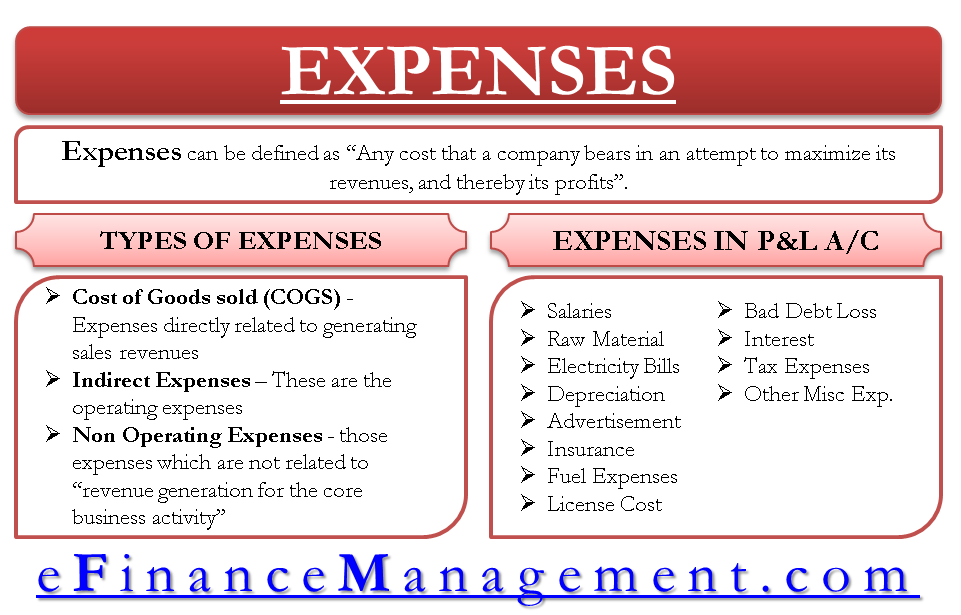

Expenses can be defined as “Any cost that a company bears in an attempt to maximize its revenues, and thereby its profits.” It is a cost to sustain and excel in business, resulting in an “outflow” of funds. An expense is a part of the income statement – a key financial statement. Hence, it is inevitable to clarify the meaning of expense in accounting.

In an ideal scenario, a company would like to reduce its expenses in business to a minimum level without hampering its revenues. It is to be noted that “All expenses are costs while all costs are not expenses necessarily.”

It is calculated for an accounting period, generally one financial year. Expenses are accounted under the “accrual principle,” i.e., they are recognized for an accounting period irrespective of whether they are incurred presently or not. Following the rules of debit and credit, “Expenses” are debited.

Types of Expenses

Different types of expenses in accounting include the following:

Cost of Goods Sold (COGS) or Direct Expenses

Expenses directly related to generating sales revenues form a part of COGS. A manufacturing firm may include the cost of raw materials and wages to workers in the cost of goods sold. A retailer may include the cost of merchandise under this head. One can arrive at gross profits by deducting the cost of goods sold from sales/revenue.

Also Read: CAPEX vs OPEX – All You Need To Know

Indirect Expenses

Indirect expenses (also termed synonymously with operating expenses) are also called selling, general, and administration expenses. Common indirect expenses include utility bills, selling expenses like advertising expenses and commissions paid to salespeople, salary for supervisors, etc. Deducting operating expenses from gross profit, one can arrive at Profit before Taxes (PBT) or Income from Operations.

Non-Operating Expenses

While the former two types of expenses fall in operating expenses, non-operating expenses refer to expenses unrelated to “revenue generation for the core business activity.” Some examples include- the cost of borrowing, commission on share transactions when the core business is trading of garments, donation or charity expenses, etc.

To summarize,

| Sales Revenue – Cost Of Goods Sold | = | Gross Profits |

| Gross Profits – Operating Expenses | = | Income From Operations |

| Income From Operations – Non Operating Expenses | = | Taxable Income (PBT) |

| PBT- Tax | = | Profit After Tax/Net Profit |

List of Expenses in Income Statement

Common financial expenses in the income statement are listed below.

- Salaries

- Raw materials

- Light bills, phone bills, rent (Utilities), etc.

- Depreciation

- Advertising

- Insurance

- Fuel expense

- License cost

- Bad debts are written off

- Provisions

- Interest

- Tax

- Miscellaneous expenses

Illustration Listing Expenses in Income Statement

XYZ Company is into the production of plastic bottles. For the financial year 11-12, it earned revenues worth USD 100,000. It paid its employees wages worth USD 20,000. The cost of powder for producing bottles is USD 10,000. It rents the factory space for which it shelled out USD 20,000 as rent. Utility expenses, including electricity bills and phone bills, amount to USD 10,000. It pays USD 5000 to the quality check supervisor. To sell its bottles, it advertises which costs USD 5000. The depreciation cost annually on its machines is USD 5000. It pays an interest on capital employed amounting to USD 5000 USD, and the tax authorities stipulate 30% of earnings as a tax.

| Revenue | 1,00,000 |

| Less: | |

| Material Cost | 10,000 |

| Wages | 20,000 |

| Gross Profit | 70,000 |

| Rent | 20,000 |

| Utility Cost | 10,000 |

| Supervisor Salary | 5,000 |

| Selling Cost (Advt. expenses) | 5,000 |

| Depreciation | 5,000 |

| Operating Income | 25,000 |

| Interest Paid | 5,000 |

| Profit Before Tax (Taxable Income) | 20,000 |

| Less: Tax @ 30% | 6,000 |

| Net Profit After Tax | 14,000 |

Also read – Expense Report.

RELATED POSTS

- Expense Report – Explanation, Uses, and Contents

- Operating Expenses – Meaning, Importance And More

- Selling, General and Administrative Expenses – All You Need To Know

- Fundamentals of Accounting: Meaning, Principles, Categories, and Statements

- Overhead Costs – Types, Importance, and More

- Accrued Expense – Meaning, Accounting Treatment And More

As I site possessor I believe the content matter here is rattling excellent , appreciate it for your efforts. You should keep it up forever! Best of luck.