LIBOR (London Interbank Offered Rate) is a benchmark rate that serves as the basis for calculating the interest rate for many types of financial contracts. LIBOR has been in use for decades now, and it is referenced in almost every financial contract, such as derivatives, loans, and others. However, in the last decade, questions have been raised about the credibility of LIBOR. The financial institutions globally have decided to phase out LIBOR in the next few years. SOFR (Secured Overnight Financing Rate) is seen as a formidable replacement for LIBOR, at least in the U.S. If you want to know why the financial industry is leaning towards SOFR as a replacement for LIBOR, then understanding the differences between LIBOR vs SOFR is important.

LIBOR vs SOFR – What Are They?

SOFR is a benchmark interest rate that depends on the U.S. Treasury repurchase agreements or the short-term lending contracts between banks. The New York Federal Reserve releases it.

LIBOR is a global reference rate for unsecured short-term borrowing between banks. This rate serves as a benchmark to set the interest rate for many financial instruments globally, including mortgages, interest rate swaps, and more. The ICE ( Intercontinental Exchange) oversees LIBOR. The calculation is for five currencies, as well as for 7 different maturities (from one year to 12-months).

LIBOR – Why there is a Need to Replace?

Understanding why there is a need to replace will also help understand the differences between LIBOR vs SOFR.

LIBOR rate depends on the estimation of rates that key London banks use to lend money to each. For decades, the financial industry has been using LIBOR for pricing their financial products, including derivatives, cash products, and more.

All was going well with LIBOR until the 2008 financial crisis. The financial crises helped in revealing the weaknesses in LIBOR. And in 2012, it was that some banks were manipulating the LIBOR for their benefit. Specifically, the panel banks were together using the strategy of giving inaccurate data in order to make profits from their transactions.

Owing to all these factors, the FCA (Financial Conduct Authority) in 2017 decided to phase out LIBOR by the end of 2021

LIBOR vs SOFR – Differences

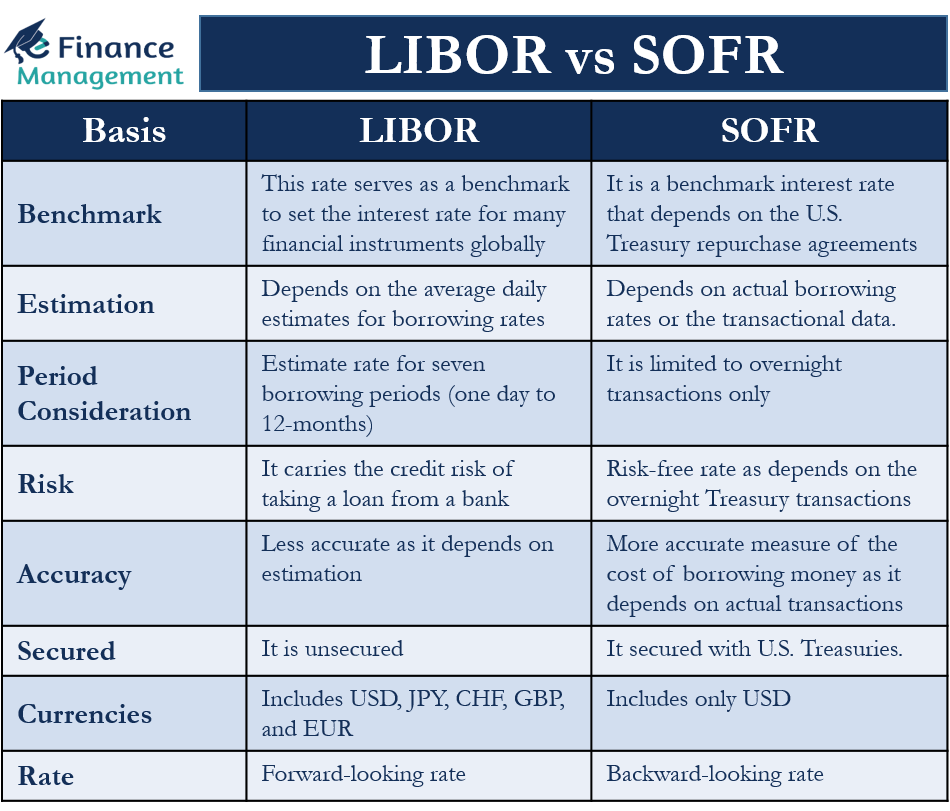

We will discuss below the key differences between LIBOR Vs SOFR:

