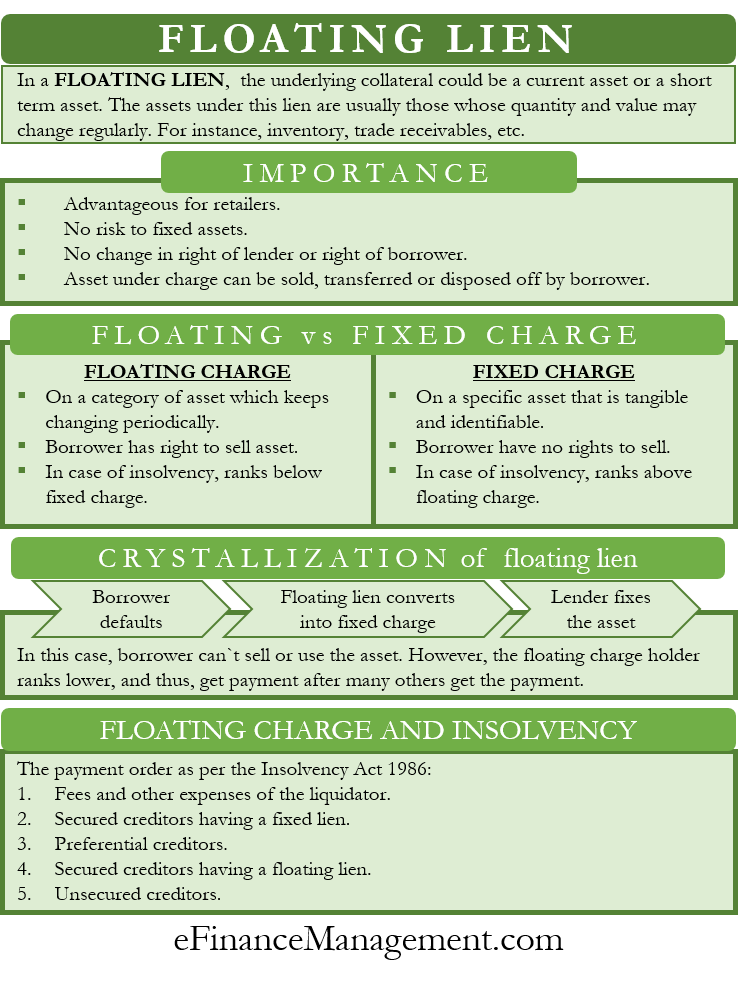

In the business world, a loan or debt is usually against a fixed asset, such as land, equipment, or any other. In a floating lien, however, the underlying collateral could be a current asset or a short-term asset. Generally, the underlying asset in the floating charge could change in value from one period to another.

Floating Lien, or the floating charge, is a lien not on any specific asset but rather on a set of assets or an asset class. We can say that such a lien allows a company to get a loan by keeping a set of assets as collateral. In this lien, the lender and the borrower don’t specify the asset but instead, agree on a set of assets that are collateral.

The assets under this lien are usually those whose quantity and value may change regularly, such as inventory, accounts receivables, and more.

Floating Lien – Importance

A floating charge is very advantageous for retailers. They could use their inventory or debtors to get loans without risking their fixed assets. In a floating lien, the items under the specific asset category may change, but this doesn’t change the right of the lender or the right and responsibility of the borrower.

In fact, the borrower can continue to use the assets under the floating charge for carrying out business operations. The borrower has full authority to sell, transfer or even dispose of the assets under floating charge in the ordinary course of business. Generally, the assets under the floating charge are those that a company may consume in a year.

Also Read: Floating Charge

For example, a company uses its inventory as a floating charge. Now, the company will be able to sell, revalue it, or even increase or decrease its quantity. Also, any change in the value of the inventory won’t impact the floating charge.

Another example is when a company uses cash for a floating charge. In this case, the cash balance with the company will change regularly.

Floating vs. Fixed Charge

Fixed charge is the opposite of a floating charge. In a fixed charge, the collateral is a tangible asset, such as a machine, building, and more. The asset in a fixed charge is identifiable. One simple example is a company taking a mortgage on a building; it is a fixed charge. In this case, the company or the borrower can’t sell, transfer or dispose of the asset until they pay back the debt.

Following are the differences between floating vs. fixed Charges:

- A fixed charge is on a specific asset that is tangible and identifiable. On the other hand, the floating charge is on a category of assets whose numbers, composition, and value would change periodically.

- In a fixed charge, the borrower can sell or transfer the asset only after getting permission from the lender. At the same time, the borrower has the complete right to sell or transfer items under the asset class in the floating charge without seeking any permission from the lender.

- In the case of insolvency, the fixed charge ranks above the floating lien.

- A floating charge gives businesses more freedom as they can get funds without putting their fixed assets as collateral. Secondly, they can use their current and business assets for the purpose of floating lien.

Crystallization of Floating Lien

This is a very crucial concept of floating lien and comes into play when the borrower defaults. Basically, crystallization is a process when a floating charge converts into a fixed charge. This happens when the borrower is not able to pay the debt or enters liquidation, or ceases operations. Another scenario that triggers crystallization is when there is a dispute between the lender and borrower, and both of them reach the courts, who then appoint a receiver.

Once the floating charge converts into a fixed charge, the lender fixes an asset that the borrower can’t use or sell. Also, the lender may take ownership of the asset. However, the floating charge holder ranks lower and thus, gets payment after many others get the payment (and only if and if funds are still available at the time).

Floating Charge and Insolvency

When a company gets insolvent, there is a specific order in which creditors get their payment. The lenders with fixed and floating charges are the secured lenders. Thus, they rank higher in terms of payment over unsecured creditors.

So, a fixed charge holder is the first to get the payment from the sale of an asset that they hold a charge for. Since the company pays off the fixed charge holders, it pays other preferential creditors before making the payment to the floating charge holders. His preferential creditors are employees, insolvency practitioners, and others.

Following is the payment order as per the Insolvency Act 1986:

First are the fees and other expenses of the liquidator.

Next, are the secured creditors having a fixed lien.

Then is the turn of the preferential creditors.

Next, are the secured creditors having a floating lien.

Last are the unsecured creditors.

Final Words

Floating Lien is a pretty useful tool that retailers have to get funds for their operations. His charge involves lower risk as the company doesn’t risk its fixed asset. Moreover, the company has freedom over the use of the assets. Since the composition, quantity, and value keep changing under the floating lien, the lender puts a clause while lending. The clause mandates that the total value of such assets should not fall below a specified value. A d this value is arrived at considering a safety margin thought appropriate by the lender, usually ranges between 10-40%, depending upon the nature and the type of assets covered under the floating lien.