How to Read Currency Pair in Forex Market?

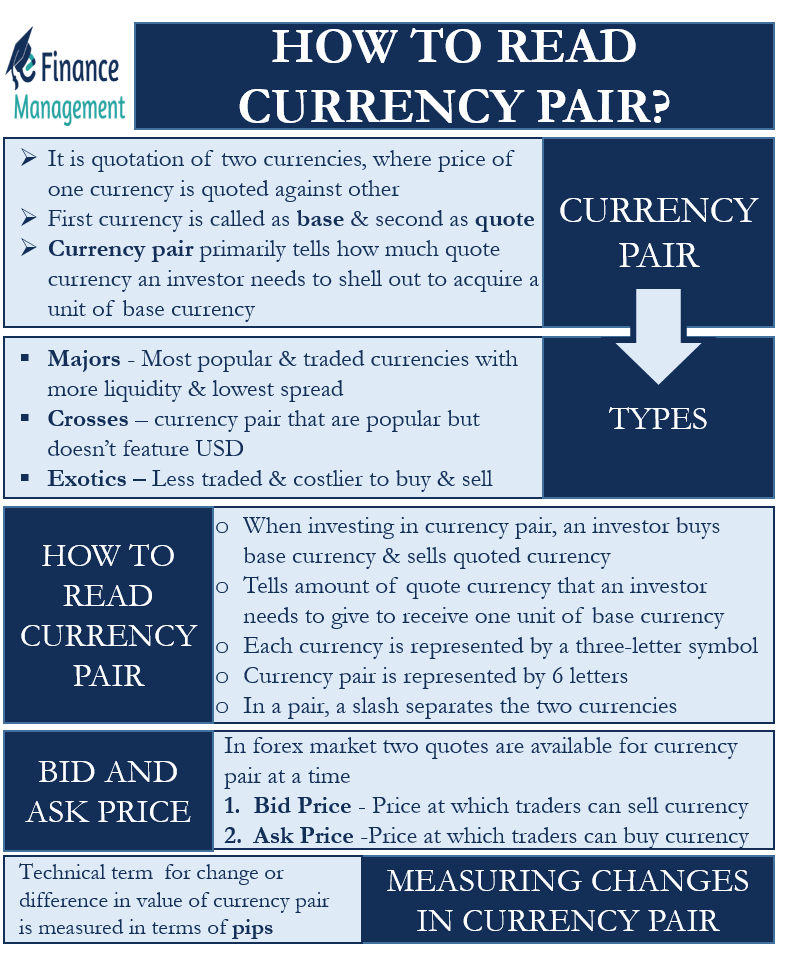

Unlike the stock market, where investors get a single rate, the prices in the foreign exchange market are quoted in pairs, i.e., the price or the quote always talks about two currencies. This quotation of the price of currencies in pairs is what we call a currency pair. Every investor in the foreign exchange market must know how to read currency pairs.

What is a Currency Pair?

It is a quotation of two currencies, where the price of one currency is quoted against the other. In a currency pair, we call the first currency a base, and the second currency a quote. A currency pair primarily tells how much of the quote currency an investor needs to shell out to acquire a unit of the base currency. For simplicity, we can say that the base currency is what needs to be bought through the quote currency.

Moreover, to make reading the currency pair easy, one can identify each currency with its standard three-letter symbol. For instance, the symbol for the U.S. dollar is USD, and the Canadian dollar is CAD. ISO (International Organization for Standardization) is responsible for developing and publishing codes and standards for the currencies.

There are primarily three kinds of currency pairs, these are:

- Majors – these are the most popular and most traded currencies. Such pairs are the most liquid ones and carry the lowest spreads. Moreover, these currencies are relatively more stable. A few examples of majors are EUR/USD, GBP/USD, and more.

- Crosses – these refer to the currency pairs that are popular but do not feature USD. For example, GBP/AUD and EUR/CAD.

- Exotics – these are the currency pairs that are traded less, as well as are relatively costlier to buy and sell.

