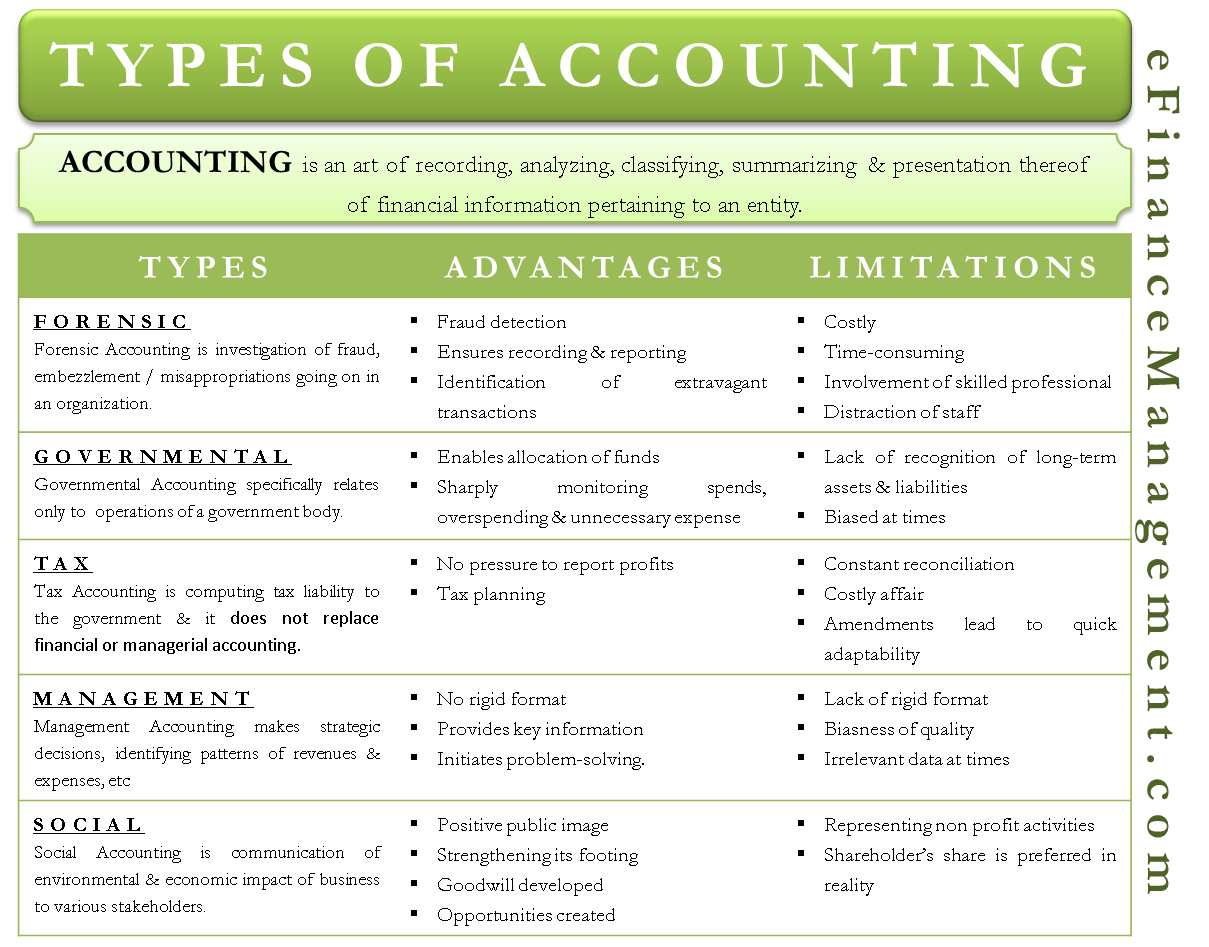

Accounting is the art of recording, analyzing, classifying, summarizing, and presenting financial information pertaining to an entity. It serves two purposes internal, i.e., to the management, and external, i.e., to the outsiders. Let’s see the different types of accounting with their advantages and disadvantages.

Types of Accounting

Forensic Accounting

Think of forensic accounting as detectives for your financial statements. Forensic accountants are mostly called upon to investigate cases of fraud, embezzlement, or misappropriations that may have been going on in an organization. They are also the true valuation experts of property in cases of insurance claims or divorce settlements. The results of their findings are substantive evidence in a court of law. Forensic accountants have to be more dynamic than financial accountants in making sense of economic theories and financial information combined with MIS and statistical techniques.

Advantage

Apart from fraud detection, forensic accounting also aids in keeping the work of in-house professionals and experts in check. In addition to acting as a moral hindrance for employees, it also ensures that the recording and reporting are up to date. It facilitates the identification of abnormal and extravagant transactions in the initial stages itself.

