What is Activity Based Costing (ABC)?

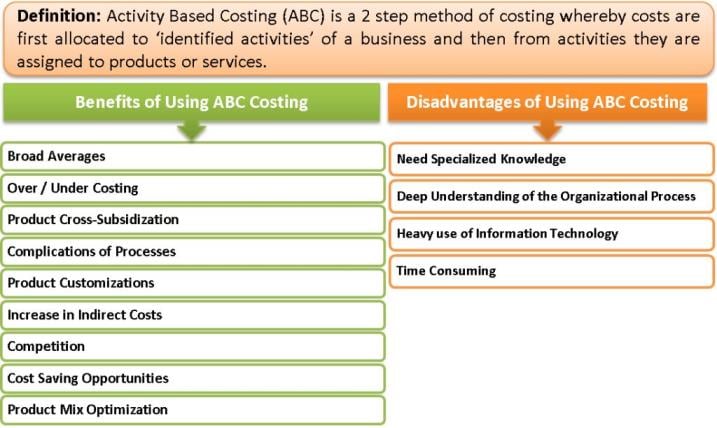

Activity Based Costing (ABC) is a 2 step method of costing whereby costs are first allocated to ‘identified activities’ of a business and then from activities they are assigned to products or services. In other words, the costing of products or services is based on activities performed to manufacture/render a particular product or service. If, for manufacturing a product A, activity X is not used, the cost for that activity would not be allocated to that product A. It is a much more refined method of costing a product that suits the current industry environment.

Benefits of Using ABC Costing

Broad Averages

Traditionally, costing exercises have relied a lot on broad averages. That is where; the ABC had to take birth to refine the costing system from the curses like averaging as far as possible.

Over / Under Costing

Over and under costing was a result of such a method of averaging and loosely defined cause and effect relation between the cost and the product. By introducing activity between costs and products, the relation between cost – activities – products is clearer.

Product Cross-Subsidization

The products which are victims of over costing automatically allow another product’s under costing and vice versa. ABC costing can help eradicate the problem if implementing an activity-based costing system is appropriate.

Also Read: Types of Cost Accounting

Complications of Processes

With the growth and development of industry and business, the complications in the processes of manufacturing or providing services have increased significantly. An average product manufacturing requires more than 3 to 4 processes. ABC is a blessing in disguise to deal with complications in costing created due to processes.

Product Customizations

Previously, there were less number of options for a product, but now there are a lot of variations in products due to colors, design, durability, weight, etc. All of these are manufactured in the same setup. This again calls for a refined costing system so that one can price the products accordingly.

Increase in Indirect Costs

There has been a significant increase in indirect costs with the advent of technology. Against the only cost, i.e., labor, there are fixed costs of machinery replacing the labor cost. Technical hitches due to the introduction of sophisticated machineries have increased.

Competition

Because of heavy competition, every business is looking out to streamline its cost structure and manufacture products that suit its manufacturing and organizational setup.

Cost Saving Opportunities

It is easy to find cost-saving opportunities in this kind of costing system.

Product Mix Optimization

Product mix problems can be better addressed when a system like ABC Costing is in place.

Disadvantages of Using ABC Costing

Need Specialized Knowledge

Knowledge of costing, cost accounting, and costing terms such as cost drivers, allocation, cause and effect relation, etc., is a must. It is not a job of a layman.

Deep Understanding of the Organizational Process

The people employing this costing method require vast experience in the related industry or an in-depth understanding of the products and processes.

Heavy use of Information Technology

It would not be possible without the use of information technology. It needs to collect a lot of data, convert it into information, and analyze it to extract reasons for implementing a particular decision.

Time Consuming

Since there are a lot of steps and groundwork required to come out with a costing based on this system, it is quite a time to consume.

We have understood what Activity-based costing is and also understood its benefits and disadvantages. Also, we can encounter that the benefits definitely overcome the disadvantages, and therefore this system is worth for every organization. We know that the ‘Cost of costing should not be more than the benefits we derive from costing.’ Though it is a very useful method, it may not be as useful for trading firms compared for manufacturing firms. Therefore, before implementing such a system, benefits to the individual organization should carefully understood and then took a forward decision.

Aslo read Activity-Based Costing vs Activity-Based Management to get a clear idea of differences between the two.

Great stuff !

Thanks for appreciating.