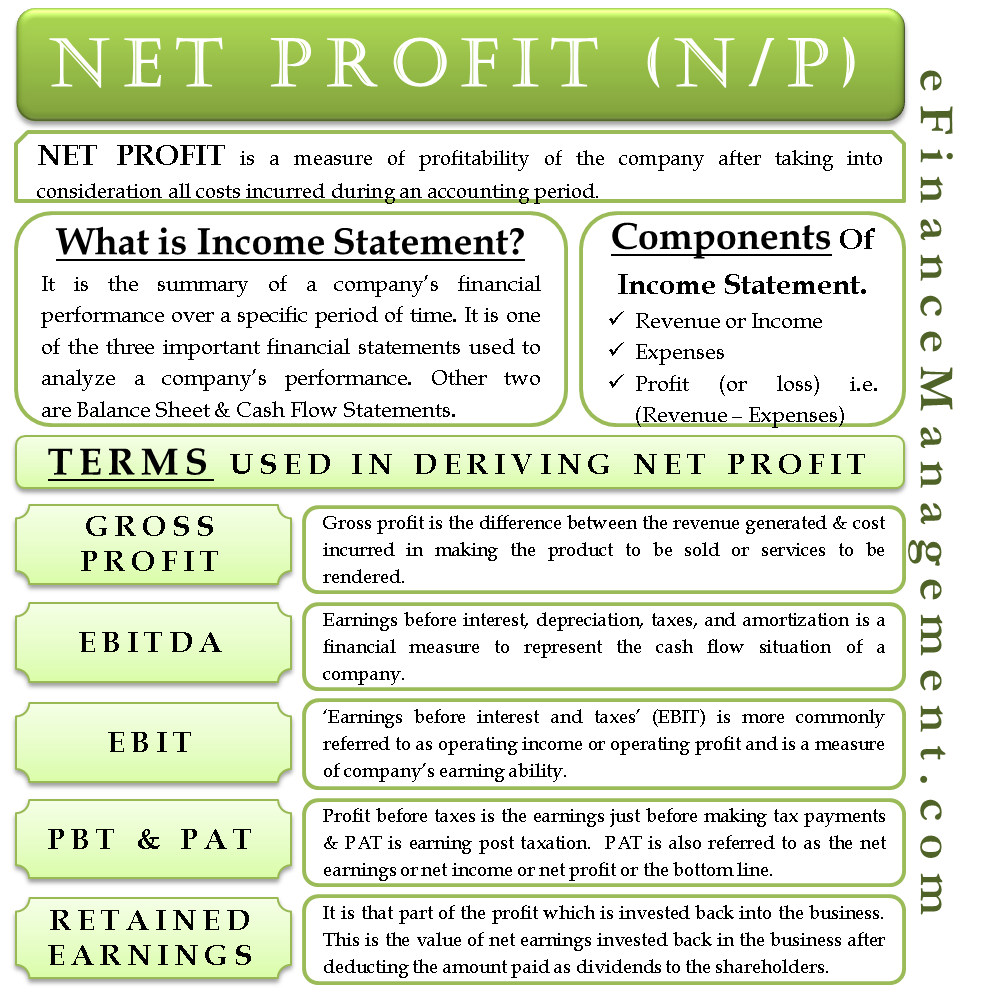

Net Profit is a measure of the profitability of the company after taking into consideration all costs incurred during an accounting period. Other names for net profit are; net income, net earnings, bottom line, profit after tax (commonly known as PAT), etc.

Meaning of Net Profit

In simple words, it is the money left over after paying off all expenses, including the cost of goods sold, selling and administrative expenses, operating and non-operating expenses, depreciation, interest payments, preference dividend (if any), and taxes. Net income is reported on the income statement (profit and loss account) and forms a key indicator of a company’s performance. Financial analysts determine the net profit margin for their analysis and comparison purposes.

Net profit or earnings are different from Earnings before Interest and Tax (EBIT; aka Operating Income / Operating Profit) and Earnings before Interest Tax Depreciation and Amortisation (EBIDTA). Let us look at an example of the income statement to get a clear understanding of the various elements of an income statement. Before the example, let us briefly understand what an income statement or profit and loss account is?

What is an Income Statement?

An income statement summarizes a company’s financial performance over a specific period of time. It is one of the three important financial statements which we use to analyze a company’s performance. The other two are the balance sheet and the cash flow statements. Other names of the income statement are; profit and loss statement, statement of income, or statement of operations.

Also Read: Net Income

Components of an Income Statement

An Income Statement comprises 3 parts which are:

- Revenue or Income

- Expenses

- Profit (or loss), i.e. (Revenue – Expenses)

An income statement itemizes every source of revenue and expense that the company has made over the period under consideration. The difference between the income earned and the expense made gives the amount with which the owner’s equity is changing. A positive difference will indicate a rise in the owner’s equity by the corresponding amount, and a negative difference will indicate a drop in the owner’s equity.

Example of Income Statement

| Income Statement | Amount in Mio | |

| Sales revenue | $ 600 | |

| Less: Cost of goods sold | $ 275 | |

| Gross Profit (GP) | $ 325 | |

| Less: Operating Expenses | ||

| Salary | $ 30 | |

| Rent | $ 20 | |

| Wages | $ 6 | |

| Utilities | $ 4 | |

| Other operating expenses | $ 10 | $ 70 |

| EBITDA | $ 255 | |

| Less: Depreciation | $ 30 | |

| Less: Amortisation | $ 10 | |

| EBIT (Operating Income) | $ 215 | |

| Less: Interest | $ 15 | |

| Profit Before Tax (PBT) | $ 200 | |

| Less: Tax (@ 35%) | $ 70 | |

| Profit After Tax (Net Profit) | $ 130 |

To understand net profit closely, let us understand the terms which are used in deriving net profit in an income statement:

Gross Profit

Gross profit is the difference between the revenue generated and the cost incurred in making the product to be sold or services to be rendered. It is also referred to as sales profit which in our example is $ 600 – $ 275 = $ 325.

EBITDA

Earnings before interest, depreciation, taxes and amortization (EBITDA) is a financial measure to represent the cash flow situation of a company. It is a measure usually used by lenders to ascertain that the company has enough cash flow available to make interest and principal repayments on loans that will be given. It is also used to gauge the short-term liquidity health of the company. A company with a negative EBIDTA may be more problematic for a lender to give any new credit line.

EBIT

‘Earnings before interest and taxes’ (EBIT) is more commonly referred to as operating income or operating profit and is a measure of a company’s earning ability. Operating income is the income generation of the company by its day-to-day operating activities. It signifies how stable the revenue of the company is. A company with a stable EBIT or increasing EBIT is considered favorable even if the company’s profits are fluctuating.

Also Read: Net Income Formula – Calculation and Example

PBT and PAT

Profit before taxes is the earnings just before making the tax payments. And PAT is the profits after payment of tax. PAT is also referred to as net earnings, net income, net profit, or bottom line. Net profit is the key number that determines the final profitability of the company. And there are various financial ratios that are linked to net profit for analyzing the performance or year-on-year growth of a company.

Retained Earnings

Retained earnings refer to that part of the profit which the company invests back into the business. This is the value of net earnings invested back in the business after deducting the amount paid as dividends to the shareholders. If no, there is no dividends payment; the retained earnings will be the same as net earnings or net profit for the year.

Read more on What is the Best Definition of Profit?

Top article ; simple and no nonsense

But I have few clarifications ; how do I ask?

You can ask in the comments only.

Just a confirmation – we don’t reduce salaries and other G&A expenses to calculate gross profit. True? If yes, is this something globally acceptable I.e. true for any income statement that I read?