A fiduciary is a position for a trust or any other organization. The biggest responsibility of the person in this position is to maintain financial records of these organizations, as well as to issue periodic reports. So, the fiduciary uses fiduciary accounting to maintain records of the assets and liabilities of the trust and report the same to the beneficiaries.

So, fiduciary accounting also does what other types of accounting do. That means recording all the transactions of the trust or entity and grouping them all. And share the periodic reports of the activities undertaken and the current financial status of the entity. Of course, this accounting follows the cash basis of accounting and not the accrual basis of accounting. This means the fiduciary records the cash as and when he receives and records the disbursement when he pays it.

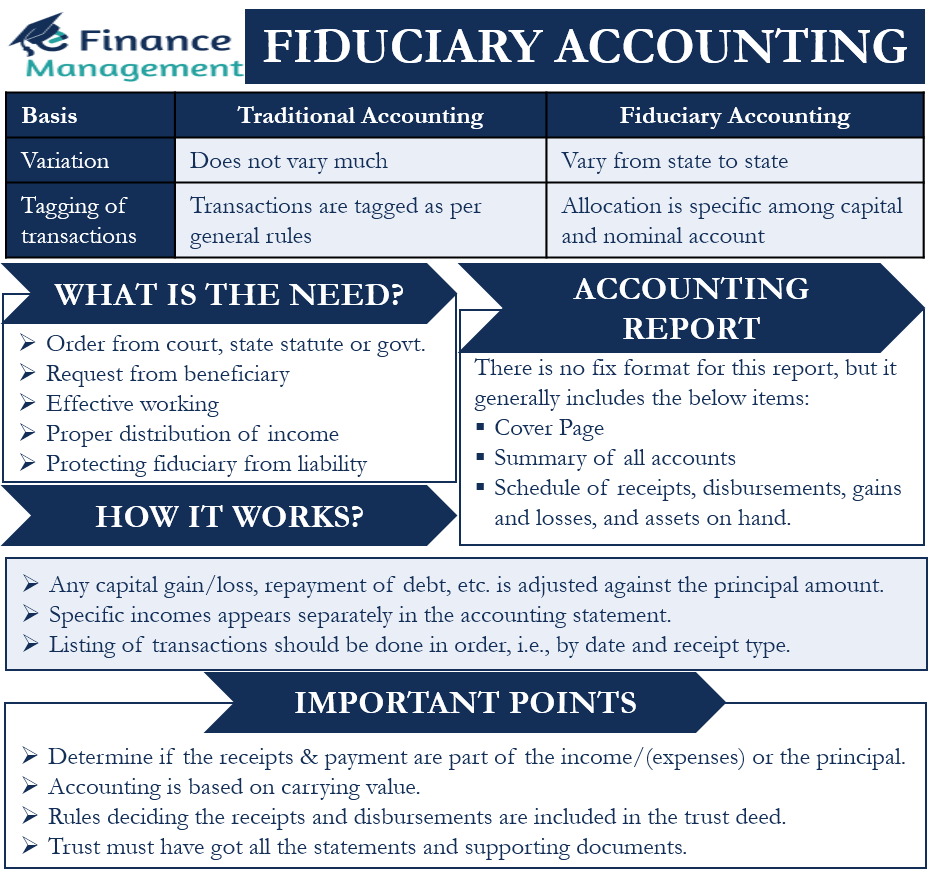

How Fiduciary Accounting is Different from Traditional Accounting?

This accounting is distinct from commercial accounting in many ways. For instance, the rules and principles of this accounting could vary from state to state or even from county to county. It is because fiduciary accounting considers the wishes of the decedent or grantor that ultimately guides the accounting. Such wishes are usually part of the will or trust instrument and thus, do not come under the state law.

Another difference is that fiduciary accounting has to allocate the transactions between principal and income. Even the incomes are also in a separate list as per the source, that is, interest income on deposits, dividend and interest income on investments, and so on. This is so because the beneficiaries may be different for different types of income sources as per the terms of the trust. But there is no such practice in traditional accounting. Also, such an accounting could require a more detailed description of a transaction in comparison with traditional accounting.

Despite these differences, many basic accounting principles are the same as required in fiduciary accounting as well.

Fiduciary Accounting – What’s the Need?

Such a type of accounting is usually for guardians, trustees, executors, administrators, as well as for assignees and receivers. The requirement of this type of accounting arises because of a court order, state statute, or an order from the government. Also, the request for such an accounting may come from a beneficiary. A fiduciary may also decide to use such accounting to effectively carry out their work, including proper distribution of the income.

One major advantage of accounting for fiduciary is that it helps to protect them from any liability. Similarly, such accounting is beneficial for the beneficiary as it requires the fiduciary to reveal all the financial transactions of the trust or estate.

How it Works?

A fiduciary manages a trust, which usually includes cash, assets, or any income-producing assets. If there is any capital gain, we add it to the original principal amount. At the same time, any capital loss gets deducted from the principal account. Similarly, we deduct any debts by the trust from the principal amount.

The fiduciary accounting reports include the principal amount and any other income that the trust gets. This income could be through interest or dividends, and it appears separately in the accounting statement.

If the administrator sells an asset that is part of the trust, then the accounting report must reveal the book value and the selling price of that asset. This would then help to calculate the capital gains or capital losses.

The fiduciary must list the income that the trust makes in a specific order (i.e., by date and receipt type). Such a presentation helps to easily verify if all the records are in place or not. Similarly, payments from the trust should come in the same order in the fiduciary trust accounting statements. These payments could be for maintaining or administering the trust. And, if any beneficiary gets any income from the trust, then the statement must reveal it as well.

After the fiduciary prepares the accounting reports, it is sent to the stakeholders, including the court (if there is a need). The recipients are free to ask for clarification or object to any item. Once the fiduciary clears all the objections, or there is no objection, the fiduciary can go ahead to distribute the proceeds from the trust.

Fiduciary Accounting Report

A fiduciary usually issues the fiduciary accounting report to all the beneficiaries at least once a year. There is no fixed format for this report, but it generally includes the below items:

- Cover page

- Summary of all accounts

- Schedule of receipts, disbursements, gains, and losses, and assets on hand.

Fiduciary Accounting: Points to Consider

The most important point in this type of accounting is to determine if the receipts and payments are part of the income/(expenses) or the principal. The principal is basically the asset or assets that the trust owns, while income is the money that the trust gets from the principal asset.

Another crucial issue in such type of accounting is of carrying value. Generally, in accounting, the concept of carrying value refers to the current book value of an asset. But fiduciary accounting implies that the asset’s value is revalued after a certain event, like the start of a trustee’s administration. Such a thing ensures that any changes in the value of an asset can be attributed to that specific trustee.

Generally, the trust deed includes the rules deciding the receipts and disbursements. If there are no such rules, then the fiduciary may refer to the Uniform Principal and Income Act.

Separately, the fiduciary should take into account the following points when preparing the accounting report:

- The trust or estate must have got all the statements and supporting documents.

- Distribution to beneficiaries must be in accordance with the governing instrument.

- If the distribution to beneficiaries is not on the same date, then the distribution needs to be equalized.

- Proper identification and analysis of nonstandard transactions.

- The fiduciary should allocate the fees accurately between principal and income in accordance with the governing instrument or the state law.

- The fiduciary should ensure that the trust has all interest and dividends and is properly recorded.