‘For every action, there is an equal and opposite reaction.’ A couple of hundred years ago, Sir Newton gave this phrase to the world. He gave this statement while discussing the laws of motion in physics. What is amazing is that after hundreds of years, we use the same statement to explain debits and credits in accounting. Now before we get deep into what is debit and credits, let’s first understand that various transactions take place in a business every day.

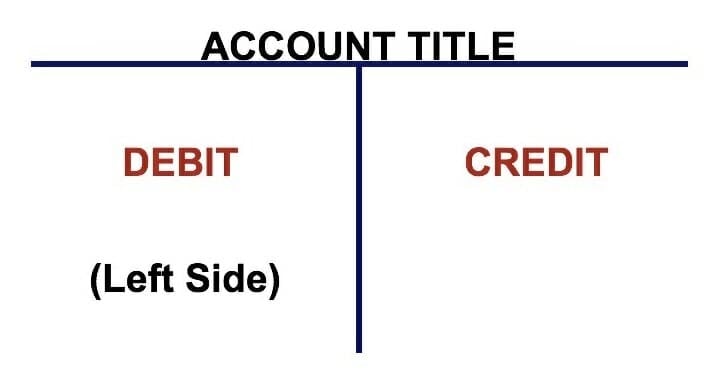

Accountants examine these transactions and record them in the accounts which these transactions affect. As the first step of recording, accounts are broken into T accounts. A T account is a graphic representation of a general ledger account. This T format graphically depicts the debits on the left side of the T and credits on the right side of the T. The following visual is an example of a T-format.

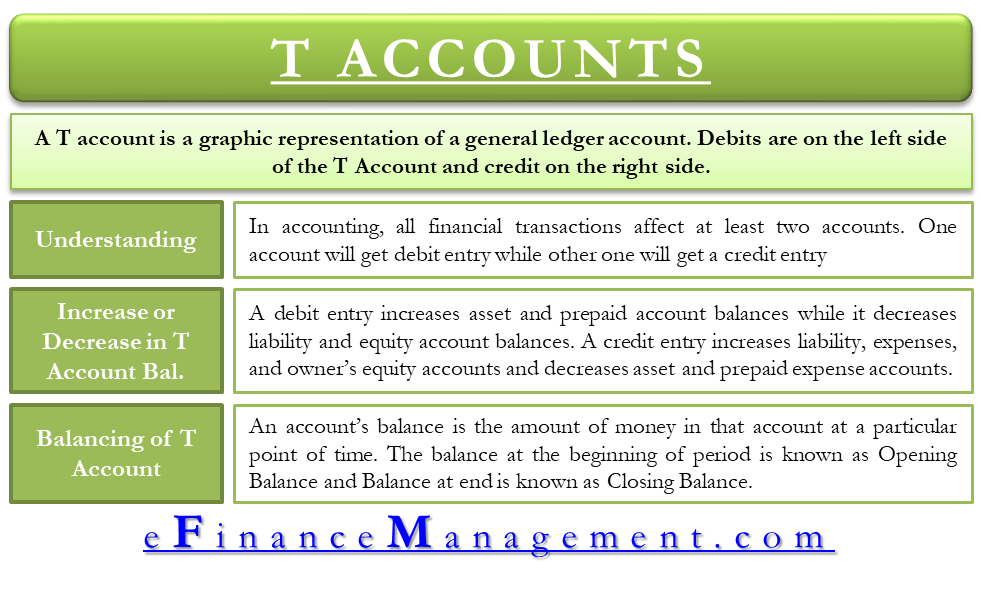

Understanding T Accounts

In accounting (particularly the Double Entry System), all financial transactions affect at least two of a company’s accounts. One account will get a debit entry (left side of the T), while the other one will get a credit entry (right side of the T). A graphic representation of these accounts resembles a T shape; hence, any individual account/ledger account is called a T account.

To repeat it one more time, a T account is nothing but a general ledger account that records business transactions. T accounts consist of the following:

Also Read: What are Debit and Credit

- An account title at the horizontal line of the T.

