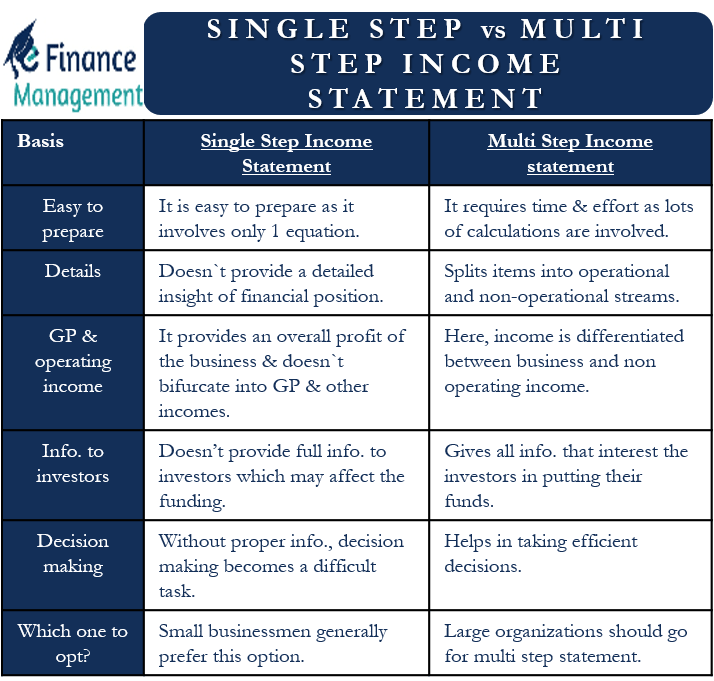

When it comes to preparing an income statement, the businesses have two options. The two options are a single-step income statement or a multi-step income statement. And they are free to opt for any of the statements. Because the end result of the two options remains the same. The difference is only in the structure of the two methods. To know the option that is best for your firm, it is crucial that you know the differences between Multi-Step vs Single Step Income Statements.

Single-Step Income Statement

Such a statement gives a simple view of the company’s profit or loss. In this, we use a single equation to come up with the profit or loss. This method reports revenue, expenses, and profit or loss, but it does so in a single equation. In this, we total all revenues and expenses and subtract them from each other to get the net income. We total all revenues (and gains) at the top of the statement, and then we total all expenses (and losses).

This method uses the following equation:

Net Income (or Loss) = (Revenues + Gains) – (Expenses + Losses)

The biggest advantage of this method is that it is easy to understand and use and is pretty straightforward.

Multi-Step Income Statement

In a multi-step income statement structure, a specific segregation/split is made between the revenue and expenses on the basis of whether they belong to the operational and non-operational stream. Under this method, there are three steps to calculate the net income or loss for a company. Like the single-step, this method also shows and uses all the information. But, it uses more than one equation to come up with the profit or loss for the company.

Since it differentiates between the operational and non-operational revenues and expenses, it classifies the expenses that could be directly linked or relatable to the business’s operations from those that do not relate directly.

Also Read: Multi-Step Income Statement

Basically, it uses three equations to come up with the net profit or loss for a business:

- Gross Profit = Net Sales – COGS (cost of goods sold)

- Operating Income = Gross Profit – Operating Expenses

- Net Income = Operating Income + Non-Operating Items

Advantages of Multi Step Income Statement over Single Step

Following are the advantages of a single-step income statement:

Easy to Prepare

It is very easy to prepare since it takes fewer calculations and doesn’t split operational and non-operational revenue and expenses. Moreover, it involves the use of just one equation.

Easy to Read

Since it is concise and uses just one equation, the single-step income statement is very easy to read. Just a glance will give a user all the information they need.

Following are the advantages of a multi-step income statement:

More Details

In this, one splits the revenue and expenses into operational and non-operational streams. This gives a better insight into the financial position of a business and the impact of non-operational items in the performance of the business.

Gross Profit

This method helps find the gross profit, in contrast to the single-step income statement. GP is a crucial financial metric as it tells whether or not the company is efficiently using direct material and labor. Making loss or not generating enough margins at a GP level is quite a serious issue for smooth operations.

Also Read: Income Statement

Operating Income

This method also informs of the operating income or loss along with gross profit. This gives an idea of how well a business uses its primary/core business activities to make an earning.

Multi-Step vs Single Step Income Statement – Disadvantages

Following are the disadvantages of the single-step income statement:

- It may not give enough information to the investors, such as the gross profit, operating income, and more.

- Since there is a lack of information, investors may not know the true financial health of a company.

- Investors may not put their funds in a company that does not reveal all the information.

- Even in the absence of the information in a property structured manner, it becomes difficult for the operating management to take a right corrective actions.

Following are the disadvantages of the multi-step income statement:

- It takes time and effort for the accounting department to come up with such a type of income statement.

- Since it requires each item to be categorized, there are more likely to be wrong classification and grouping errors.

- Any mistake may result in investors making wrong assumptions about the business.

Multi-Step vs Single Step Income Statement – Example

Suppose a business has the following heads:

Sales $50,000; Interest earned $2500; Profit from asset sale $1500; COGS $37,500; Commission expense $2,500; Office supplies $1,750; office equipment expense $1,250; Advertisement $1,000; Interest expense $250; and loss from lawsuit $750.

Single Step Income Statement

| Particular | Amount |

| Sales | $50,000 |

| Interest | $2,500 |

| Profit from the asset sale | $1,500 |

| Total Revenue | $54,000 |

| COGS | $37,500 |

| Commission expense | $2,500 |

| Office supplies | $1,750 |

| Office equipment expense | $1,250 |

| Advertisement | $1,000 |

| Interest expense | $250 |

| Loss from lawsuit | $750 |

| Total Expenses | $45,000 |

| Net Income | $9,000 |

Multi-Step Income Statement

| Particular | Amount | |

| Sales | $50,000 | |

| Less: COGS | $37,500 | |

| Gross Profit | $12,500 | |

| Operating Expenses | ||

| Commission expense | $2,500 | |

| Advertisement | $1,000 | |

| Office supplies | $1,750 | |

| Office equipment expense | $1,250 | |

| Total Operating Expenses | $6,500 | |

| Operating Income | $6,000 | |

| Non-operating Income/Expenses | ||

| Interest Income | $2,500 | |

| Profit from the asset sale | $1,500 | |

| Interest expense | $250 | |

| Loss from lawsuit | $750 | |

| Total Non-operating Income/Expenses | $3,000 | |

| Net Income | $9,000 |

Which Should One Use?

If your business is small, or you operate via sole-proprietorships and partnerships, then you can go for either of the two methods. But, if your business is big or the number of transactions is large, then you must go for the multi-step income statement. Almost all public companies use the multi-step income statement to report their net income.

Also, if a company plans to go for a debt or get new investors, then a multi-step income statement is the right option. This is because it would give stakeholders a true idea of the financial health of the business.