Meaning of Floating Charge

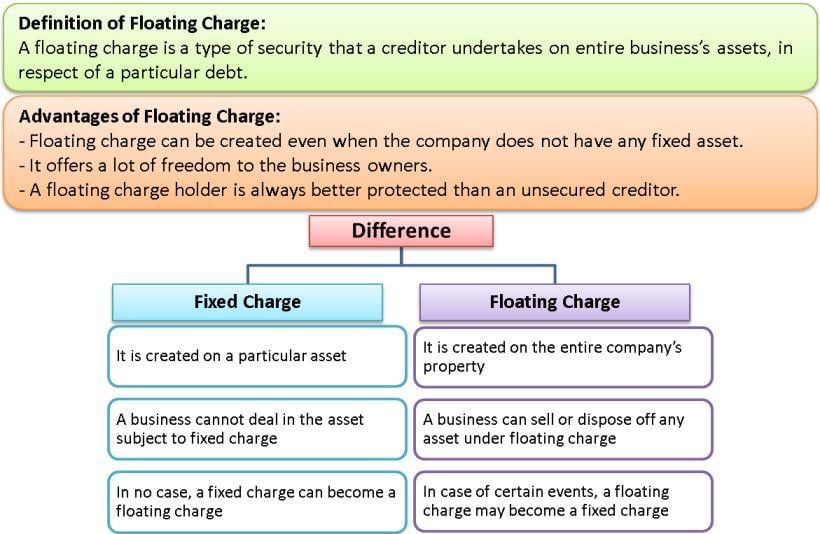

A floating charge is a type of security that a creditor undertakes on an entire business’s assets in respect of a particular debt. A floating charge allows a business to borrow even when it does not own a particular asset like premises, which can act as a security. Under floating charge, a business can borrow against its assets like plant and machinery, stock in trade, vehicles, etc. It is also known as Floating Lien.

One of the main reasons why floating charge came into existence was to allow businesses to buy and sell business inputs and stocks without affecting their day-to-day operations. They can obtain funding by keeping a charge on their inventories as collateral without interrupting their business operations.

After understanding what is floating charge is, let us know its characteristics of the same.

Characteristics of Floating Charge

Some of the characteristics of a floating charge are:

- A floating charge allows unrestricted use of the asset held as security.

- It is a cover against all the assets of the business. As and when the value of the assets changes, the value of the charge also changes.

- In the case of the floating charge, the borrower is not required to obtain the lender’s consent. The company can buy or sell the charged asset freely in the normal course of business.

Advantages of Floating Charge

The floating charge is very beneficial. Let us see some of the benefits of floating charges.

- Even when the company does not have any fixed assets, a floating charge can be created.

- It offers a lot of freedom to business owners.

- The business is free to deal with the asset as if it was never secured. A business does not need any permission or consent from the lender before buying or selling the asset.

- A floating charge holder is always better protected than an unsecured creditor.

- In case of liquidation of the company, the floating charge holder can appoint an administrative receiver who will ensure maximum return to them.

Difference Between Floating Charge and Fixed Charge

A floating charge is different from a fixed charge. The fixed charge is attached to one or more assets, while a floating charge is attached to all the company’s assets, both present, and future, which the company uses in the ordinary course of business.

In simple words, the fixed charge can be against tangible assets like equipment and building or intangible assets like patents and trademarks. It is a mortgage against a particular asset. For example, if a business obtains a loan on a fixed charge basis by mortgaging its building, then, in that case, the business cannot sell or dispose of this building until it repays the entire loan.

Also Read: Floating Lien – Meaning, Importance and More

On the other hand, a floating charge is created against a current asset, whose value and size keep on fluctuating. It does not affect the ability of the business to use the underlying asset in normal business operations. The business can sell, transfer or dispose of these assets when required. For example, suppose a business obtains a loan on a floating charge basis against its inventory. In that case, it can sell or dispose it off in the normal course of business without obtaining any consent from the lender. As and when the inventory gets sold or repurchased, the float value shifts. Hence, it is called a floating charge.

Below are a few points of difference between fixed and floating charges.

| Fixed Charge | Floating Charge |

| It is created on a particular asset. | It is created on the entire company’s property. |

| A business cannot deal in an asset subject to a fixed charge. | A business can sell or dispose of any asset under a floating charge. |

| In no case, a fixed charge can become a floating charge. | In the case of certain events, a floating charge may become a fixed charge. |

When Does a Floating Charge Become Fixed?

The floating charge becomes a fixed charge only when the company goes into liquidation or ceases to trade, or fails to meet the terms of payment, i.e., non-repayment of the loan undertaken. In such cases, the floating charge gets converted into a fixed charge. The process of conversion of floating charge security into fixed charge security is termed Crystallization.

Once the security is crystallized, it cannot be sold or disposed of by the borrower. In addition, the lender obtains the right to take possession of the crystallized security.

Conclusion

A floating charge allows flexibility to the receiver and is less of a hindrance for the lender. Overall, there are several good reasons that prove floating a charge is a great option for banks and other lenders.