What is Public Finance?

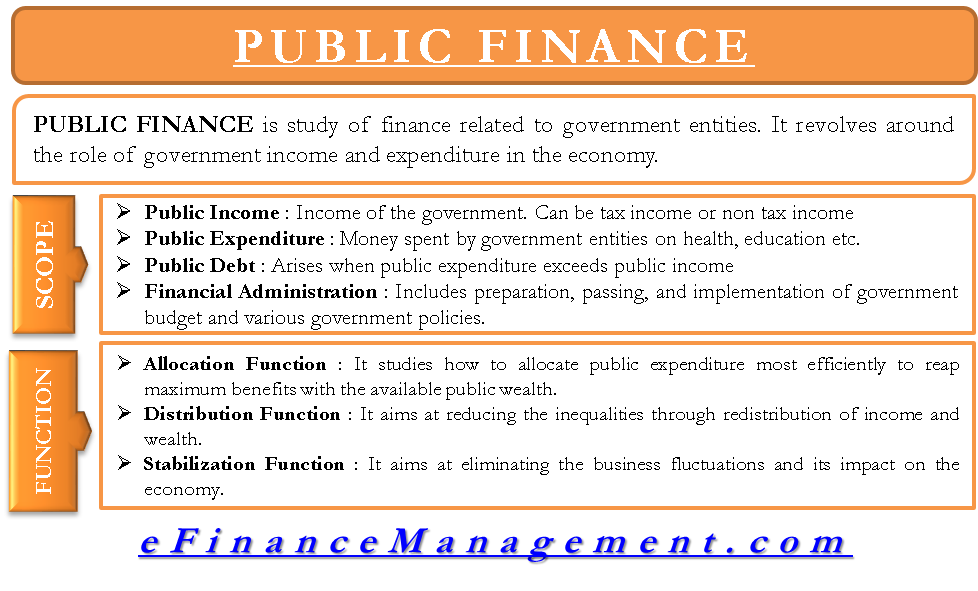

In simple layman’s terms, public finance is the study of finance related to government entities. It revolves around the role of government income and expenditure in the economy.

Prof. Dalton, in his book Principles of Public Finance, states that “Public Finance is concerned with income and expenditure of public authorities and with the adjustment of one to the other”

By this definition, we can understand that public finance deals with the income and expenditure of government entities at any level, be it central, state, or local. However, in the modern-day context, public finance has a wider scope – it studies the impact of government policies on the economy.

Let’s understand the scope of public finance to understand how public finance impacts the economy.

The scope of Public Finance

Prof. Dalton classifies the scope of public finance into four areas as follows –

Public Income

As the name suggests, public income refers to the income of the government. The government earns income in two ways – tax income and non-tax income. Tax income is easy to recognize; it’s the tax paid by people of the country in the form of income tax, sales tax, duties, etc. On the other hand, non-tax income includes interest income from lending money to other countries, rent & income from government properties, donations from world organizations, etc.

Also Read: Sources of Public Debt

This area studies methods of taxation, revenue classification, methods of increasing government revenue and its impact on the economy as a whole, etc.

Public Expenditure

Public expenditure is the money spent by government entities. Logically, the government will spend money on infrastructure, defense, education, healthcare, etc., for the growth and welfare of the country.

This area studies the objectives and classification of public expenditure, effects of expenditure in different areas, and effects of public expenditure on various factors such as employment, production, growth, etc.

Public Debt

When public expenditure exceeds public income, the gap is filled by borrowing money from the public or from other countries or world organizations such as The World Bank. These borrowed funds are public debt.

This area of public finance explains the burden of public debt, why it is necessary, and its effect on the economy. It also suggests methods to manage public debt.

Also Read: Finance vs Accounting vs Economics

Financial Administration

As the name suggests, this area of public finance is all about the administration of all public finance, i.e., public income, public expenditure, and public debt. Financial administration includes preparing, passing, and implementing government budgets and various government policies. It also studies the policy impact on the social-economic environment, inter-governmental relationships, foreign relationships, etc.

