A firm should be managed effectively and efficiently. This means that the firm should be able to achieve its objectives by using minimum resources. Financial planning indicates a firm’s growth, performance, investments, and requirements of funds. This planning is done for both the short term and the long term.

Short-term Financial Planning

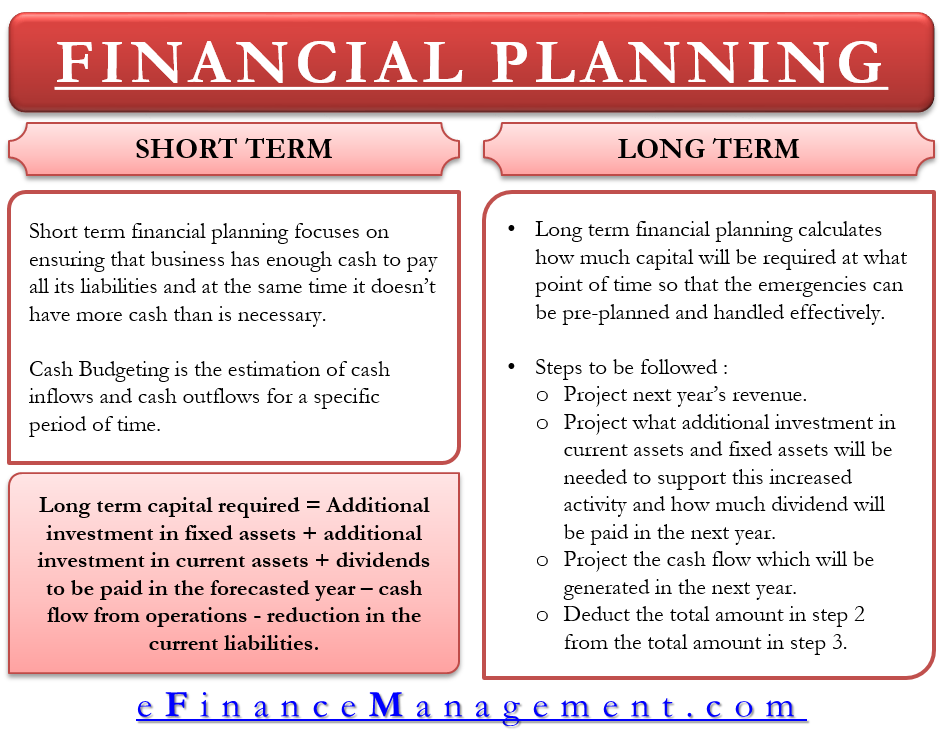

Short-term financial planning focuses on ensuring that the business does not run out of cash. It seeks to ensure that the firm has enough cash to pay its bills and makes sensible short-term borrowing and lending decisions. But how can a firm possibly run out of cash? Let’s understand this with an example.

Suppose the marketing manager at ABC company wants to allow a 60-day credit period to his customers (Credit period is the maximum number of days within which your customers should make the payment) rather than the current 30 days. At the same time, the production manager also wants to stock raw materials for the next 2 months. Since it is an off-season, sales are quite low, so there is no cash inflow. Suddenly, the accounts department finds that the business has no cash at all to pay the electricity bill for this month as all the cash is blocked in raw materials and as credit with the customers.

To avoid such situations, short-term financial planning is done, and it is ensured that the business has enough cash to pay all its liabilities, and at the same time, it doesn’t have more cash than is necessary.

Also Read: Current Assets and Their Key Features

The Need for Capital

All businesses require capital- that is, money to be invested in plant, machinery, receivables, inventories, and all other assets it takes to run a business. These assets can be financed(purchased) by either long-term or short-term sources of capital. When long-term capital (money raised for a long period of time, such as a 10-year loan from a bank) doesn’t meet the capital requirements of the business, a firm raises short-term capital (money raised for a period of less than one year). When long-term financing gives more cash than the capital requirements of the business, the firm has surplus cash available. This surplus cash is considered idle cash, and it is usually invested in some short-term project.

Current assets can be converted into cash more easily than non-current assets. So, firms with large current assets don’t have to worry about finding the money to pay next month’s bills. Of course, some of the current assets are more rapidly converted into cash than others. A company’s bank balance can be easily converted into cash to pay the bills. Inventories, however, will generate cash only when goods are sold and cash is collected from the customers.

Maintaining a Balance

Finance managers want a level of cash that is neither small to meet the expenses nor large to lie idle. In the above example, we have already discussed what happens when less cash is available than needed- you don’t have the money to pay your bills. But when more money is available than is needed, it means that the company is not making good use of its money. E.g., if $ 30,000 worth of inventory is present in your godown when only $ 3,000 worth of inventory is used every month, it means that you are making poor use of your cash.

So, to attain the level of cash which is sufficient to operate the business, finance managers use Cash Budgeting.

Cash Budgeting

It is the estimation of cash inflows and cash outflows for a specific period of time. Cash inflows mean cash is coming into the business (by sales or by payments by the debtors etc.). Cash outflow means that cash is going out of the business. (by electricity bills, payments to the lenders, etc.).

Suppose Smith starts a new business of manufacturing shoes in the month of June. He has forecasted that in the month of June, he will sell shoes worth $2,50,000, and in the month of July, he will sell $3,00,000 worth of shoes. He starts this new business with a capital of $ 5,00,000. On 1st June, Smith calculated that $3,00,000 was used to purchase machines and $2,00,000 would be used to make the shoes. Now Smith knows that all of his customers will pay only at the end of July. He also knows that to manufacture $3,00,000 worth of shoes(forecasted) for the month of July, he will need an amount of $ 2,40,000 on the 1st of July itself. So, he goes to the bank and gets a loan of $5,00,000. This is how Finance Managers use cash Budgeting to pre-plan any requirement of cash which may arise.

Long-term Financial Planning

Long-term financial planning calculates how much capital will be required at what point of time so that the emergencies can be pre-planned and handled effectively. Long term financial planning has these steps:

Step 1

Project next year’s revenue. Suppose this year the revenue of business was $1,00,000 and next year the revenue is expected to be $1,20,000.

Step 2

Project what additional investment in current assets and fixed assets will be needed to support this increased activity and how much dividend will be paid in the next year. Suppose the business needs an additional investment of $1,00,000 in fixed assets and $20,000 in current assets. It will also pay $10,000 as dividends.

The sum of these expenditures in step 2 gives you the uses of capital. Now, as a third step, you have to calculate the inflow of capital.

Step 3

Project the cash flow which will be generated in the next year. Suppose the cash flow projection is $1,20,000 (which will be generated by revenues). Also, the project if the current liabilities in the projected year are expected to go down.

Step 4

Deduct the total amount in step 2 from the total amount in step 3. This is the additional long-term finance you need to raise to run the business.

This can also be expressed using the formula:

Long-term capital required = Additional investment in fixed assets + additional investment in current assets + dividends to be paid in the forecasted year – cash flow from operations – reduction in the current liabilities.

So, Long term capital required = $1,00,000 + $20,000 + $ 10,000 – $1,20,000 – 0.

Additional long-term capital required = $10,000.