Disadvantage

It does not take a genius to figure out that any activity of forensic accounting will be a very pricey affair. The involvement of highly skilled and adept forensic professionals obviously involves a lot of costs. Moreover, this is among the types of accounting that are highly time-consuming. Also, the employees are distracted from their routine, and the overall efficiency of the staff may be compromised.

Also Read: Accounting Information

Governmental Accounting

Governmental accounting specifically relates only to the operations of a government body. The main sources of revenue for any governmental body are taxes. Also, it exists to effectively allocate the large pool of funds accumulated with it among different resources and projects to promote overall social welfare. Therefore, such a body accountable to the public at large requires a separate set of accounting and reporting principles than any other profit-making entity. The Governmental Accounting Standards Board (GASB) is responsible for drafting reporting and accounting standards for state and local governments.

Advantages

It enables the allocation of funds among several resources. Governmental accounting thus enables micro-management of funds allowing the authorities to closely monitor the spending, reduce the risk of overspending and prevent unauthorized expenditure.

Disadvantages

The major purpose of governmental accounting is to convert assets and borrowing to hard cash to facilitate government spending. Therefore, the focus is only on current assets and liabilities. Long-term assets and liabilities unlikely to be converted into cash in the near future are not recorded on the balance sheet. The lack of acknowledgment of long-term assets and liabilities paints a misleading picture. In the absence of all information, the government may remain biased and make incorrect judgments.

Tax Accounting

InThenternal Revenue Services (IRS) controls tax accounting in the US. Whether an individual or a corporate body, a citizen must mandatorily comply with the tax accounting directions. The end goal differentiates tax accounting from other types of accounting. General accounting is performed to arrive at the profitability of a business and reporting to stakeholders. On the other hand, the sole purpose of tax accounting is to compute the tax liability to the government. It is important to note that tax accounting does not replace financial or managerial accounting carried out on a routine basis.

Also Read: What is Accounting?

Advantage

Tax accounting is the only one among the various types of accounting where incurring losses is rewarded. Tax accounting allows for an assessee to carry forward previous years’ losses. This underestimates the current year’s profits and thereby reduces the tax liability. No such concessions are available in financial accounting. The entity is under constant pressure to report profits year after year. Also, tax accounting allows for the deduction of various investments and other qualifying expenditures. Most importantly, tax accounting helps in tax planning.

Disadvantage

Constant reconciliation between the financial and tax accounts is required. Also, the taxation laws are frequently updated. This requires the tax accountants to adapt quickly and apply amendments to the accounts already drawn up. Needless to say, tax accounting is a costly affair requiring the services of professional tax experts. In the US, Certified Public Accountants (CPAs) are eligible to provide taxation advice.

Management Accounting

Management accounting leans more towards being a management information system (MIS) rather than any general-purpose financial statement. It is more concerned with strategic decision-making rather than mere reporting and recording. The foremost goal is to identify patterns of revenue and expenses and report deviations from immediate corrective action. Apart from this, statements evaluated as a part of management accounting include capital budgeting analysis, loan covenant compliance, project profitability, etc.

Advantage

There are no rules in management accounting. Since it is only for internal purposes, it does not follow a fixed format. In fact, management accounting reports are tailored to suit the specific needs of the management and display the crux of the information required. This allows the management to highlight only the key information required and initiate problem-solving.

Disadvantage

The pro can also be a con, like two sides to a coin. Due to the lack of a standard format, the preparation of a management accounting report depends largely on individual discretion and the opinion of the accountant. Therefore, there is always a high chance of individual bias impacting the quality of reports. Moreover, management accounting can only put forth hordes of data that would mean nothing without the analytical skills of the top management.

Social Accounting

Social accounting refers to the communication of the environmental and economic impact of a business to various stakeholders. Corporate social responsibility (CSR) and social accounting are closely related. Social accounting is a relatively newer branch of accounting. It has emerged with the growing hazards businesses have been imposing on their surroundings. Any business is ultimately a part of society and utilizes the resources provided to it by society. Therefore, a business must strive to be accountable to the community at large. It must, therefore, undertake action to improve the living, economic, environmental, and social conditions of the society where it operates.

Advantages

In addition to the direct benefits accruing to society, the company also reaps indirect benefits. An organization undertaking social accounting boosts a positive public image. It strengthens its footing in the society it operates. It leads to the development of goodwill that opens further doors of opportunities for the company.

Disadvantages

The basic motives of a company in business and social accounting are starkly opposite. As per the books, a business exists solely to expand shareholders’ wealth. In contrast, engaging in social welfare defeats this objective. They represent not-for-profit activities that do not generate any economic benefit. Although socially responsible behavior is desired in the long run, it is the shareholder’s precious share of profit lost in the short run.