Estimation

The biggest and crucial difference between these two terminologies is the basis of the calculation of these rates. LIBOR calculation is based on the average daily estimates of the transactions for the various maturities borrowing rates. But, SOFR depends on the actual borrowing rates or the transactional data. Estimates of borrowing rates from panel banks help to come up with the LIBOR. But, SOFR is a broad measure of the cost of borrowing money overnight that is collateralized by the U.S. Treasury securities.

Period Consideration

Another difference between the two is that LIBOR helps estimate the rate for seven borrowing periods, i.e., from one day to 12-months. On the other hand, the use of SOFR is limited to overnight transactions only. This is a major disadvantage of SOFR.

Risk

Since SOFR is only for the overnight treasury transactions and that too collateralized ones, hence it is considered a Risk Free Rate (RFR). On the other hand, LIBOR carries the credit risk of taking a loan from a bank (interbank transactions).

Accuracy

Since the basis of calculation of SOFR is the actual transactions taking place, hence, it is a more accurate measure of the cost of borrowing money. And this feature or base of calculation makes it difficult for the participants to manipulate SOFR. LIBOR, on the other hand, is less accurate as it depends on estimates. And, since it depends on estimates, it can be manipulated easily.

Secured

LIBOR is unsecured, but SOFR is secured with U.S. Treasuries.

Currencies

LIBOR involves several currencies, including USD, JPY, CHF, GBP, and EUR. But SOFR has only one currency (USD) option for now.

Rate

Since LIBOR depends on estimates, it is a forward-looking rate. This means users know before what rates to expect. On the other hand, SOFR is backward-looking as it uses actual data.

Size of the Market

LIBOR market size is comparatively very small to SOFR. The estimated market size for LIBOR is $500 Million Daily. At the same time, the market size for SOFR is about & 1 Trillion daily.

Credit Risk Component

As SOFR is an overnight transaction rate that is further backed by collaterals of US Treasuries, these rates have no credit risk and hence no credit risk component inbuilt in these rates. However, such is not the scene with LIBOR. As LIBOR is based on unsecured transactions, the rates also include the credit risk component.

LIBOR vs SOFR – Which is Better?

SOFR addresses the biggest drawback of LIBOR, and that is manipulation. The manipulation is negligible or minimalist as SOFR is based upon the actual transaction data. But LIBOR uses estimates, so it is more prone to manipulation.

While SOFR, by having based upon actual data, addresses the biggest drawback of LIBOR, SOFR also does have its own share of drawbacks too. And the biggest and most important drawback is its short track record. Therefore, SOFR becomes irrelevant or useless for detailed economic analysis. For instance, the lack of past SOFR data makes it difficult to connect it with economic growth and other macro parameters. This is not the case with LIBOR, which has tons of past data.

Also, SOFR is more volatile than LIBOR on a day-to-day basis. But, banks can overcome this volatility by using an average SOFR rate of the past 1-month or 3-month.

This, however, is not an actual drawback of SOFR because this drawback (and others such as less liquidity, time periods, and more) would go away with time. SOFR is new, and it helps to address the biggest drawbacks of LIBOR. This certainly makes SOFR better, but it still needs to go a long way to reach the level and acceptance that LIBOR once commanded.

RELATED POSTS

- Bank Rate vs Repo Rate – All You Need To Know

- Discount Rate – Meaning, Importance And More

- Types of Interest Rates

- Floating Interest Rate – What It is And When You Should Choose It?

- How is the Interest Rate related to the Required Rate of Return, Discount Rates, and Opportunity Cost?

- Letter of Credit Vs. Line of Credit