What is a Holding Company?

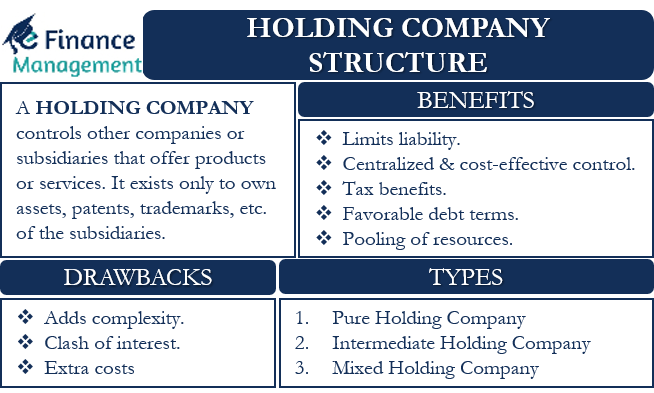

As the name suggests, a holding company holds the stocks of another company. Such a company does not usually carry out any traditional business activities, such as manufacturing or offering services. Instead, it owns enough assets or equity of other companies to hold voting power or influence their policies and management decisions.

Another name for a holding company is a parent company. And the company that the parent company controls is an operating company or subsidiary.

Since holding companies do not usually offer any products or services, their objective is to control operating companies and benefit from them. Apart from shares, holding companies can own the rights to the business, real estate, and more of operating companies. Let’s take a look at the Holding Company Structure and how it benefits it and its subsidiaries.

Holding Company Structure – Forms

Following are the main types of Holding Company Structures in practice:

Pure Holding Company

In such a form, the holding company does not conduct ordinary business operations. Instead, it exists only to control the subsidiaries, including holding their assets. Thus, they limit themselves as a holding company in its literal meaning.

Operational Holding Company

This type of holding company not only holds the shares of its subsidiaries but also actively participates in their management and operations. It may provide centralized services like HR, finance, or marketing to its subsidiaries.

Intermediate Holding Company – Layers

In this form, we will see layers – a bigger and a smaller layer of holding companies. All smaller holding companies align to and are controlled by a Bigger Holding Company. In other words, a holding company is basically a subsidiary of another larger holding company. For example, there will be a pure holding company at the top and many intermediate holding companies that are its subsidiaries-wholly owned or partially owned.

Mixed Holding Company

As the name implies, it is a mixture of a holding company and an operating company. Thus it performs both tasks. It does have its own business operations. And at the same time, in addition, it operates as a holding company by controlling its subsidiaries as a holding company.

Holding Company Structure: How It Works?

Any company can be a holding company in one of the two states. The first is by acquiring or buying enough voting shares in another company so as to get control of the management. The second is by creating or starting a new company and maintaining control over its management.

Thus, there are two strategies by which a firm can gain control over another firm. The first is to own a 100% stake in another company or its subsidiary. And the second is by acquiring enough stake (controlling voting stock) in another company to be able to control the management. Usually, it means acquiring 51% of the voting shares. However, in practice, there are so many shareholders in the company. Hence, in such situations, even if a company acquires a controlling stake that could be less than 51%, it may also be enough to exert control over the management of that firm.

Also Read: Subsidiary Company

How does a Holding Company Make Money?

As said above, holding companies do not usually carry out their usual business activities. So, a question that arises here is how holding companies make money. The answer to this is simple; it makes money from the operating companies. It makes money from operating companies in five ways;

- Interest, dividends, or profit earned from the subsidiaries.

- Royalties and Licensing Fees

- Management Fees

- Any service it may offer to the operating company.

- From the sale and purchase of assets or stock of the subsidiaries.

All such things are decided beforehand, like profit sharing, cost of service, and more. Both companies sign an agreement that includes all these things and also the budget of the operating company. Primarily, this budget allocation is what helps holding companies evaluate the performance of their subsidiaries.

