Fund Accounting is an accounting system that focuses more on accountability than profits. Generally, non-profits and government organizations use this type of accounting. Therefore, profitability is never the aim nor the objective. But the aim is to properly utilize resources for the purpose it has been accumulated or sourced and allocated. Such an accounting helps the organization to track the funds they get and the use of those funds.

The purpose of such accounting is not to determine whether or not an entity is profitable but to track the inflow and outflow of funds. And whether the funds’ utilization is happening as per the charter, purpose, or law. Such an accounting enables non-profit entities to get information on their resources. Also, it helps non-profit organizations (NPOs) to report their use of funds to third parties.

Following are the type of entities that use such an accounting: colleges and universities, nursing homes, orphanages, charities, churches, hospitals and artistic foundations, governments, etc.

Fund Accounting – How it Works?

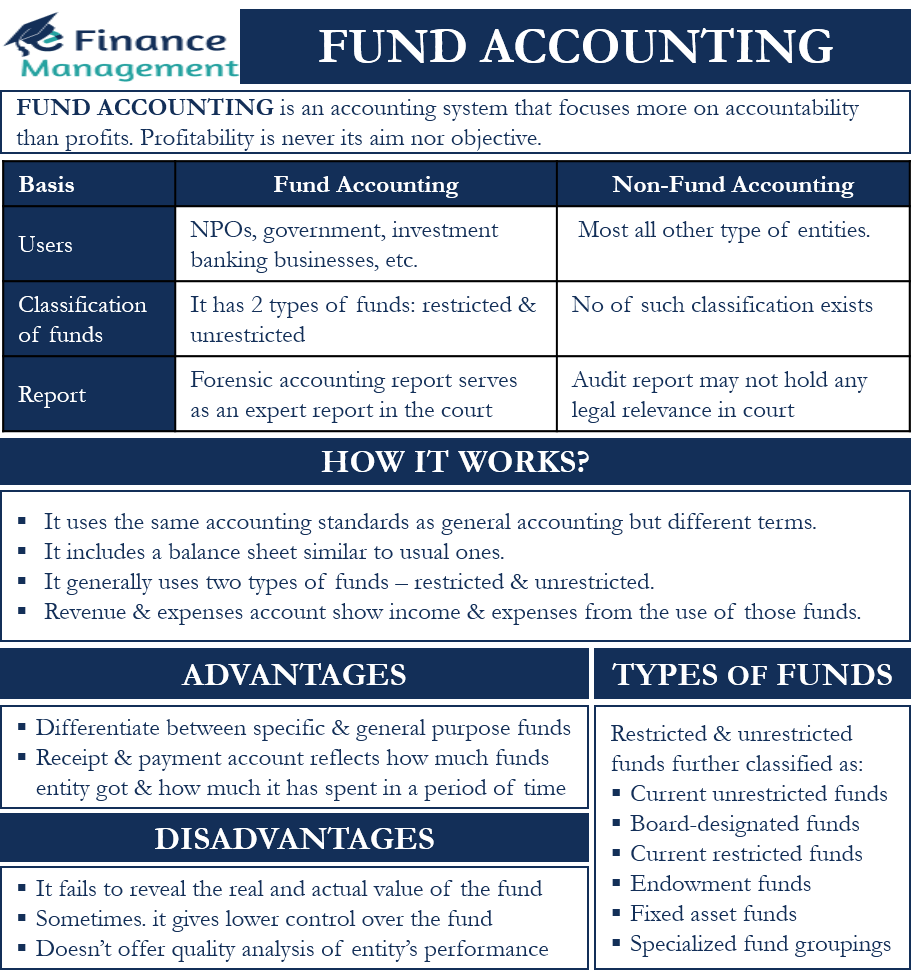

Non-profit entities generally use two types of funds – restricted and unrestricted. In restricted funds, there is a restriction on the use of the funds. And unrestricted funds are freely available for use without any such restrictions. We can also say that a non-profit entity can use the restricted fund for specific purposes only. Still, the unrestricted funds are general-purpose funds, and non-profit entities can use them for any purpose.