- A debit side on the left side of the T.

- A credit side on the right side of the T.

Increase and Decrease in T Account Balances

For different accounts, the debit and credit can mean either an increase or a decrease in that account’s balance. For all the asset accounts, which include cash, accounts receivable, property, plant, equipment, etc., an entry on the left side of the T (debit entry) means an increase in that account balance. A right-side entry (credit entry), on the other hand, means a reduction in that account’s balance. For liability accounts, which include bills payable, loans, outstanding salary, etc., this equation is exactly the opposite. An entry on the left side of the T (debit entry) signifies a decrease in that account’s balance, while a right-side entry (credit entry) in a T account means an increase in that account balance.

To summarize the above paragraph:

- A Debit side entry comes on the left side of a T account. A debit entry increases asset and prepaid account balances while it decreases liability and equity account balances.

- A Credit side entry comes on the right side of a T account. It increases liability, expenses, and owner’s equity accounts and decreases asset and prepaid expense accounts.

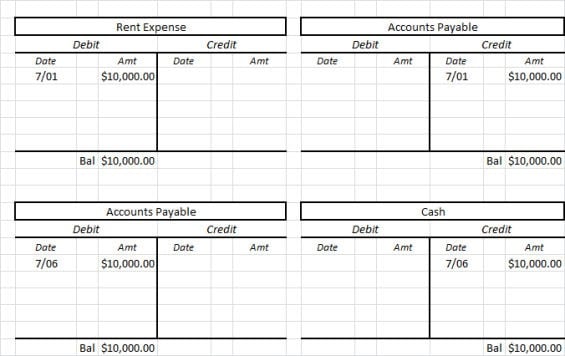

T Account Example

Let’s take an example to understand how entries are recorded in T accounts. Suppose there is a company named ABC corporation. The company receives a $10,000 invoice from the landlord for the July rent payment, which is due. Since we have incurred an expense of $10,000, we will create a rent expense account and debit it with an amount of $10,000. Correspondingly, since the rent is due, we will also create a liability account called accounts payable account. Since we have got an increase of $10,000 in our liabilities, we will credit this amount of $10,000 to the accounts payable account.

Now suppose, a few days later, on the 6th of July, the company pays the rent amount which was due. We will decrease our liability balance by debiting the liability account- accounts payable by $10,000. We will also decrease our asset balance by posting a credit to the cash account (since our cash balance has decreased by paying the July rent.)

The effect of all these transactions on a T account will look like this:

A T account has 2 primary uses, which are:

- To teach accounting since a T account clearly explains the flow of transactions through accounts.

- To provide a clear record of all the transactions and all the accounts.

Balancing T Accounts with Opening and Closing Balances

An account’s balance is the amount of money in that account at a particular point in time. In a T- account, we show the balance of an account for the beginning of a period (a month or year) and the end of the period.

Also Read: Double Entry System of Bookkeeping

The balance at the beginning of a period is called the opening balance. The balance at the end of the period is called the closing balance. Also, note that last year’s closing balance becomes this year’s opening balance.

Sample Problem on T account

Suppose George has a catering business. At the beginning of this year, on April 1st, 2018, his bank account (of the business) showed a balance of $4,300. This balance of $4,300 is the opening balance of the asset account, and so George will post it on the debit side of his bank account. Now suppose the following transactions take place in his business during FY 2018-19:

- George brought a fresh capital of $15,000 to his catering business.

- George took a bank loan of $5,000 to support his catering business.

- A piece of catering equipment for $12,000 was purchased.

- He drew $500 out from his business for personal use.

- The business earned $10,500 for services rendered to its customers.

- He had earned $5,000 for services given to his customers in the previous year. But the customers paid him today.

- George paid $ 4,000 as a salary to his employees.

- He purchases office supplies worth $200 for credit.

- Out of the $5,000 loan he had taken, he pays back $4,000 to the bank.

Draw a bank account for George’s catering business and obtain the closing balance of the bank account.

Solution

Step 1

Make the following entries into the bank account.

