Greenmail: Meaning

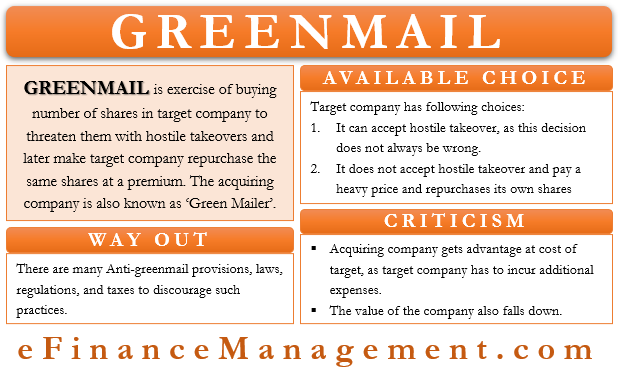

Greenmail is an exercise of buying a large number of shares in the target company so as to threaten them with hostile takeovers and later make the target company repurchase the same shares at a premium. It is a practice where the purchasing company intentionally buys a major chunk of shares of the target company from the open market. After purchasing so much stake, it threatens the target company that it will initiate hostile takeovers unless those same shares are bought back by the company at a premium price. To avoid such hostile takeovers, the target company repurchases those shares at a premium. Under this practice, the acquiring company is not willing to have a hostile takeover at all. Their main target is to threaten the target company and earn profits out of the premium received above the market value.

The Acquiring Company is also known as the Greenmailer or Raider or Corporate Raider under this practice. The money paid by the target company to the acquiring company is known as Greenmail Payments. Another name of Greenmail strategy is Bon Voyage Bonus or Goodbye Kiss.

Understanding the Term: Greenmail

The Greenmail is created by merging two terms, i.e., Blackmail and Greenbacks. The acquiring company threatens the target company to initiate a hostile takeover by buying enough shares. The acquiring company, to avoid a hostile takeover, asks the target company to repurchase the same chunk of shares at a premium price. Thus, it is Blackmail for the money. The Target Company, in order to save itself from such hostile acquisitions, buys back its own shares at a premium. The acquiring company promises to leave the company once the repurchasing of shares takes place.

The literal meaning of the term Greenbacks is US Paper Dollar, but now it is useful as a term determining money at large. By combining Greenbacks and Blackmail, we get the term Greenmail. Thus, it is an exercise of paying money to the Acquiring Company by the Target Company to avoid hostile takeovers in the future.

Also Read: Hostile Takeover

Choices in the Hands of the Target Company

In the case of Greenmail practice, the target company has to choose between two major decisions as follows:-

- The first decision is that the Target Company can accept a hostile takeover by doing nothing. It can allow the raider to take shares on premium and slowly the stake in the company. This decision is not always wrong, though. If the resources are not utilized by the target company properly, then the acquisition would be fruitful for both parties in the future.

- The second choice with the target company is not to accept a hostile takeover. Under this, the target pays a heavy price and repurchases its own shares, and keeps the stake safe. Most of companies make this choice rather than doing nothing.

Criticism of Greenmail

One of the biggest criticisms of this practice is that the acquiring company gets an advantage at the cost of the target company. The target company has to incur additional costs for buying back those large chunks of shares from the Acquiring Company or the Raider for almost zero returns. This makes it a very unfair deal for the target company.

The target company uses shareholder’s money to repay the raider or takes additional debt. As a result, shareholders are at the highest loss after the repurchase of shares gets over. The value of the company also falls down to a record low after the repurchase because of an increase in the amount of debt. This is the second criticism of this practice.

These criticisms are non-exhaustive in nature.

A Way Out of Greenmail Practice

In order to overcome the above-mentioned criticisms, now there are many Anti-greenmail provisions, laws, regulations, and taxes to discourage such practices. The Internal Revenue Service (IRS) of the USA has levied an extra excise tax of 50% on the profit earnings from greenmail payments. Also, The New York Statute also specifically provides that a company can not purchase more than 10% of its shares from the shareholders at a higher value than the market value. Almost all states and/or countries have one or the other regulations to avoid greenmail exercises. The companies at the time of incorporation also put anti-greenmail provisions in the prospectus of the company. This kind of provision does not allow the directors to release any greenmail payments.

Thus there are many options acting as an anti-greenmail element after the year1980. Before 1980, there was not any such anti-greenmail measure.

Real-Life Examples of Greenmail

Let us have a look at two real-life examples of Greenmail. They are as follows:-

- In 1986, one investor had an 11.5% stake in The Goodyear Tire & Rubber Company at a price of $42.2 per share. The investor threatened the company to buy an additional stake. In such a situation, the company repurchased the 11.5% stake back at a premium price of $49.50 per share. Here the raider made a profit at the cost of the company.

- The next real-life example is that of the Saxon Industry. A retail investor from America had a 9.9% ownership in the company at a price of $7.21 per share. The company expected future threats and so repurchased a 9.9% stake with a premium of 45% at a price of $10.5 per share.

There are many more real-life examples as well.

Conclusion

The focus of Greenmail’s practice is to earn profits by the acquirer at the cost of Target Company by threatening to go for a hostile takeover. It is similar to Blackmail, where the target, in order to avoid hostile takeovers, gives the money in the form of a premium for the purchase of shares. These days, this practice has come under legal regulations. The Acquirer has to go through a lot of legal requirements before imposing such unfair practice on any targets. These days, the target company also imposes anti-greenmail provisions to avoid such hostile takeovers and high losses.