To invest in the equity of a firm, we have stock exchanges in different countries like NASDAQ for the US and HKEx for Hongkong. Retail investors, institutional investors, and firms invest in public companies for buying their equity shares/stakes. The aim is to take up a share of the company’s equity capital to earn and grow with the growth of the company and/or become a partner of the company. For this purpose, there are instruments through which an investor sitting in the US can invest funds in London Stock Exchange. Moreover, such an opportunity has widened the scope of capital flows between different countries and led to globalization.

The secondary market acts as a medium for connecting investors with the investee companies needing funds, even internationally. There are two ways through which an investor can invest globally, the first is dealer markets, and the second is the agency market. Further, when an investor is making a deal with the dealer through dealer markets, it is also known as the over-the-counter market. And the dealer is responsible for carrying out investor deals in the OTC market. However, such transactions are not visible to the public. While, in the agent market, brokers are responsible for carrying out the investor’s transactions.

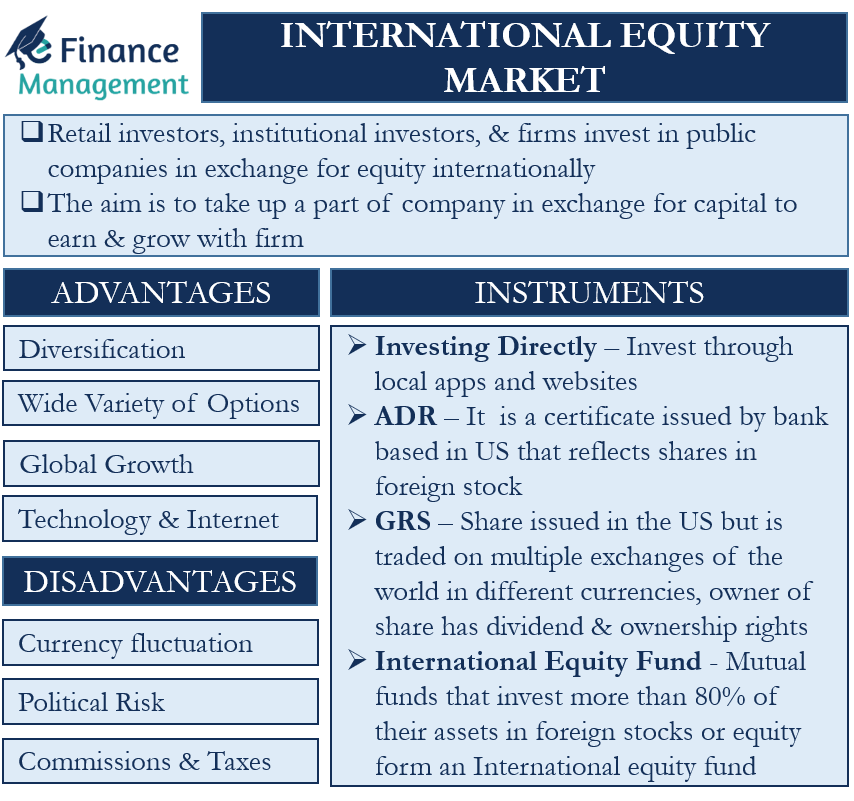

Advantages of the international Equity Market

Diversification

One of the prime advantages of investing in the international equity market is risk diversification. For many retail investors investing in global markets helps in diversifying their portfolios. Diversifying your portfolio to different geographies results in low correlations between the asset classes and can also help mitigate a domestic country’s economic shocks.

Wide Variety of Options

Every country has a different industry specialization. The US is famous for tech companies, and the UK is famous for its banking and insurance industry. By investing internationally, one gets a portfolio of many outperforming companies driving the world today. A simple example is investing in Google, Amazon, or other major tech companies.

Also Read: International Financial Markets

Global Growth

IMF predicts a global growth rate of 4.4%-5.9% in 2022. As different developing countries are growing at varied rates, investing in the global market adds the possibility of greater returns compared to only investing in the domestic market. The growth rates and so as risks are quite high in the emerging market economy. And a lot of funds flow from developed countries to these emerging market countries.

Technology and Internet

These tools have changed the investing scenario of the world. Now, one sitting in the comfort of home can easily invest in stocks of different parts of the world. The ease has made the process smoother and hassle-free.

Disadvantages of the International Equity Market

Currency fluctuation

There is a risk of international currency rate fluctuations. When the exchange rate is in favor, one can earn a better return on investments. However, when the exchange rates go against the investor, it may lead to negative or reduced returns.

Political Risk

Many countries have substantial political risks, where the laws of government keep changing. In the case of China, the government is constantly updating its policies to align the economy with its primary goals. The constant uncertainty on the part of the government increases the risk significantly. The particular sector or the market of that country may go out of favor. And in such a case withdrawing investments may lead to a substantial loss.

Also Read: Forex Market Participants

Commissions and Taxes

One disadvantage that reduces the returns of investors is the taxes, duties, and brokerage charges on the transactions. Trading internationally is subject to many of these issues, reducing the return of investors.

Instruments of the International Equity Market

Even US firms will now expand their purview and raise funds from different parts of the world. The idea is to raise money for international projects at low costs and commissions. Likewise, there are many ways for investors to invest in international equity markets:

Direct Investment

The international investment process is now quite eased out. And the investors these days can directly invest in the international market through local apps and websites. Therefore, the process is easy and accessible to retail investors. Retail investors can use various apps, sitting in the comfort of their houses to invest in the equity of companies based in various parts of the world.

American Depository Receipts (ADR)

ADR is a certificate issued by a bank based in the US that reflects shares in foreign stock. Let us say a US bank represents shares of Barclays on the stock exchange of the US. And the shares are bundled together to form one ADR that is further sold to the investors. This way, Barclays reduces the hassle of listing itself on the US stock exchange and still can approach and onboard now American investors. There are two types of ADR, sponsored and unsponsored ADR. In the case of sponsored ADR, only one bank is legally allowed to represent the shares of the company, and the bank shares a contract. While, in unsponsored ADR, there is no legal contract from the foreign company.

Global Registered Shares (GRS)

A share is issued in the US but is traded on multiple exchanges of the world in different currencies. Moreover, the owner of the share has dividend and ownership rights equivalent to any other investor. Let us say a firm is listing its shares on NYSE and London stock exchange; then the firm is issuing global registered shares. Currently, with diminishing boundaries and globalization GRS is becoming an attractive concept compared to ADR.

International Equity Fund

Mainly, Mutual funds that invest more than 80% of their assets in foreign stocks or equity form an International equity fund. A fund or group in the US investing in the funds or equity of US tech companies is an example of international equity funds. A fund manager and other key members will invest money in foreign funds or equity. This way, one can access the global market by trusting a skilled fund manager who knows the functioning of the various funds.

Conclusion

To conclude, in simplicity, the International equity market means having access to equities present globally. It is becoming a prominent concept with increasing globalization and trade agreements. One should conduct thorough research before investing. Furthermore, It is better to take the help of financial advisors to understand risk and return balance.