- When George brings a fresh capital of $15,000, the balance in the bank account will increase. Since the bank account is an asset account, to increase the balance in an asset account, we will debit it.

- Taking a loan will increase the balance of the bank account. So, to increase the bank account balance, we will debit it by $5,000.

- Purchasing a piece of catering equipment will decrease the asset account balance by $12,000. So, to decrease the asset account, we will credit it by $12,000.

- Taking $500 out from the business will decrease the bank account balance. So, we will credit the bank account.

- Earning a revenue of $10,500 will increase the asset account balance. So, to increase the asset account balance, we will debit it.

- The customers paid him $5,000. So, the balance in his bank account will increase by $5,000. To increase the balance in the asset account, we will debit it.

- Paying a salary of $4,000 will decrease his bank account balance. So, to decrease this balance, we will credit the asset account.

- Purchasing office supplies worth $200 will decrease the bank account balance. So, we will credit the bank account.

- Paying back the loan will decrease his bank account balance. We will credit the bank account by $4,000 to reduce its balance.

After making all the 9 entries in his bank account, the account will look like this:

| Dr. | Bank Account | Cr. | |||

| Date | Particulars | Amt ($) | Date | Particulars | Amt ($) |

| 01/04/2019 | Opening Balance | $4,300 | 09/04/2019 | Catering Equipment | $12,000 |

| 01/04/2019 | Capital | $15,000 | 15/04/2019 | Drawings | $500 |

| 07/04/2019 | Loan | $5,000 | 19/05/2019 | Salary | $4,000 |

| 17/04/2019 | Revenue | $10,500 | 13/04/2019 | Creditors | $200 |

| 19/04/2019 | Accounts Receivables | $5,000 | 13/04/2019 | Loan | $4,000 |

Step 2

Total the amounts on both sides of the T account, i.e., the debit side and the credit side. Now find out which side has the bigger total. Put the bigger of the two totals on both sides. In our example, the debit side has a greater total of $39,800. So, we will put it on both sides as follows:

| Dr. | Bank Account | Cr. | |||

| Date | Particulars | Amt ($) | Date | Particulars | Amt ($) |

| 01/04/2019 | Opening Balance | $4,300 | 09/04/2019 | Catering Equipment | $12,000 |

| 01/04/2019 | Capital | $15,000 | 15/04/2019 | Drawings | $500 |

| 07/04/2019 | Loan | $5,000 | 19/05/2019 | Salary | $4,000 |

| 17/04/2019 | Revenue | $10,500 | 13/04/2019 | Creditors | $200 |

| 19/04/2019 | Accounts Receivables | $5,000 | 13/04/2019 | Loan | $4,000 |

| Total | $39,800 | Total | $39,800 |

Step 3

Subtract the total of the smaller side from the total of the bigger side—the difference in nothing but the closing balance of your bank account. In our problem, the total of the smaller side (credit side) is $20,700. So, we will subtract $20,700 from $39,800 to get a closing bank account balance of $19,100. This closing balance is written on the smaller side so that the addition of all the items on both sides after finding this closing amount will be equal. This is the final picture of the account after all the adjustments:

| Dr. | Bank Account | Cr. | |||

| Date | Particulars | Amt ($) | Date | Particulars | Amt ($) |

| 01/04/2019 | Opening Balance | $4,300 | 09/04/2019 | Catering Equipment | $12,000 |

| 01/04/2019 | Capital | $15,000 | 15/04/2019 | Drawings | $500 |

| 07/04/2019 | Loan | $5,000 | 19/05/2019 | Salary | $4,000 |

| 17/04/2019 | Revenue | $10,500 | 13/04/2019 | Creditors | $200 |

| 19/04/2019 | Accounts Receivables | $5,000 | 13/04/2019 | Loan | $4,000 |

| Closing Balance | $19,100 | ||||

| Total | $39,800 | Total | $39,800 |

Continue reading – Charts of Accounts.

Hi. I was hoping to see double entry on T-accounts for the catering example. Ie credit one account, and debit another with the same amount.