A quote may be direct or indirect. A direct quote is when the home currency is the quoted currency, and the foreign currency is the base currency. For example, a EUR/USD quote will be a direct quote for U.S. traders. And the indirect quote is the opposite of the direct quote, where the value of the domestic currency is in terms of the foreign currency.

Now that we know what a currency pair is let us understand how to read currency pairs.

How to Read Currency Pair?

Trading a currency means selling one currency to buy the other one. As said above, a currency pair includes a base and a quote currency. When investing in a currency pair, an investor buys the base currency and sells the quoted currency. The currency price tells the amount of the quote currency that an investor needs to give to receive one unit of the base currency.

Since each currency is represented by a three-letter symbol, a currency pair is represented by 6 letters. And, in a pair, a slash separates the two currencies. For example, suppose AAA/BBB is a currency pair. In this, AAA represents the base currency, and BBB represents the quote currency.

Example of How to Read Currency Pair

Let us take an example of the two popular currencies: the U.S. dollar (USD) and the Canadian dollar (CAD). The currency symbol for these will be USD/CAD.

Now, suppose Mr. A resides in Canada and is planning a trip to the U.S. He visits a local currency exchange store to exchange his Canadian dollar for the USD. The shop executive gives him an exchange rate of 1.3 (USD/CAD). This implies that USD 1 equals CAD 1.3, or he needs to give CAD 1.3 to get one USD. In this example, USD is the base currency, while CAD is the quote currency.

Also Read: Foreign Exchange

One easy and important way to read the currency pair is to remember that the base currency always equals 1. Thus, the currency price always represents the amount of the quote currency that one needs to pay to buy one unit of the base currency.

Bid and Ask Price

Now that we know how to read a currency pair, there is another important thing that we need to be aware of. In a foreign exchange market, there are always two available quotes of a currency pair at a time. One is the bid (Sell) quote, and the other is the ask (Buy) quote.

The bid price refers to the price at which traders can sell a currency. And the asking price refers to the price at which traders can buy the currency. It may appear confusing as usually, bid means buying.

So to remember the bid and ask concept in the forex market, you need to consider them from the broker’s perspective. It means if you are a potential trader, then to buy a currency, you need to pay the asking price of the dealer. And to sell the currency, you need to agree on the dealer’s bid price.

The price at which traders buy the currency is generally more than the price at which they sell a currency. This difference between the two quotes (bid and ask) is what we refer to as the spread. It is the money that a broker earns for processing the trade. Generally, the spread is less for popular currency pairs, such as EUR/USD. This is because such pairs have a very high trading volume.

For example, the sell quote for EUR/USD is $1.1403, and the buy quote is $1.1404. In this case, the spread is just $0.0001.

Normally, in the real world, traders do not see the full bid/ask quote (1.1403/1.1404). Instead, what they see on their terminals is 1.1403/04. This is because the difference between the pairs is very thin, and that difference is usually in the last two digits of the quote. Thus, the convention is that the last two digits of the asking price appear on the screen.

Measuring Changes in Currency Pair

For a forex trader or investor, it is also important to know how to read a change in the value of a currency pair. Similar to the stock market, the value of currencies also goes up and down. But in the forex market, a change in the value of one currency affects its exchange value with all other currencies.

For instance, suppose the value of the currency pair GBP/USD (pound sterling to U.S dollar) goes up from $1.2305 today to $1.2309. This means an appreciation in the value of GBP in relative to the USD. Or, we can say traders now will have to shell out more USD to buy one unit of GBP.

In technical terms, this change or difference in the value of the currency pair is measured in terms of pips. In the above example, the change in the value, i.e., $0.0004 ($1.2305 less 1.2309), will mean four pips.

RELATED POSTS

- Indirect Quote –Meaning, Formula, Example and More

- Cross Currency Rate – Meaning, Importance, Calculation, and Example

- Real vs Nominal Exchange Rate – All You Need to Know

- Forex Market Participants

- What are the Characteristics of the International Money Market?

- Currency Arbitrage – Meaning, Types, Risk and More