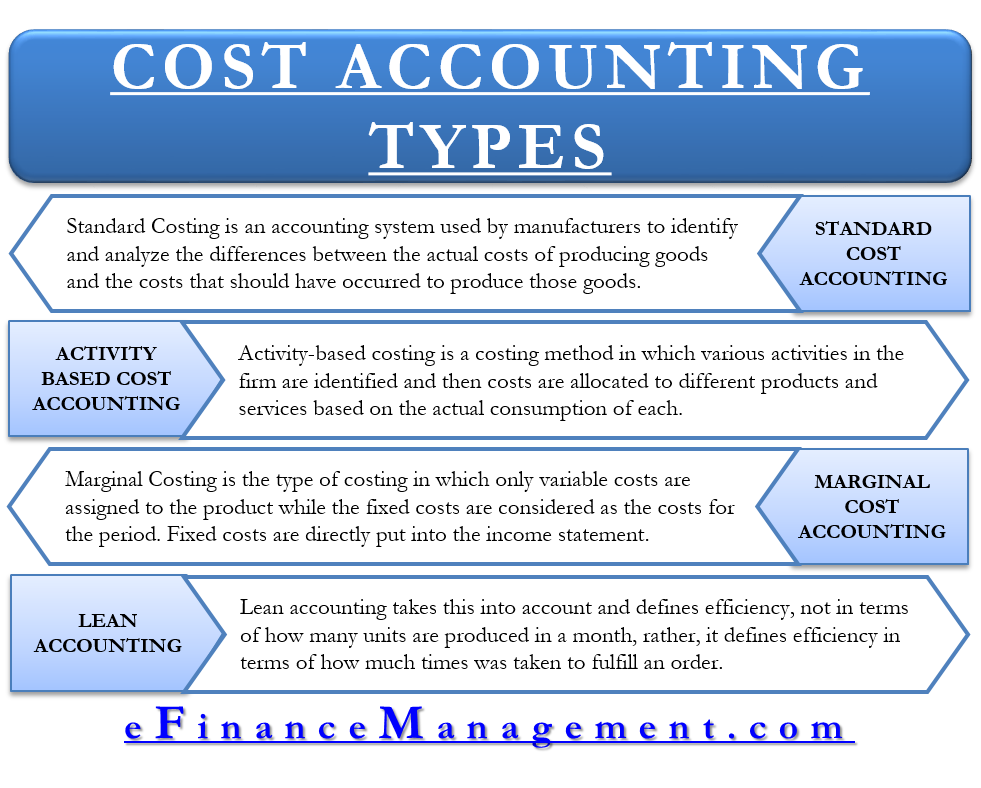

There are four major types of cost accounting: standard cost accounting, activity-based cost accounting, marginal cost accounting, and lean accounting.

Standard Cost Accounting

Standard costing is a cost accounting system. Manufacturers use it to identify and analyze the differences between the actual costs of producing goods and the estimated costs that would have occurred to produce those goods.

Standard costs are the costs that management estimates to occur while producing goods. These costs are based either on the past reports/experience of the firm or market research conducted by management. Standard costs involve product costs, direct material costs, direct labor costs, and manufacturing overhead costs.

Since managers have set the standard costs, they can then proceed with planning and budgeting decisions. This will help them to project the net income based on the standard costs of production. Any deviations with the set standards will be treated as variances that will be taken care of by managers.

Dealing with Variances

Calculating standard costs is a great tool for planning purposes. But in reality, standard costs (or the cost which should have occurred) often differ from the actual costs. The difference between the standard cost and the actual cost is variance. Favorable variances happen when the production cost of goods is lower than the standard cost. While unfavorable variances happen when goods end up costing more than the standard cost.

Also Read: Types of Costing

But managers are not dumb to not know all these. They expect actual costs to be different from standard costs. However, one of the main objectives behind using standard costing is to find out these variances and investigate the reasons behind them.

Activity-Based Cost Accounting

Activity-based costing is a costing method in which various activities in an organization, typically a factory, are identified, and then costs are allocated to these activities. The costs accumulated in these activities are further allocated to the products and services based on the actual consumption by each product. Activity-based costing assigns costs to products and services based on:

- Activities that go into their production

- Quantity of resources consumed by these activities

Steps in using Activity-Based Costing

ABC costing is a bit complex. So, to simplify it, let us understand it with the help of an example. Suppose there is a firm which manufactures jeans, shirts, and trousers. The firm wants to calculate how much it costs to produce jeans, shirts, and trousers individually. The firm decides to use ABC costing to find out the relevant costs. Following are the steps that firms will have to take:

Identify Activities

Identify what all activities are required to manufacture the product. In our example, the activities may be purchasing, processing, transporting, etc.

