Today let us discuss the Net income metric. As many would agree, revenue growth is vital to the growth of your business. However, a measure of revenue alone is not useful because this doesn’t consider the expenses incurred to earn this revenue. You must know whether your company is profiting after deducting business expenses. In other words, you need to determine the net income of your business.

Calculating your business’s net income helps to determine your business’s profitability. It’s a helpful measure to use to make several other decisions, such as whether to expand or reduce operations and to plan budgets. It’s also a useful measure for investors to gauge the health of your business.

In this post, let us look at what net income is, how to calculate it, and on which financial statement can we record it.

Definition of Net Income

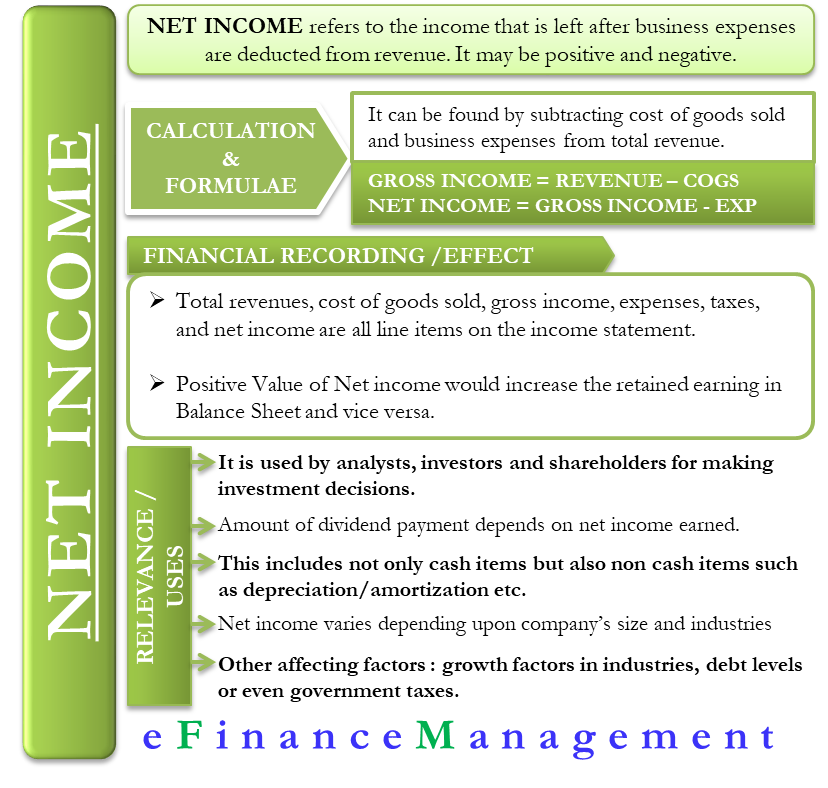

Net income is your company’s total profits after deducting business expenses. Some may refer to it as net earnings, net profit, or as a company’s bottom line.

Net income may be either positive or negative. If you have more revenues than expenses, your NI would be positive. If your expenses outweigh your revenues, you will have a net loss or a negative value for NI.

Also Read: Net Income Formula – Calculation and Example

Types of business expenses you might have to include operating expenses, payroll costs, rent, utilities, taxes, interest, certain dividends, etc.

You can find yearly, quarterly, or monthly net income. Use a time frame that works for your business.

To find your company’s NI, you need to know your business’s gross income and expenses for the period.

How do you Find Net Income?

You can calculate this metric by subtracting the cost of goods sold and expenses from your business’s total revenue.

The first step to be carried out before calculating NI is to get the figure of your gross income. This can be obtained from the gross income formula shown below:

Gross Income = Gross Revenue – Total Cost of Goods sold

The next step is to obtain NI by using the formula as shown below:

Net Income = Gross Income – Business Expenses

Example

Consider that a company ABC Inc. earns revenue of 250,000 for the year 2016-2017. It paid $ 20,000 as employee wages, $ 50,000 for raw materials, and $10,000 for factory-related maintenance expenses. ABC Inc. also has an interest income of $ 3000. Various taxes paid by the company amount to $ 5000. What is the net income of ABC Inc.?

Step 1.

Total Revenue= Revenue from sale + Interest Income= 250000 + 3000 = 253000

Step 2.

Total expenses = Employee wages + raw materials + factory maintenance + taxes = 20000 + 50000 + 10000 + 5000 = $ 85,000

Step 3.

Net Income = Total revenue – total expenses = 253000 – 85000= 168000

Where to Record Net Income

Record this metric on your business’s income statement. The income statement is one of three main financial statements companies use.

An income statement shows you the profitability of your company. It reports your business’s profits and losses over a specific period.

Total revenues, cost of goods sold, gross income, expenses, taxes, and net income are all line items on the income statement. NI is the final line of the statement, which is why it is also called the bottom line.

Effect of Net Income on the Balance Sheet

NI can affect the balance sheet as follows. A positive value of this metric leads to an increase in retained earnings, which is a part of stockholders’ equity. Similarly, a negative NI value would result in a decrease in retained earnings and subsequently a decline in stockholders’ equity.

Relevance and Uses

- Net Income is the most important number for several stakeholders of the company. Many are impacted by the figure, including analysts, investors, and shareholders. This is because it measures the profit earned by the company over a period of time.

- Shareholders keenly follow this metric as the amount of dividend paid to the shareholders depends on the net income earned by the company.

- NI, however, does not represent the actual cash earned by the Company. It can include many non-cash items like depreciation and amortization.

- A change in the NI or the financial ratios needs to be carefully analyzed. Lower NI may be due to many factors, including poor sales, poor management, high expenses, etc.

- NI varies for different companies and even for different industries. It can vary depending on the company’s size and the industry in which it works.

- Some companies have a heavy asset, business models. In such cases, the depreciation expenses will be high, while others may have light asset models.

- Other factors that may affect this metric include growth factors in industries, debt levels, or even government taxes.

Continue reading – Gross vs. Net Income.