Net sales is the income earned by a company after deducting its returns and discounts. The comprehensive income produced by a company in a year, including cash and credit sales, is denoted as Net Sales in the income statement. This is an essential metric important to Sales personnel in a company. It helps as a decision based on this. This metric has an estimate each month and for each period which the company has to work to fulfill. All functions from the Sales process to operations are designed to maximize sales throughout the year. This number determines if the efforts are in the right direction, and the final amount of profit and growth are a function of it.

Calculating Net Sales

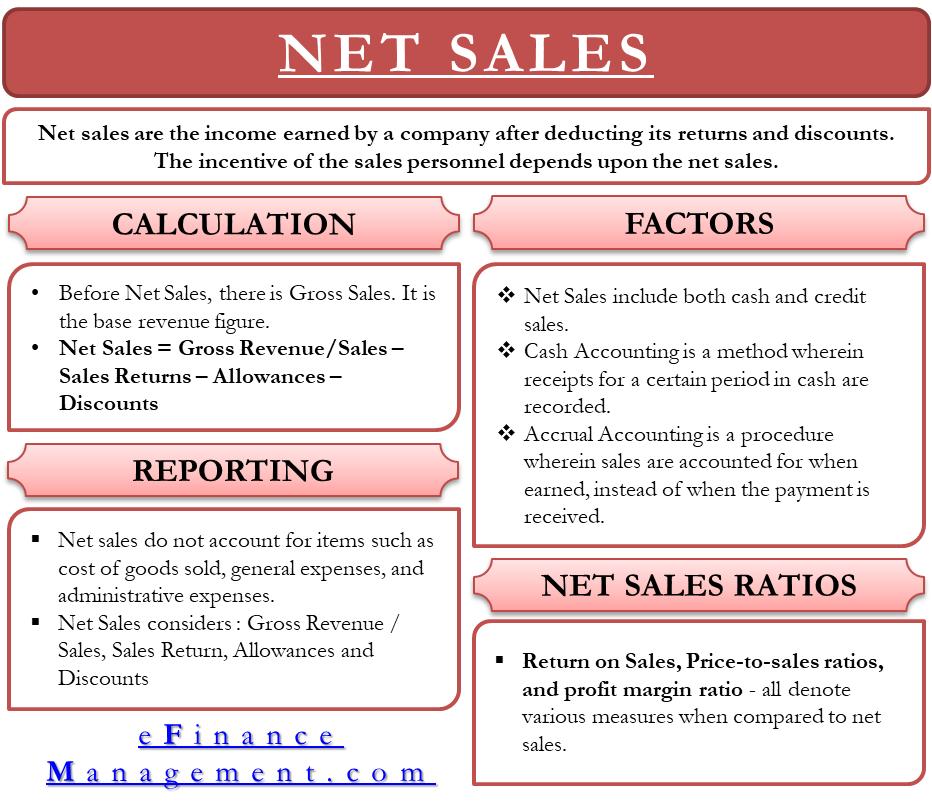

Before Net rev, there is Gross Revenue. It is the base revenue figure and is an addition of all sales that have taken place in the last period (let’s say one month). There might be returns by customers or refunds on account of defects. There might also be discounts given at the point of sale to close the sales process. Thus, these need to be deducted from the Gross Revenue figure to get an accurate picture of the sales earnings. This number is Net Sales.

Net Sales = Gross Revenue/Sales – Sales Returns – Allowances – Discounts

For example, you had gross revenue of $50,000 last month at your cupcake shop. You gave a discount of $100 to a school team and also had to refund $250 to overcome late delivery.

Net Sales for last month = $50,000 – $100- $250 = $49,650

Thus, when companies quote their revenue figures, they usually refer to their Net sales.

Factors Influencing Net Sales

Net sales are the top line of the company’s operation. It is an amount not yet adjusted for internal expenses. The point to note is that it includes both types of sales – cash and credit. The sales figure at any given point in time is a function of the kind of accounting system in use by the company. Sometimes many sales numbers are not shown right away in the Income statement, and some of them might already be part of cash.

Also Read: Net Income Formula – Calculation and Example

The two most crucial accounting processes affecting net sales are Cash Accounting and Accrual Accounting.

- Cash Accounting is a method wherein receipts for a certain period in cash are recorded. Receivables are separate and not part of the “Sales” figure. The Net Sales figure is determined mainly by the money received from customers.

- Accrual Accounting is a procedure wherein sales are accounted for when earned instead of when the payment is received. This is the system in use across the world. All sale transactions come under Gross Revenue irrespective of its payment in cash payment in the future. Thus, Gross Revenue or Net revenue figures also includes Receivables.

Significance of Net Sales

Companies allow for returns with refunds or allowances and discounts. They will try to minimize this gap between Gross and Net revenues to get maximum revenues. This shows how many issues exist at the point of sale. It can be a good indicator of changes in discounts, how well are these discounts working, problems in product quality, and huge marketing discounts. If the returns are many, this difference will accompany notes and explanations in the annual report indicating the reasons for the same.

Reporting of Net Sales

The Direct Income part of the Profit & Loss (Income) Statement houses Net Sales as a line item. Costs incurred by the company to deliver net sales affect a company’s gross profit and gross profit margin. However, it does not account for the cost of goods sold, which is the main component of gross profit margins.

Net sales do not account for items such as the cost of goods sold, general expenses, and administrative expenses. These are important to analysis separately in the income statement as overheads.

- Sales Return – this is a refund to the customer and is an expense item. This amount is debited, and an asset is credited when this transaction happens. Companies can sometimes account for them as inventory.

- Allowances – these are not done efficiently and are discounts given after the sale has been made. This occurs if the customer complains about damage, and the seller can allow a partial refund.

- Discounts – Most businesses work on the principle of invoicing where, if the customer pays earlier than anticipated, the seller may give a pre-decided discount. E.g., discounts can be 1/10 net 45, where a customer can receive a 1% discount if he pays within 10 days of the 45 days payment cycle. This works well for recurring customers.

Net Sales Ratios

Net Sales are even more insightful when it is put to use in the analysis of financial ratios. Return on Sales, Price-to-sales ratios, and profit margin ratio – all denote various measures when compared to net sales. These ratios are measurements of conversion of the base sale into final profit and net returns earned.

Also Read: Net Income

The internal costs are in terms of percentage of net sales. This is as an internal barometer to check on the progress of operations and how well managed they are. Senior management utilizes these sales ratios to fine-tune internal processes and cost control.

Profitability ratios also help external stakeholders like analysts to gain insight into the management of the company. Thus, Net revenues are the base of all these things. It has to be a clean and complete figure for all concerned parties in the financial statements.

Conclusion

Net Sales is mistaken to be a simple figure but is of great importance when the analysis is done in detail. To understand the efficiency of the sale process, reading Gross Revenue, Net Revenue, and their associated costs can give great insight into a company.