Pool Expenses in Each Activity

Break down each activity into individual costs associated with that activity. A group of all these individual costs associated with that activity is known as a cost pool. To explain it again, a cost pool is the group of all individual costs associated with an activity. E.g. for an activity called processing, individual costs will be cutting costs, stitching costs, coloring costs, inspecting costs, etc. If we group all these four costs, we will get a cost pool called processing costs.

Identify Cost Drivers

Identify cost drivers for each activity. A cost driver is a unit of activity that changes the costs associated with that activity. E.g., for a cost pool like purchase costs, this unit can be the number of parts (sheets of cloth in our case of manufacturing clothes) purchased. For a cost pool such as processing costs, man-hours usage can be the cost driver.

Derive Rate of Using Each Activity

Now, suppose the cost pool of processing shows an amount of $3,00,000. And suppose the company’s workforce had to spend 10,000 hours to process all the three products. Now, recall that workforce is your cost driver for processing activity. So, step 4 is to divide the total of a cost pool by the number of units of a cost driver. So, in our case, we will divide $3,00,000 (total of a cost pool) by 10,000 hours (total units of the cost driver). What we have got is $30 per man-hour. This $30 is the rate of using a worker or the manpower for an hour.

Evaluate Total Cost

In step 5, we finally determine how much the cost of activity belongs to which product. We know that the total cost associated with processing is $3,00,000. We also know that the total manpower hours spent in processing is 10,000 hours. Now suppose, out of these 10,000 hours, the company spends 4,000 hours on processing jeans, 3,000 hours on processing shirts, and 3,000 on trousers. Since the rate of using manpower for 1 hour came out to be $30 in step 4, the processing costs for manufacturing of all the jeans is 4,000 (manpower hours) * 30 (rate of manpower per hour) = $1,20,000.

This is how activity-based costing helps us to accurately determine which product deserves how much of the total costs incurred. This allocation helps us to find out the exact profitability of all the products. If the firm doesn’t know how much an individual product costs them, it might happen that out of the 3 products manufactured, 1 product is making losses, and the company never comes to know about it because the company doesn’t know its cost.

Marginal Cost Accounting

Marginal costing is the type of costing in which only variable costs are assigned to the product while the fixed costs are considered as the costs for the period. This means that the fixed costs, such as rent, electricity, etc., are directly a part of the income statement as expenses and are not assigned to any particular product.

The marginal cost of a product is its variable cost. This cost includes items such as direct material costs, direct labor costs, and every such cost, which is variable, whether of direct or indirect nature. As the volume of production changes, these costs also change proportionately. On the other hand, fixed costs are costs that remain unchanged regardless of the volume of production.

In this approach, it is not possible to identify net profit per product since we don’t know how much of the fixed cost belongs to an individual product. This approach only gives the amount of contribution to fixed costs and profits. The contribution is the difference between total revenue and the total variable costs. This contribution amount is the deciding factor of this whole marginal costing. It suggests that until and unless there is a contribution of a single penny per unit, the product should be manufactured.

Lean Accounting

Lean accounting has some principles and processes that provide numerical feedback for manufacturers implementing lean manufacturing and lean inventory management practices. Traditional accounting system recognizes inventory as an asset even if the inventory sits on the shelf for a year and has holding costs associated with it. Lean accounting, however, considers that more than necessary inventory at a time is bad for the company and has costs associated with it in terms of holding costs, the opportunity cost of the cash blocked in inventory, etc. Lean accounting considers this and defines efficiency, not in terms of production in a month. Instead, it defines efficiency in terms of how much time processing an order takes.

Cost accounting is a very basic costing term. Read our detailed article – Costing Terms to learn about various other terms.

RELATED POSTS

- Cost Accounting and Management Accounting

- Cost Accounting Systems – Meaning, Importance And More

- Cost Accounting vs. Financial Accounting – All You Need to Know

- Peanut-butter Costing – Meaning, Example, Drawbacks and More

- Types of Costs and their Classification

- Cost Object – Meaning, Advantages, Types and More

Great work! This is the type of information that should be shared around the internet. Shame on Google for not positioning this post higher!Thanks =)

thank you for the article

A very good way of explanation

Hi,

Thanks for visiting our website.

Keep reading