Net Assets and Capital Employed: Meaning

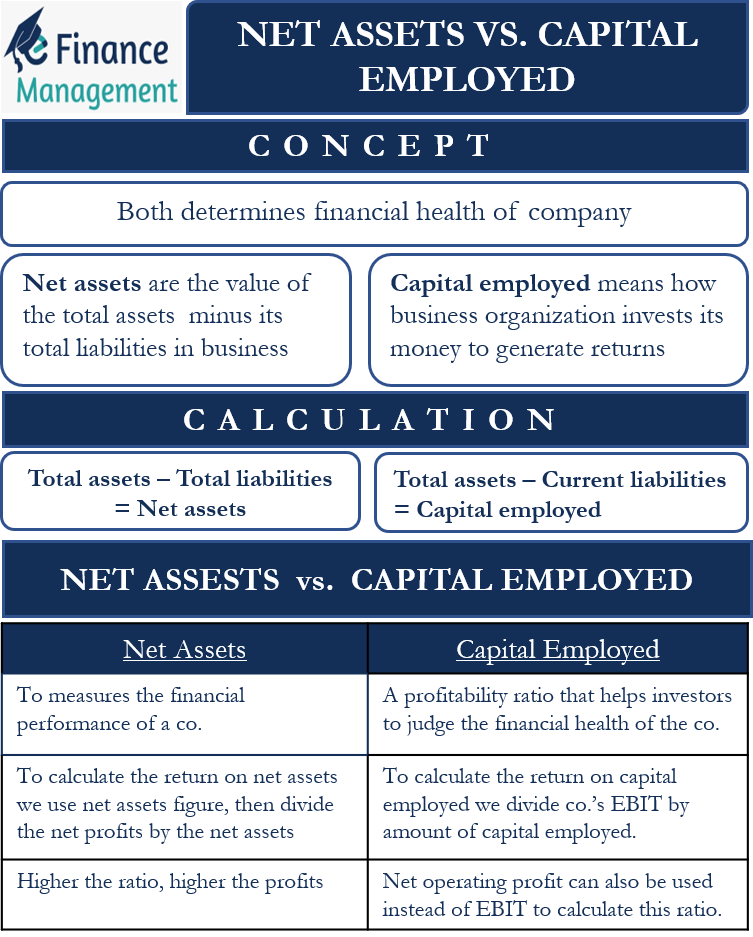

We often need to know the financial health of a company. There are various metrics we use to assess that. Net assets and capital employed are two such metrics, amongst others, that are used to ascertain financial health.

Net Assets

The net assets in a business organization are the value of the total assets of the business minus its total liabilities. Net assets are the total assets owned by an organization after deducting all its liabilities to outsiders and its stakeholders. In other words, it is the difference between the gross assets and liabilities, including the ownership capital of an organization. Further, the total gross assets include the fixed and all the current assets of an entity. Similarly, the total liabilities include the current liabilities and all the long-term liabilities.

Capital Employed

Capital employed means how much funds or capital a business organization has invested to generate returns. It denotes the amount of capital a business can use to earn profits. It is the actual value of the assets that any organization employs to generate revenues and earnings. We calculate the capital employed by subtracting the business’s current liabilities from its total assets. Therefore, the most important difference between net assets and capital employed in the treatment of the long-term liabilities, which we will discuss ahead.

Calculation of Net Assets

We can calculate an organization’s net assets by simply using its balance sheet. The right side of the balance sheet contains all the business’s assets. Hence, We can do a sum total of the right side of the balance sheet to find the value of total assets owned and managed by an entity. These assets can include fixed assets such as land, plant, machinery, etc. Also, they will include current assets such as sundry debtors, cash and bank balances, inventory, etc.

Also Read: Net Assets Calculator

All business liabilities are placed on the left side of the balance sheet. Hence, like what we did for finding the net assets, we can do a sum total of the left side of the balance sheet to find the value of total liabilities carried by an entity. The total liabilities will include the long-term liabilities, such as long-term loans and borrowings. In contrast, the short-term liabilities will include sundry creditors, provisions, and other liabilities that are due to be paid within a period of one year or lesser.