Functions of Public Finance

There are three main functions of public finance as follows –

The Allocation Function

There are two types of goods in an economy – private goods and public goods. Private goods have a kind of exclusivity to themselves. Only those who pay for these goods can get the benefit of such goods, for example – a car. In contrast, public goods are non-exclusive. Regardless of paying or not, everyone can benefit from public goods, for example, a road.

The allocation function deals with the allocation of such public goods. The government has to perform various functions such as maintaining law and order, defense against foreign attacks, providing healthcare and education, building infrastructure, etc. The list is endless. The performance of these functions requires large-scale expenditure, and it is important to allocate the expenditure efficiently. The allocation function studies how to allocate public expenditure most efficiently to reap maximum benefits with the available public wealth.

The Distribution Function

There are large disparities in income and wealth in every country in the world. These income inequalities plague society and increase the crime rate of the country. The distribution function of public finance is to lessen these inequalities as much as possible through the redistribution of income and wealth.

In public finance, primarily three measures are outlined to achieve this target –

- A tax-transfer scheme or using progressive taxing, i.e., in simpler words charging higher tax from the rich and giving subsidies to the low-income

- Progressive taxes can be used to finance public services such as affordable housing, health care, etc.

- A higher tax can be applied to luxury goods or goods that are purchased by the high-income group, for example, higher taxes on luxury cars.

The Stabilization Function

Every economy goes through periods of booms and depression. It’s the most normal and common business cycle that leads to this scenario. However, these periods cause instability in the economy. The objective of the stabilization function is to eliminate or at least reduce these business fluctuations and their impact on the economy. Policies such as deficit budgeting during the time of depression and surplus budgeting during the time of boom helps achieve the required economic stability.

Now that we understand the study of public finance, we must look into its practical applications. So let us understand the career opportunities in public finance –

Career Opportunities in Public Finance

Investment Banking

An investment banking career in the public finance domain entails raising funds for the development of public projects. Investment bankers help government entities in the following three areas –

- Raise funds by underwriting debt securities such as bonds, debentures, commercial papers, etc.

- Analyzing project finance opportunities for large government projects and raising debt and equity funds for such projects.

- Advising government companies on mergers and acquisitions, divestments, etc.

Research

This is a fairly large area of public finance careers, and a lot of public finance professionals eventually become researchers. Many large banks, government entities, and world organizations require public finance professionals to consolidate necessary data points for decision-making. Thus there is a regular requirement for public finance professionals in the field of research.

Academia

Many public finance professionals eventually go on to become professors and teach public finance in universities and colleges. They are not only limited to teaching, but they also participate in university research to improve understanding of the field and create new tools for efficient, practical applications.

RELATED POSTS

- Advantages and Disadvantages of Different Types of Accounting

- What is the Relationship of Financial Management with Other Disciplines?

- Functions of Financial Management

- Accounting Vs Finance

- What is Fiscal Policy, Its Objectives, Tools, and Types

- Fund Accounting – Meaning, How it Works, Benefits, and More

Thank you very much for this

I really learnt a lot and it is self explanatory

Once again

Thank you very much❤

I LOVE YOU A LOT

Easy to understand and really helpful. Thank you

This is awesome, can’t stop learning

Nice one. It’s simplified to utmost comprehension

Hi sir thank u for this information but actually u have missed 3 more point here 1.stabilization functions 2.accelarating economic development 3.distributive justice. plz add these 3 points .

Thanks. I intend studying public finance at m.sc level to broaden my understanding of the concept.

Really impressive as it was too simple to have clear understanding of the subject.thanks

Thanks you everymuch

What a superb write-up!

Thanks i learnt a lot from this

Hi,

Keep reading

After I go through a little bit moment on this site I scored ‘B’ in my public finance examination! My attached words of appreciation directly goes to the site Founder. Thank you so much

Thank you so much.

Such an appreciation motivates us to work harder.

Thanks for the anticipated efforts 🙏🙏

Wow. Thanks so much for this.