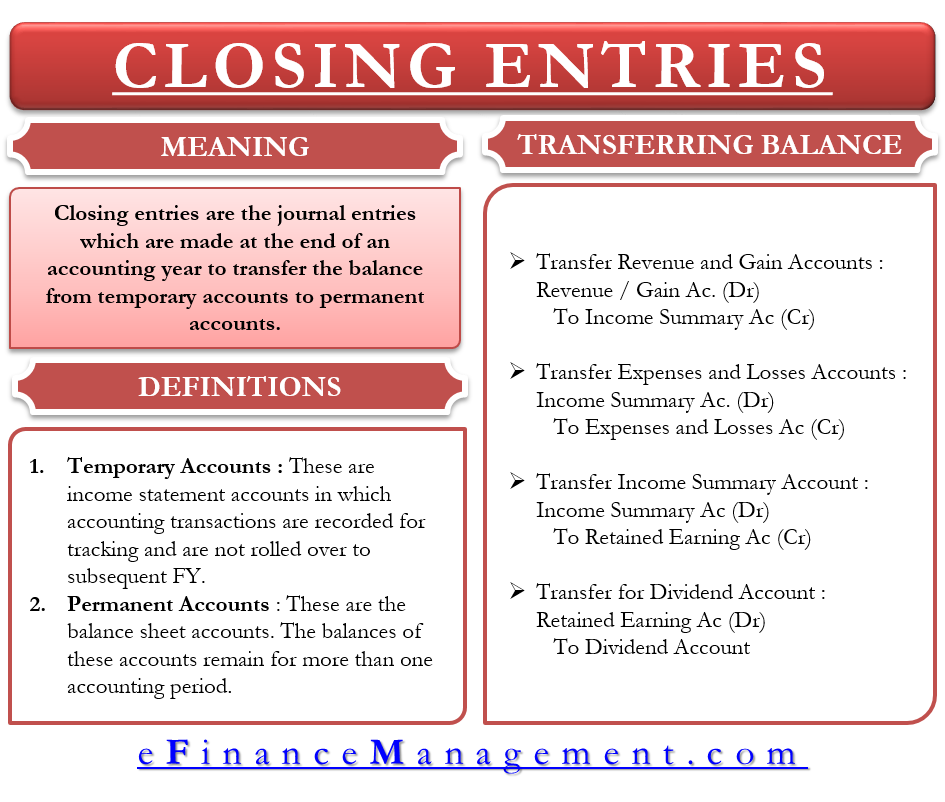

Closing entries are the journal entries that are made at the end of an accounting year to transfer the balance from temporary accounts to permanent accounts. Posting closing entries is an important step of the accounting cycle. In other words, we post-closing entries to reset the balance in all temporary accounts to zero. This ensures that these temporary accounts have zero balance at the beginning of the next accounting year.

Temporary Accounts

Temporary accounts are income statement accounts that we use to record transactions and track accounting activity during an accounting period. The balances in these accounts do not roll over to the next year. E. g, we use the revenues account to record the revenues of the business for an accounting period and not for the whole life of the business. Since no business will want to carry forward the amount in revenue account of FY 2015 to FY 2016. So, we call these accounts to be temporary accounts.

All income statement accounts are temporary accounts. Examples include interest account, depreciation account, sales account, rent expense account, salary expense account, etc. The balance in these accounts shows the financial performance of a business for some time which is the accounting year. Hence, there is no sense in an income statement account, such as a salary expense account, carrying the balance of the previous year’s salary expense incurred. The previous year’s salary relates to the performance of the business in the previous year and not the current year.

For this reason, income statement accounts are temporary accounts, and we bring down the balance in them to nil before the start of the next accounting year.

Permanent Accounts

Permanent accounts are the balance sheet accounts, the balance of which exist for a period longer than one year or the current accounting year. In permanent accounts, the ending balance of this year will be the beginning balance for the next year. For E.g., a vehicle account is a permanent account since you will enjoy the benefits of a vehicle for the years to come and won’t through it away after the end of the current year. Likewise, you will keep using all the assets on your balance sheet and will be obliged to pay all the liabilities beyond the current year. For these reasons, balance sheet accounts are permanent accounts.

Transferring the Balance

The balance of all temporary accounts can either be directly transferred to the Retained Earnings account or through an intermediate account called the Income summary account. The income summary account is also a temporary account that soaks/absorbs the balances of all the temporary accounts of the income statement and then transfers the ‘net’ of these amounts to the retained earnings account. This net amount in the income summary account is equal to the net income for the period shown by the income statement.

If you use an income summary account to transfer balances from the temporary accounts to the permanent accounts, four closing entries are made:

Closing Entry for Revenues and Gains Accounts

The total revenues (from sales) and other gains (say, from selling machinery at a profit) at the end of the accounting period are transferred to the income summary account. The objective is that the revenue and gains account should begin with a zero balance in the following accounting year.

The journal entry will be:

| Date | Particulars | Debit ($) | Credit ($) |

| March 31, 2019 | Revenue and gains account

Income summary account (To record purchase of a new vehicle) | — |

— |

Closing Entry for all the Expenses and Losses Accounts

Like the revenue and gains account, all the expenses and losses are also transferred to the income summary account so that the balance in them is nil at the start of the next accounting year.

The journal entry will be:

| Date | Particulars | Debit ($) | Credit ($) |

| March 31, 2019 | Income summary account

Cost of Goods Sold account Depreciation expense account Rent expense account Salary expense account Interest expense account Other expenses account (To record transfer of expenses to income summary account) | — |

— — — — — — |

Closing Entry for the Income Summary Account

The next step is to close the income summary account by transferring the net balance, or the difference between the income and the expenses, to the retained earnings account. In case of a profit, the income summary account will be debited, and the retained earnings account will be credited. The journal entry will be:

| Date | Particulars | Debit ($) | Credit ($) |

| March 31, 2019 | Income summary account

Retained Earnings account (To record transfer of income summary account balance to retained earnings) | — |

— |

Closing Entry for the Dividend Account

We close the dividend account after calculating the net profit and transferring the balance to the retained earnings. The need to close the dividend account arises only if the company decides to pay dividends in that accounting year. The journal entry will be:

| Date | Particulars | Debit ($) | Credit ($) |

| March 31, 2019 | Retained earnings account

Dividend account (To record transfer of dividend account) | — |

— |

All these 4 entries are collectively known as closing entries.