country.

Limited Role

One more criticism is with regards to the role of institutional investors in financial globalization. Many believe their role was much less than what the original expectations were. The institutional investors were expected to use private and public savings in a counter-cyclical and long-term way.

There is evidence that the role of institutional investors was more limited. This is because they were not diversifying risks as per the initial expectations and were investing in fewer stocks. All that where the investments flow are the stocks having past history of winning, and similarly, all that they sell are the stocks with a losing history. Also, these investors have received criticism for triggering contagion effects that spread crises globally.

Also Read: International Banking

Small Contribution

Despite having benefits, many believe that it has failed to fully achieve its objectives or has only brought about a small positive change in the world.

Political Interferences

This financial globalization has taken some form of old school practices, where developed nations make the underworld and developing nations large borrowers. And after that, they start twisting their arms to get political, geographical, and military benefits.

Final Words

Financial globalization is still an ongoing process, and there is no way of knowing how long will this process take. Though the linking of markets is benefiting some, the pace is much slower. On the other hand, the risk of contagion effect is now more than ever. The 2009 crisis is a very good example of this, where bankruptcy in the U.S. leads to a steep economic decline in many countries. Any purported move by any developed nations or investors controlling the markets can de-rail the global markets and may create knee-jerk reactions. It was thought that the movement of capital will help all but major investments flowing to the stock and currency markets, and the speed with which it travels back to its home country on any small event has made these markets vulnerable.