Revenue run rate is a concept that takes the company’s current revenue to predict future revenue. Basically, it takes the current revenue of a company for a week, month, quarter, or yearly and converts it into an annual figure for the next year. The concept simply extrapolates or extends the current financial number over a year.

For instance, if a business makes $1 million in revenue in the first month of the year, then on the basis of revenue run rate, the company will make $12 million in the full year.

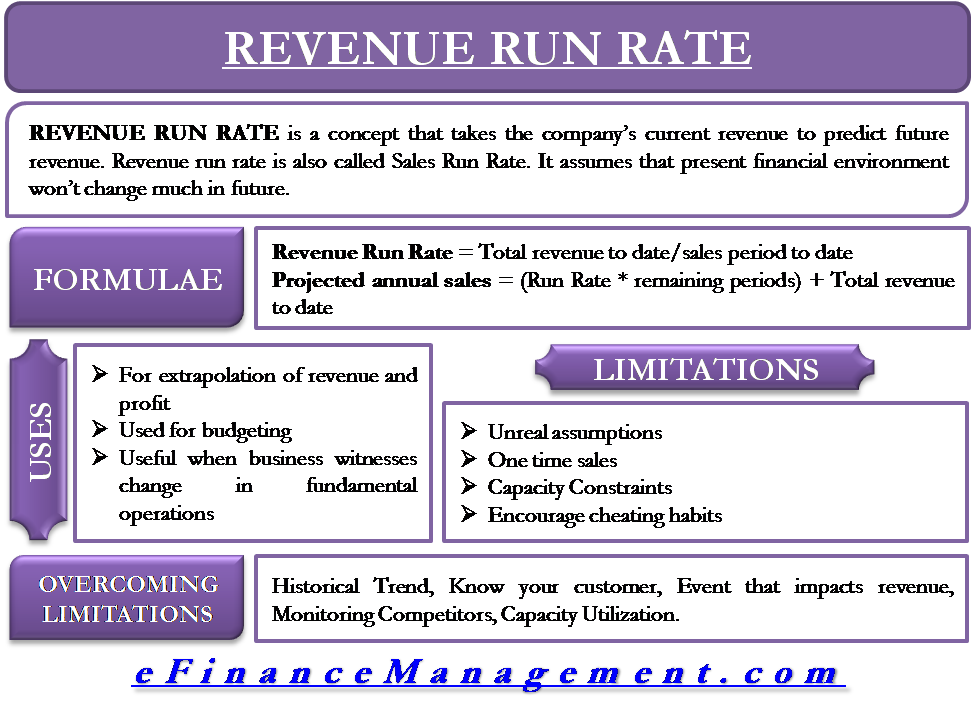

Revenue run rate is also called Sales Run Rate and is primarily used by rapidly growing companies. The concept assumes that the present financial environment won’t change much in the future.

Formula & Uses

To calculate the run rate, divide the year-to-date sales by the sales periods to date. And multiply the result with the remaining sales period.

Revenue Run Rate= Total revenue to date/sales period to date

Projected annual sales= (Run Rate*remaining sales periods) + Total revenue to date

Along with the companies witnessing rapid growth, this concept of predicting revenue is useful for startups or a new unit within the company. The concept also helps investors, venture capitalists, and managers to predict the annualized revenue.

Also Read: Net Sales

Additionally, the run rate concept is useful in several situations:

- When a business is attempting to sell itself, it will extrapolate its revenue to get more price.

- The management team may use the revenue run rate for the budgeting

- A business may also use the concept to extrapolate the profits when it has incurred losses in the earlier periods. Usually, such a strategy is adopted by startups.

- Such a concept is also useful when a business witnesses any change in its fundamental business operation in the midway. Suppose, after intense cost-cutting, a business is able to increase its quarterly profits by five times. In such a case, the run rate is a better indicator of the firm’s profitability than the previous year results.

Limitations

Unreal Assumptions

The run rate concept assumes that the current financial condition of the business will continue in the future year as well. This assumption is unreal as businesses nowadays face changing business scenarios.

One Time Sales

Businesses have customers whose contracts expire after a set time. If sales from these clients expire in the extrapolated period, it would unnecessarily boost the forecasted revenue.

Seasonality

If sales of a company are seasonal, then the annual revenue run rate on the basis of peak season would not be achievable. To overcome this, a business must calculate the run rate on the basis of a full year to factor in the full season effect.

Capacity Constraints

There are chances that a business uses massive capacity utilization in a period. And, if that same period is used for revenue run rate, it would give a wrong picture as a business may not be able to direct the same resources again.

Also Read: Target Profit Sales Calculator

Encourage Cheating Habits

A business may also use this concept to fool investors. What they can do is use the month with very high sales as a base to calculate future revenue.

How to Overcome these Limitations?

Historical Trends

Usually, a company has comparatively better sales in some months and worst in others. So, one must identify those months and take an average of those. This will give a more realistic picture.

Know your Customers

Understanding the customer’s buying pattern, preferences and behavior also help get a better run rate. To get an accurate picture, one must consider patterns and deviations from the customer’s behavior. For instance, a manager must know how many repeat and one-time customers they have, what products are the following, etc.

Events that Impact Revenue

Events like elections, sports events, or religious events may affect the sales of a business. So, one must keep a record of when there is an increase or decrease in sales due to any event. It will be better not to include such sales in calculating the run rate.

Monitor Competitors

Keeping a close watch on your rivals will help you adjust your prices and strategies accordingly. Eventually, this will help get a better run rate.

Capacity Utilization

It is normal for a business to operate at full or over capacity during a particular period. Then to make up for that, a business needs to slow down. So, neglecting such periods will help you get a better run rate.

Bottom Line

Revenue run rate is a useful metric, but it can give unreal numbers under some scenarios. So, using it carefully and normalizing the effect of uneven numbers will help get a real financial picture.