Return on investment, one of the profitability ratios, is a measure to evaluate the gain on investment. It is a ratio of the ‘profit on any investment’ to ‘the cost of the same investment.’ It is very useful in making investment decisions and evaluating different investment opportunities. Usually, you make investments with the motto of earning a profit. So if an investment is not earning the standardized return, there is no point in blocking the money in that particular investment.

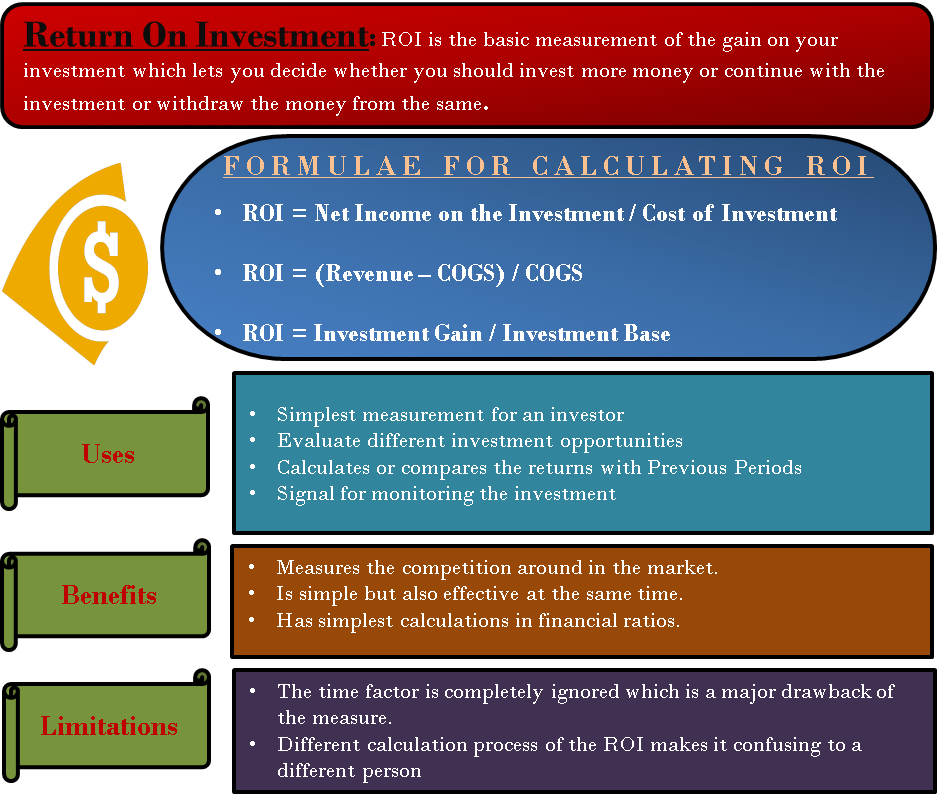

But how to understand whether it is earning the required amount of profit or not or judge if there are any better investment gains you can make with the same amount? One simple yet very effective technique or tool is the return on investment, which is popular as “ROI.” It is the basic measurement of the gain on your investment, which lets you decide whether you should invest more money or continue with the investment or withdraw the money from the same.

What is a Return on Investment (ROI)?

ROI or return on investment can be defined as the measure of performance of an investment. The efficiency of the investment to earn returns on it is evaluated with ROI. The return is evaluated against the investment cost, and thus we get ROI in percentages. It is a relative measure of return on any specific amount invested in a business project or general investment like shares, mutual funds, or any other asset. ROI is a generic ratio, and for an investor, the higher the ratio, the more the benefits.

In other words, it can be explained as the incremental earnings or gain out of a business operation divided by the operating cost (operating cost). It evaluates the efficiency of the business and whether the resources are optimally used or not. It is a very important financial metric for public companies for management to satisfy the shareholders. For small and medium scale businesses, it is used for evaluating the performance of projects/investments and businesses overall.

Read more about other PROFITABILITY RATIOS.

Calculation of ROI using Formula

The formula of ROI is not limited to one; there are many versions depending on the type of investment or the project.

| ROI = Net income from Investment / Cost of Investment |

| ROI = (Revenue –COGS) / COGS |

| ROI = Investment Gain / Investment Base |

The first formula is the basic one that is used in most cases. It is the net income generated from an investment against the cost of that investment.