We then deduct the total liabilities from the sum total of total assets to arrive at the net assets of the business organization.

Refer to Net Assets Calculator for a quick calculation.

Calculation of Capital Employed

We can also calculate the capital employed in an organization by using its balance sheet. We will find out the value of the total assets by adding up all the components from the assets side or the right side of the balance sheet. They include both the fixed as well as current assets.

Then we will find out the sum total of only the current liabilities of the organization from the liabilities side or the left side of the balance sheet. These can include sundry creditors, short-term debts, dividends, taxes payable, etc. We will then subtract this amount from the sum of total assets to arrive at the capital employed by the organization.

For a quick calculation, refer to Capital Employed Calculator.

Differences between Net Assets and Capital Employed

Treatment of Long-term Liabilities

The most important difference between net assets and capital employed is in the treatment of long-term liabilities of the organization. We deduct the business’s total liabilities from its total assets to arrive at the value of net assets. Here we include the long-term liabilities of the business in the total liabilities. These are the liabilities that are due for payment after a period of one year or more.

Also Read: Capital Employed Calculator

But we do not include the long-term liabilities in the amount of liabilities that we use to calculate the capital employed in the organization. We deduct the current liabilities that the business has to pay within a period of one year or lesser. Therefore, capital employed or funds deployed consists of the shareholders’ total funds and the business’s long-term liabilities.

Ratio Analysis

The return on net assets or RONA measures a company’s financial performance by making use of its figure of net assets. We divide the net profits by the net assets to calculate this ratio. A high ratio will mean that the company is generating higher profits on every dollar that is invested in its assets and vice-versa.

The ratio that we calculate using the capital employed value is the return on capital employed or ROCE. While RONA is a ratio to judge the frequency and usage of the net assets. ROCE is a profitability ratio. And it indicates the financial health by understanding the rate of return generated by the business on its capital employed. We calculate ROCE by dividing the company’s earnings before interest and taxes (EBIT) by the amount of capital employed. Net operating profit can also be used instead of EBIT to calculate this ratio.

Read more at Return on Capital Employed.

Example: Net Assets and Capital Employed

Let us understand the concept of net assets and capital employed with the help of an example. ABC Inc. is a garments manufacturer. Its Balance Sheet comprises of the following:

Sundry Debtors- $4000

Inventory- $3500

Cash and Cash Equivalent- $3000

Land, Plant, and Machinery- $12000

Sundry Creditors- $5000

Long-term Loan- $15000

Net Assets of ABC Inc.-

- Total current assets = $4000 +$3500+$3000= $10500

- Total fixed assets = $12000, Total current liabilities- $5000

- And, total long-term liabilities = $15000

Hence, Net Assets = Total Assets – Total Liabilities

= ($10500+$12000) – ($5000 +$15000)

= $22500 – $20000 = $2500

The net assets, in this case, is positive, which means the company has sufficient assets to cover all its liabilities. Companies with negative net assets will usually be financially unsound and in trouble.

Now let us calculate the capital employed.

Capital Employed = Total Assets – Current Liabilities

= ($10500 + $12000) – $5000

= $22500 – $5000 = $17500

The above figure of capital employed is the amount of capital that is available to the business to operate, make sales, and generate profits. It helps an investor calculate the ROCE and compare it with the cost of capital to know whether the business is generating more or able to cover its capital cost. Similarly, it helps the investors to know the operating income that the business can generate on every dollar of capital that it invests.

Frequently Asked Questions (FAQs)

Net assets are the total assets owned by an organization after deducting all its liabilities to outsiders and its stakeholders. While capital employed means how much funds or capital a business organization has invested to generate returns.

The main difference between net assets and capital employed exists due to the treatment of long-term liabilities by the companies.