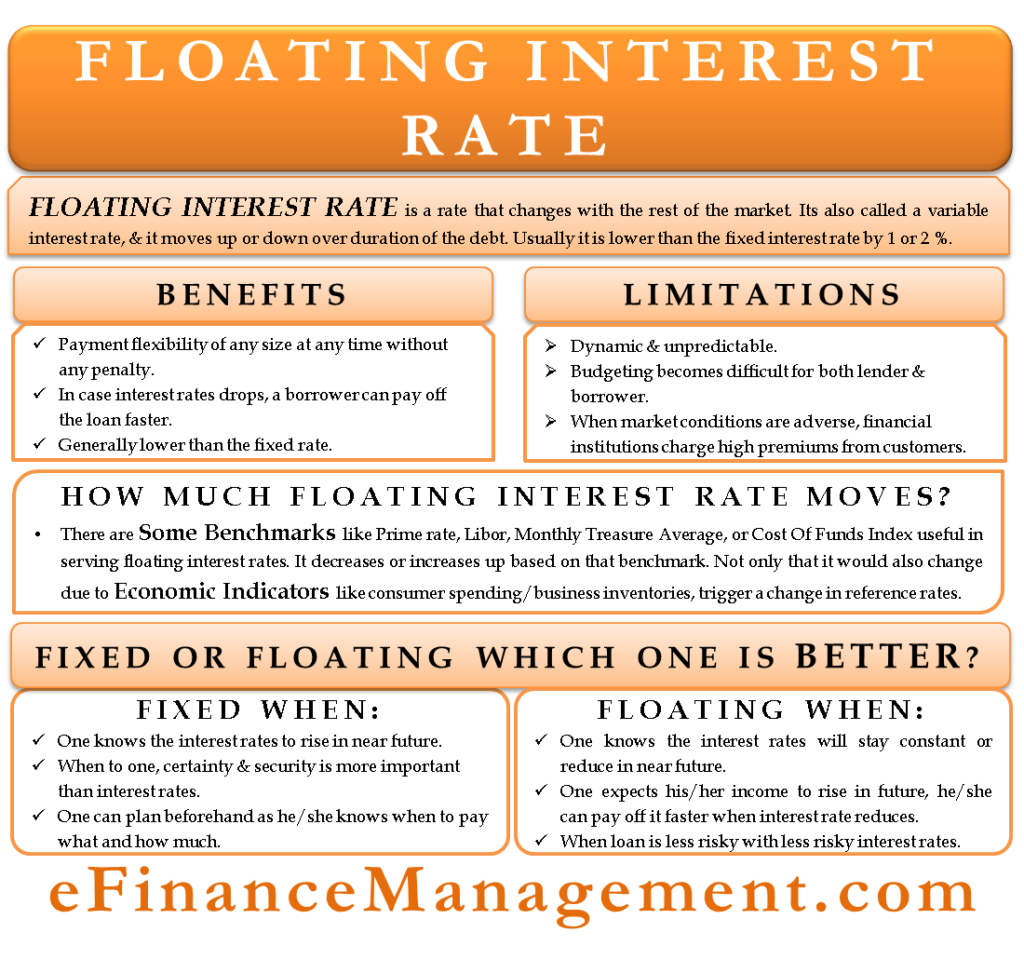

A floating interest rate is a rate that changes with the rest of the market. It is also called a variable interest rate, and it moves up or down over the duration of the debt obligation. Opposite of the floating interest rate is the fixed, which stays constant during the tenure of the debt obligation.

For example, if a borrower takes a home loan with a 4% fixed interest rate. They will pay the same rate for the full duration of the loan. In case the loan is on a variable rate, the borrower may pay 4% initially, but later, the interest rate could go up or down depending upon the overall financial environment.

Floating interest rate loans are common in mortgage loans, but credit card companies may also offer floating interest rates. Also, banks offer such loans to large corporate customers.

How Much Floating Interest Rate Moves?

Usually, a floating interest rate is benchmarked to a key reference rate in an economy. So, any change in that key metric results in a change in the variable interest rate. Some of the key metrics that serve as a benchmark are the Prime rate, LIBOR, the Monthly Treasure Average (MTA), or the Cost Of Funds Index (COFI). The Prime rate is a key reference rate in the U.S., while Libor is majorly used in Europe.

Also Read: Floating Lien – Meaning, Importance and More

Let’s understand how the floating interest rate is set with the help of an example. Assume a floating interest rate is decided to be 2% above LIBOR. So, if Libor is 3%, the interest rate charged will be 5%. And, if Libor increase to 4% going ahead, then the interest rate would also rise to 6%.

It must be noted that interest rates or the reference rates don’t just change by themselves, or no person or entity sets these rates. Economic indicators like consumer spending or business inventories trigger a change in the reference rates. For instance, a change in the prime rate is the result of a survey of what banks would charge their valuable customers.

Benefits of Floating Interest Loan

- Flexibility to make repayments of any size at any time without any penalty.

- In case interest rates drop, a borrower can pay off the loan faster.

- A floating interest rate is generally lower than a fixed rate.

Disadvantages of Floating Interest Loan

- Since the interest rate depends on the market situation, it may prove dynamic and unpredictable. Thus, leading to a rise in interest rate risk.

- The unpredictability of the interest rate makes budgeting difficult both for the lender and the borrower.

- When the market conditions are adverse, financial institutions try to pass on the burden to the customers by charging high premiums.

How it’s Different from a Fixed Interest Rate?

A fixed-rate means a fix lending rate for the duration of the loan. Usually, a fixed rate is higher than the floating rate by 1% to 2%. A fixed interest loan provides the borrower with a sense of certainty as they know the loan tenor and the monthly installments beforehand.

Choosing Between Floating and Fixed Interest Rate?

A borrower must go for a variable interest loan if they believe that the reference rate will either stay constant or reduce over time. In such a scenario, the interest on the loan will either stay the same or reduce.

Also Read: Floating Rate Bonds

Moreover, banks usually allow prepayment without any penalty with the floating interest loan. So, it helps you to pay off the loan faster and reduce the interest amount that you would have paid. Thus, if you expect your income to rise in the future, a floating interest loan could prove a better option.

On the other hand, a fixed rate is ideal if you are okay with the EMI and don’t want any surprises. It also helps to lower your financial risk. Also, borrowers should go for a fixed interest loan if certainty and security are more important to them or if they expect the rate to go up during the term of the loan. Moreover, a fixed-rate loan helps you plan your budget as you know EMI and loan tenor beforehand.

Choosing between the floating and the fixed interest rate is an important financial decision. A borrower must exercise due diligence when making this decision as it has the potential to impact their financial goals.

Swapping Fixed to Floating or Vice Versa

Yes, most banks do offer a facility to change a loan from fixed to floating or vice versa. However, banks usually charge a conversion fee, which could be a small percentage of the amount of the loan.

Read Types of Interest Rates to learn more about different types of interest rates.