The Net income from an investment = Gain from the investment – Cost of the investment

So, ROI can be = (Gain from the investment – Cost of the investment) / Cost of the investment, as well.

Keep reading: ROI ANALYSIS.

Examples of ROI

Calculation for Investment in Financial Instruments like Shares

ROI calculation for Investment in Shares (or any financial instruments)

Let’s say Mr. A invested INR 100000 in the shares of TATA Motors, and after a year, he shorts his position (sells the shares) for INR 120000.

Then, ROI = Net income on the investment / Cost of the Investment

= (Gain from the investment – cost of the investment) / Cost of the investment

= 120000-100000)/100000 = 20000/100000 = 20%.

So the investment in the shares of TATA Motors earned Mr. A 20% profit on investment.

ROI – Investment in Properties

Suppose Mr. X bought a property for INR 5000000 in 2010. In 2017, he sold it off for INR 8000000.

Then his ROI will be = Investment Gain/Investment Base

= (8000000-5000000)/5000000 = 3000000/5000000 = 60%.

So, Mr. X earned a 60% return on his investment in the property.

Under normal circumstances, a return of 60% is much better than a return of 20% from the stocks transaction. But one should also consider that while the deal with a higher ROI took three years to mature, the purchase with a lower ROI took only a year to grow. So the time value of money or the time frame of return is an essential factor before concluding.

Uses of ROI

The uses of ROI are there in every business and investment that any person does or makes.

Simplest Measurement

It is the simplest measurement of the percentage of profit made by the investor in his investment.

Investment Opportunities

ROI helps in deciding between different investment opportunities.

Monitoring the Investment

It can be used to calculate or compare the returns of the past. For example, if you are going to invest in a share, you would like to check how it has performed in the previous 5-10 years, and the first thing you would check about the company is its ROI. ROI changes from time to time depending on various factors; it can be used as the signal for monitoring the investment. When a positive ROI is good for an investment, a negative ROI might call for a selloff of the investment.

Also Read: ROI vs ROE – All You Need To Know

Investment Decision

For making investment decisions, ROI plays a great role. It helps in comparing the high and low-performing investments. This, in turn, helps the investors and the financial planners, advisors, and managers to optimize their investment returns by investing in investments with higher returns.

Benefits of Return on Investment (ROI)

The benefits of ROI are as follows:

- It helps the investors and the financial professional to quickly check the prospect of investment, and thus he saves on time and money.

- ROI also helps in exploring and measuring the potential returns on different investment opportunities.

- It assists in understanding and measuring the benefits of investment in particular departments as well.

- It helps to measure the competition around in the market.

- The most important benefit of using ROI for investment decisions is that it is simple but effective.

- The ROI calculation is one of the simplest calculations in financial ratios.

- ROI is understood by the layman as well, and it is universally accepted in the concept of finance and investment and business as well.

Limitations of Return on Investment (ROI)

There are certain limitations of ROI as well:

- In ROI calculation, the time factor is completely ignored, which is a major drawback of the measure. To understand these, let’s see an example, MR. X invested INR 10000 in shares of Wipro in 2011 and sell off his investment in 2013 for INR 15000. So, his ROI is 50%, while Mr. Y invested the same amount in the shares of SBI and sell off the shares in 2015 for INR 15000. So ROI of Mr. Y’s investment is 50% as well. But the time for which Mr. X and Mr. Y invested the amount is different. When the former ripped 50% profit on investment in just 2 years, the latter took 4 years to earn the same. We all know that “time is money,” the actual worth of the 50% profit is not the same to both the investors. In real terms, if we include inflation and the time value of money, then the profit earned by Mr. Y is less than the 50% profit of Mr. X.

- Different calculation process of the ROI makes it confusing to a different While a company calculates using one formula, the investor might calculate using another, and then there creates a difference of opinion and confusion.

You can also read about ROI vs. ROE.

Conclusion

Therefore, return on investment can be used to measure the profit of an investment, but it is better to evaluate the investments against the proper time frame as well to get the real profit margins or the percentage of profit.

Quiz on Return on Investment