Advantages of Holding Company Structure

We will discuss here the key advantages of the holding company structure:

Limits Liability

Usually, the holding company takes ownership of all the assets of the subsidiaries. It then leases those assets to its subsidiaries. If a subsidiary goes bankrupt or faces a lawsuit, the assets are secure with the holding company. This is because the subsidiary does not own the assets, and thus, creditors can not lay a claim on them. Moreover, since the holding company does not carry out usual business operations, it does not face any risk (or a minimum risk) of a lawsuit for business operations.

Centralized and Cost-Effective Control

Since a holding company controls all the subsidiaries, it leads to a well-defined centralized control. This would effectively imply that all the subsidiaries and other companies in which it has a controlling stake are accountable to the holding company for their performance and operations. Such centralized control is also cost-effective because a holding company does not need to buy a 100% stake in another company to get full control of it. Moreover, a holding company can streamline its operations by appointing executive management teams to manage its subsidiaries. This also helps to reduce the cost. This also ensures that all companies under the holding company umbrella are guided and work in unison toward the key objectives of the holding company.

Tax Benefits

A holding company can get tax benefits in two ways.

The first is through filing consolidated tax returns. If a holding company owns 80% or more of the subsidiaries, then it can present the consolidated tax returns for the whole group. In this way, the holding company can club the financial numbers of all the subsidiaries with its own financial numbers. So, if one or more subsidiaries incur a loss, the holding company can use it to offset the tax liability of the subsidiaries making a profit. Thus, this helps lower the overall tax liability. Besides, this will also cut down on so many administrative and procedural costs and exercises.

A holding company structure can also help lower or completely eliminate the dividends tax. Instead of giving dividends directly to the shareholders, it is possible to distribute the dividend to the holding company. This way, a shareholder can defer the income tax on dividends when they withdraw them from the holding company. Moreover, shareholders can also entrust the holding company to reinvest the dividends in other assets.

Favorable Debt Terms

A holding company is usually a large company with a better credit rating than its subsidiaries. This will obviously put them in a better and improved position/bargaining power while going for borrowings. And thus, they can obtain loans at better terms and interest rates than the subsidiaries on a stand-alone basis. After taking a loan, a holding company could distribute the loan to the subsidiaries. Such an arrangement could prove very beneficial in the case of a subsidiary that is a start-up or is a risky project.

Pooling of Resources

In the case of a holding company structure, there is a large pool of resources, both in terms of executives and other resources (from the holding company and subsidiaries). Depending upon the requirements of the group, the holding company can freely utilize or share these resources (man, systems, processes, space, funds, and even materials) amongst the group. This, in turn, leads to successful business operations and optimal utilization of available resources.

Drawbacks of Holding Company Structure

The following are the drawbacks of the holding company structure:

Adds Complexity

In comparison to single company structures, a holding group is definitely more complex. There could be several subsidiaries under a holding company, with each having a different business and objective. Such things add further complexity. However, a holding company can overcome such things by creating an efficient management team.

Clash of Interest

It is possible that the holding company does not own 100% of the shares in the subsidiaries. In such a case, it is possible that the remaining shareholders do not agree with the decisions of the holding company. Or there can be disputes and conflicts between the shareholders and holding companies due to different impacts on their interests. This will add further complexity to the operations. And it remains no longer an easy task to carry on smooth operations of the companies under the group.

Extra Costs

Although a holding company structure is cost-effective, it has its own costs too. These can vary more or less depending on the number of subsidiaries, the type of operations, and more. The additional costs also include registration fees, costs for maintaining accounts, and compliance costs.

Final Words

The introduction of a holding company structure has its own advantages and disadvantages. Such a structure suits companies that are very large and have a number of small subsidiaries.

Frequently Asked Questions (FAQs)

The creation of a holding company limits liability and provides tax benefits, the facility of pooling resources, better credit ratings, and centralized control.

The following are the disadvantages of holding companies:

a. It adds Complexity.

b. Clash of Interest among Shareholders of a Subsidiary and Holding Company

c. Extra costs.

A Holding Company controls other companies or subsidiaries that offer products or services. It exists only to own the subsidiaries’ assets, patents, trademarks, and more.

The intermediate holding company is a subsidiary of another bigger company. This means there will be one pure holding company at the top and many intermediate holding companies.