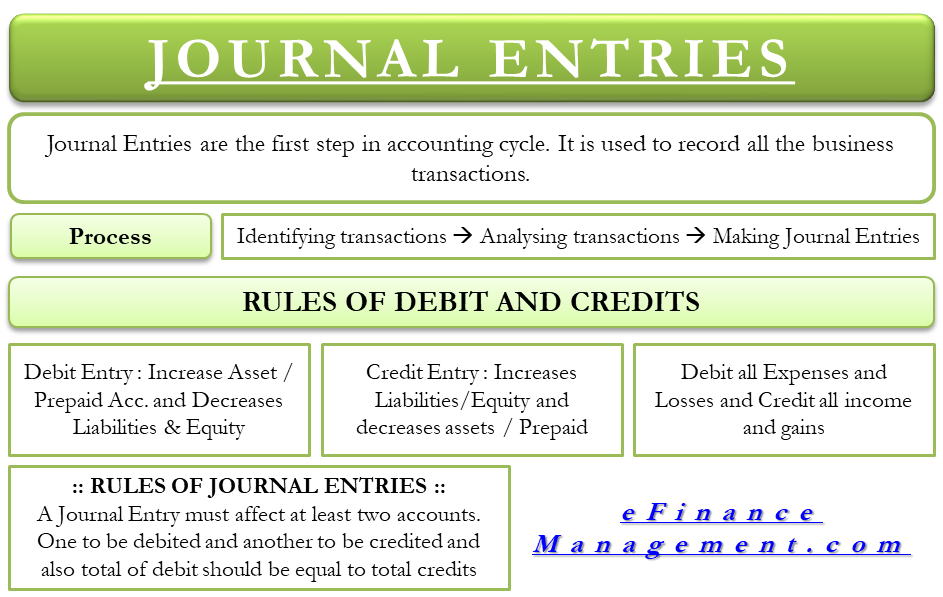

Journal entries are the first step in the accounting cycle. They are used to record all business transactions and events in the accounting records of a business. A journal entry is recorded in the company’s general journal, which is the company’s official book of recording journal entries.

Understanding journal entries is the most basic and important skill to master in accounting careers. Without properly understanding journal entries, a person cannot prepare and analyze the balance sheet and income statements of a company. Even if he does, they are bound to be inaccurate or a mess.

How to Make a Journal Entry

As business transactions occur throughout the accounting period, we record journal entries to show how these transactions have financially affected the business. Suppose that a transaction took place in the business in which the business purchased a new vehicle to deliver products. Now, there are three steps in recording journal entries. They are:

Identifying Transactions

The first step is to identify that a transaction took place in the business. You cannot possibly record a transaction if you do not know it has occurred. Therefore, the first step is to know, to bring it to your notice that a transaction has taken place. This process is also about determining whether the transaction is a business event or a non-business event. If it is a non-business event, we won’t record it in the accounting system.

Also Read: Closing Entries

In our example, purchasing a new vehicle is a business transaction, and so we will record it in our book of journal entries.

Analyzing Transactions

Transaction analysis involves determining whether the transaction will affect the assets, liabilities, or equity of the business. In our case, analyzing the transaction will tell us that the transaction will affect our assets. Purchasing a new vehicle will increase the balance of fixed assets or non-current assets, while the cash which we will pay in exchange for the vehicle will decrease our cash balance. Total assets increased and decreased by the same amount, but we will still record a journal entry because our balances of cash and non-current assets have changed.

Making Journal Entries

The next step is to make a journal entry. Journal entries use debits and credits to record the changes made by a transaction. There is a definite format in which we record journal entries which we will discuss later in this article. In our example of purchasing a vehicle, we will record the journal entry by debiting the vehicle account and crediting the cash account. But, when to debit an account and when to credit it?

Rules of Debits and Credits

In the book of journal entries, for different accounts, we use debits and credits either to increase or to decrease that account’s balance. For all the asset accounts, which include cash, accounts receivable, property, plant, equipment, etc., we debit the account to increase that account’s balance. Similarly, to reduce an asset accounts balance, we credit the asset account. For liability accounts, which include bills payable, loans, outstanding salary, etc., this equation is exactly the opposite. We debit a liability account to decrease that account’s balance while we credit a liability account to increase that account’s balance. In the previous paragraph, we debited the vehicle account (asset account) because our balance in the vehicle account had increased after purchasing the vehicles. Similarly, we credited the cash account (asset account) because our balance of cash had gone down after purchasing the vehicle.

In the case of income and expenses, we credit all incomes and gains which arise, and we debit all expenses and losses which arise.

To summarize the above paragraph:

- A debit entry increases asset and prepaid account balances while it decreases liability and equity account balances.

- A credit entry increases liability and owner’s equity accounts and decreases asset and prepaid expense accounts.

- We debit all expenses and losses and credit all incomes and gains.