Fund accounting uses the same accounting standards as general accounting but different terms. For instance, rather than using the profit and loss account, NPO prepares payment and receipt accounts and revenue and expense accounts. All the cash inflows come on the receipt side, and the payments show up on the expenses or payments side.

The revenue and expenses account shows the income and expenses from using those funds. If the income is more than the expense, then we call the balance an excess. And, if the expenses are more then, we call it a deficit.

There is also a balance sheet in fund accounting similar to the usual balance sheet. It shows the financial status of the NPOs at a specific date, including assets and liabilities with their classification and values.

How Fund Accounting is Different from Non-Fund Accounting?

Generally, NPOs and the government use fund accounting. Investment banking businesses and portfolio businesses may also use this accounting as well. Most all other types of entities use non-fund accounting.

The second difference between the two is concerning the classification of funds. When we talk about fund accounting, it has two types of funds. And these are – restricted and unrestricted funds. There is no such classification that exists in the case of fund accounting.

Another difference between the two is the type of financial statement preparation and their nomenclature. For instance, in the case of non-profit entities, there is payment and receipt accounts and revenue and expenses account. In the case of non-fund accounting, we have trading and profit and loss accounts.

Advantages and Disadvantages of Fund Accounting

Below are the benefits of fund accounting:

- It differentiates between specific and general-purpose funds.

- Segregating the funds helps with budgeting, as well as for projections.

- The receipt and payment account helps the entity know how much funds they got and how much they have spent in a period of time.

Following are the drawbacks of fund accounting:

- Sometimes it gets difficult to segregate the general and specific purpose funds.

- Such an account fails to reveal the real and actual value of the fund.

- NPOs sometimes may misappropriate the funds by including the use of cash.

- On some occasions, such an accounting gives lower control over the fund. This generally happens with government agencies.

- Such an accounting does not offer quality analysis on the performance of the entity.

- If the size of an organization gets too big and there is an increase in the sources of grants, then accounting and tracking could get difficult.

Types of Funds

We above said that there are two types of funds in this accounting – restricted and unrestricted. We can further classify these two types of funds into six more types. These are:

Current Unrestricted Funds

Such funds are for meeting the general operating expenses of the entity. There is no restriction on the use of these funds as long as the use is in-line with the objective of the organization.

Board-Designated Funds

Such funds come into existence when the board of directors transfers funds from the current unrestricted fund into a new fund. Moreover, this new fund is to be used only for specific purposes.

Current Restricted Funds

Such funds include donated assets and are useful only for specific purposes. For example, a donor gives the money and instructs that it must only be used for providing food to the homeless. Now, the organization can not use the fund for any other purpose except for paying for food.

Endowment Funds

Such funds include assets that help entities to make additional income. The entities are free to use the income they generate from such funds. Moreover, an entity can place these funds in a restricted or unrestricted account, depending on the instructions from the donor. Also, if the donor wishes, the income from such a fund needs to be put back into the fund until it reaches a certain amount.

Fixed Asset Funds

Funds or assets in this fund help the entity to pay for its long-term assets, such as plants, land, and more. The main motive of creating such a fund is to prevent the money from other funds from being used for buying assets. Moreover, such a fund helps the entity to get a clear picture of its capital spending.

Specialized Fund Groupings

These are the funds that are for special purposes. For example, universities set up scholarship funds for some students. An organization can set up specialized funds for any purpose. But the management must ensure that the money in the fund goes only towards the purpose for which it was established.

Final Words

Fund accounting offers a good way for NPOs and government entities to record the funds they get for different purposes. Such an accounting primarily helps NPOs with accountability by properly recording the inflow and outflow of funds. Moreover, it also assists auditors by allowing them to easily track the grants that the NPOs get.

We recommend you read about the role of a fund accountant.