There are four financial statements that are prepared during an accounting year. In this article, we will focus our attention on the Income Statement. We will learn what the income statement is and how it is prepared.

The income statement is a financial report that tells whether a company had made or lost money in a given period. It also allows a business owner (or other interested parties) to know how much money the business brought in (revenues) and how much money the business had to pay out (expenses).

It is pretty easy to prepare an Income Statement. All you have to know is two simple things: total revenues and total expenses. Total revenue is the sum of all money that comes into your business as an income or gain. Total expenses are the sum of all money that goes out of the business, mainly in the form of payments. You earn a profit/ net income from your business when the total of revenues exceeds the total of expenses. Similarly, you make a loss/ net loss when the total of expenses exceeds the total of revenues.

Net Income/Net Loss = Total revenue – Total Expenses.

Structure and Components of an Income Statement

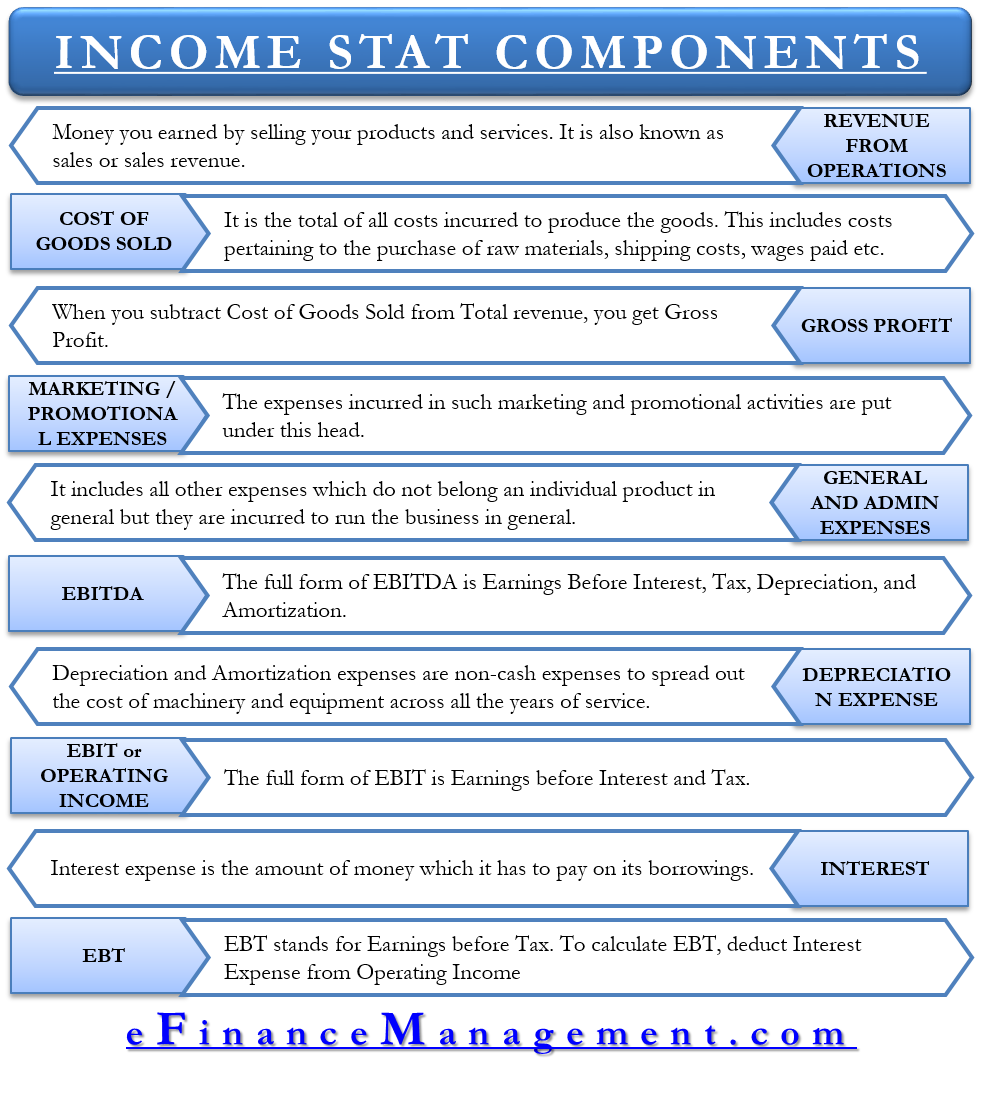

The items in an income statement may differ from company to company based on the business which a company is into and the products they sell. However, there are some broad common items that are almost always present in an income statement. Let’s go line by line to know what are the components/items in an income statement and what their order is.

