The weighted average cost of capital (WACC) is the overall cost of capital of a firm derived by a weighted average of the cost of equity, preferred, and debt capital. Weights are nothing but the respective weight of each type of capital.

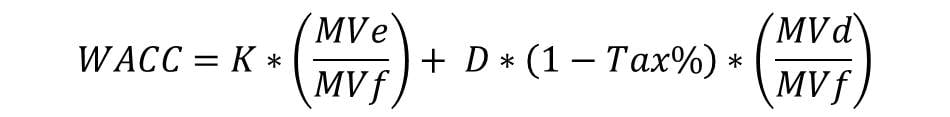

The mathematical expression of the formula of WACC is as follows:

About Calculator of WACC

This calculator calculates exactly the weighted average cost of capital (WACC) with three major types of capital, viz. equity capital, preference capital, and debt. It will show the WACC result in % after rounding off the result to 2 digits.

WACC Calculator

RELATED POSTS

- Advantages and Disadvantages of Weighted Average Cost of Capital (WACC)

- Importance and Use of Weighted Average Cost of Capital (WACC)

- Market vs. Book Value WACC

- Project or Divisional Weighted Average Cost of Capital (WACC)

- Cost of Capital

- Evaluating New Projects with Weighted Average Cost of Capital (WACC)