Read a detailed article on What is Debit and Credit.

Rules of Journal Entry

When a business transaction takes place, and we have to make a journal entry, we must follow these rules:

- A journal entry must affect at least 2 accounts in a double-entry bookkeeping system. Also, one of the accounts must be debited, and the other one must be credited.

- The debit amounts and the credit amounts must be equal.

Journal Entry Format

- The first column shows the date on which the transaction happened and the journal entry number.

- The second column includes the names of the debited and credited accounts. We also include a brief description of the reason for the entry in this column.

- The third column records the amount of the account which is debited.

- The fourth column records the amount of the account which is credited.

| Date | Particulars | Debit ($) | Credit ($) |

| April 1, 2019 | Vehicle Account | 20000 | |

| Cash Account | 20000 |

Problem on Journal Entry

Suppose George has a catering business. Now, suppose the following transactions take place in his business during FY 2018-19:

- George brought a fresh capital of $15,000 to his catering business.

- George took a bank loan of $5,000 to support his catering business.

- He purchased catering equipment for $12,000.

- He drew $500 out from his business for personal use.

- The business earned $10,500 for services rendered to its customers.

- George realized that $ 4000 worth of salaries were outstanding (payment is due).

- Out of the $5,000 loan he had taken, he pays back $4,000 to the bank.

- He provides catering services worth $7,600 to a customer. The customer promises to pay after 3 months.

- He purchases office supplies worth $200 for credit.

Post journal entries for the transactions which took place in the FY 2018-19 in the books of accounts, George.

Solution

- When George brings a fresh capital of $15,000, the balance in the bank account will increase. The bank is an asset account. So, we will debit the bank account. Also, the balance in the capital account will also increase. Since the capital account is a liability account, we will credit it to increase the balance in the liability account.

| Date | Particulars | Debit ($) | Credit ($) |

| 1 | Bank account

Capital account (To record additional capital) | 15,000 |

15,000 |

- Taking a loan will increase the balance of the bank account. So, to increase the bank account balance, we will debit it by $5,000. Also, the loan is a liability. So, to increase the loan account balance, we will credit it.

| Date | Particulars | Debit ($) | Credit ($) |

| 2 | Bank account

Loan account (To record a new loan taken) | 5,000 |

5,000 |

- Purchasing catering equipment will decrease the bank account balance by $12,000. So, to decrease the bank account balance, we will credit it by $12,000. Also, the purchasing of catering equipment will increase the balance of the equipment account (asset). So, we will debit the equipment account to increase its balance.

| Date | Particulars | Debit ($) | Credit ($) |

| 3 | Equipment account

Bank account (To record purchase of new equipment) | 12,000 |

12,000 |

- Taking $500 out from the business will decrease the bank account balance. So, we will credit the bank account. Also, the balance in his drawing account will increase. So, we will debit the drawing account.

| Date | Particulars | Debit ($) | Credit ($) |

| 4 | Drawing account

Bank account (To record drawings) | 500 |

500 |

- Earning a revenue of $10,500 will increase the bank account balance. So, to increase the bank account balance, we will debit it. Also, we credit all incomes and gains. Since sales are an income, we will credit it.

| Date | Particulars | Debit ($) | Credit ($) |

| 5 | Bank account

Sales account (To record sales) | 10,500 |

10,500 |

- An outstanding salary is a liability. To increase the liability account, we will credit it. Also, salary is an expense. So, we will debit the salary account.

| Date | Particulars | Debit ($) | Credit ($) |

| 6 | Salary account

Outstanding salary account (To record outstanding salary) | 4,000 |

4,000 |

- Paying back the loan amount will reduce the loan account balance. So, we will debit it. Also, the bank account balance will reduce after paying the loan. So, we will credit it.

| Date | Particulars | Debit ($) | Credit ($) |

| 7 | Loan account

Bank account (To record payment of loan) | 4,000 |

4,000 |

- Providing services on credit terms will increase the balance of accounts receivables. Accounts receivables are an asset so we will debit them. Also, he has made an income by selling his services. So, we will credit the services account.

| Date | Particulars | Debit ($) | Credit ($) |

| 8 | Accounts Receivables

Sales account (To record sales on credit) | 7,600 |

7,600 |

- Purchasing office supplies worth $200 will increase the balance of office supplies. Also, accounts payables will increase since he has purchased office supplies on credit. So, we will credit the account’s payables.

| Date | Particulars | Debit ($) | Credit ($) |

| 9 | Office supplies account

Accounts payables (To record purchase of office supplies) | 200 |

200 |

Good day, can I ask? What if the dates given are not specified just like your example. Is it okay to put 1, 2, 3 and so on in the date column. Thank you.

In Accounting we are recording the transactions that happened. Hence, there would be definite dates available to record those transactions and the Journal Entry in actual practice. Of course, it is for example that we can take any dates if not specified. Hope this clarifies your doubt. Thanks