Also Read: Profit and Loss Statement

Revenue from Operations

Every income statement starts with this head. Revenue from operations is nothing but the money you earn by selling your products and services. It is also known as net sales or sales revenue. Suppose Smith is a business owner selling durable electronic goods such as Television, Refrigerators, Washing Machines, etc. All the money Smith’s customers paid him in exchange for these TVs, washing machines, etc., will come here as total revenues.

Cost of Goods Sold

Cost of Goods Sold or COGS is the total of all costs incurred to produce the goods. This includes costs pertaining to the purchase of raw materials, shipping costs, wages paid to the workers, etc. If you get confused about which costs or expenses to put here, just note down how much money you have spent purchasing the goods and bringing them to the stage when they are ready for sale.

Gross Profit

When you subtract the Cost of Goods Sold from Total revenue, you get Gross Profit. If you spend more money in producing the goods and getting them ready for sale than what you earn by selling them, you will have a Gross Loss.

Marketing, Advertising, and Promotional Expenses

Most businesses run some marketing campaigns or give an advertisement in the local newspaper. The expenses incurred in such marketing and promotional activities are put under this head. Suppose Smith pays $100 per month to advertise his products in various newspapers. This expense of $100 per month will be recorded as Marketing Expenses.

General and Administrative Expenses

This head includes all other expenses that do not belong to an individual product in general but are incurred to run the business. Expenses such as the salary of the manager, rent of the office, travel expenses of the employees, etc., are recorded under this head.

EBITDA

The full form of EBITDA is Earnings Before Interest, Tax, Depreciation, and Amortization. Just as we calculated the gross profit by deducting the Cost of Goods Sold from Sales revenue, We calculate EBITDA by deducting Marketing Expenses and General and Administrative Expenses from Gross Profit.

Depreciation and Amortization Expenses

Depreciation and Amortization expenses are non-cash expenses that are recorded by the company each year to spread out the cost of machinery and equipment across all the years of its service.

EBIT or Operating Income

The full form of EBIT is Earnings before Interest and Tax. When we deduct Depreciation and Amortization Expenses from EBITDA, we get EBIT or Operating Income.

Interest

Interest expense is the amount of money it has to pay on its borrowings. Suppose Smith takes a loan of $50,000 from his bank at an interest rate of 10% per annum. The interest amount of $5,000, which he needs to pay every year, will be recorded as an Interest expense.

EBT

EBT stands for earnings before Tax. To calculate EBT, deduct Interest expenses from Operating Income or EBIT.

Tax

This is the amount that a business has to pay as Tax. Tax is calculated as a percentage of the EBT. But, if the EBT is negative, this means that the business has made a loss, and so there will be no tax for that particular year.

Net Income

Once you deduct tax expense from EBT or Earnings Before Tax, you get Net Income. In our example of Smith running a business, Net Income will be Smith’s exact income after deducting all the expenses, deductions, and tax into account.

Read more about What is the Best Definition of Profit?

Keeping the Business on Track

Preparing an income statement is useful both for the business owner and outside parties who have an interest in the business. Reading the income statement, the business owners or the managers can understand how much money is spent on which activity during the year and how much money they earned as a result. Managers can also compare the previous year’s income statement with this year’s income statement and find out by how much percentage the net income of the business has increased, by how much percentage the expenses have changed, is the rise in expenses over the past year generating additional income or not. An Income statement facilitates this analysis which helps the managers/owners to keep the business on track by continuously monitoring the income and expenses.

The outside parties who may want to invest in a business can reduce their uncertainty about the business by looking at the last few years’ income statements. And do the same analysis to find out if the business is worth investing in or not.

Continue reading – Multi-Step vs. Single Step Income Statement.