Meaning of Accounting Information

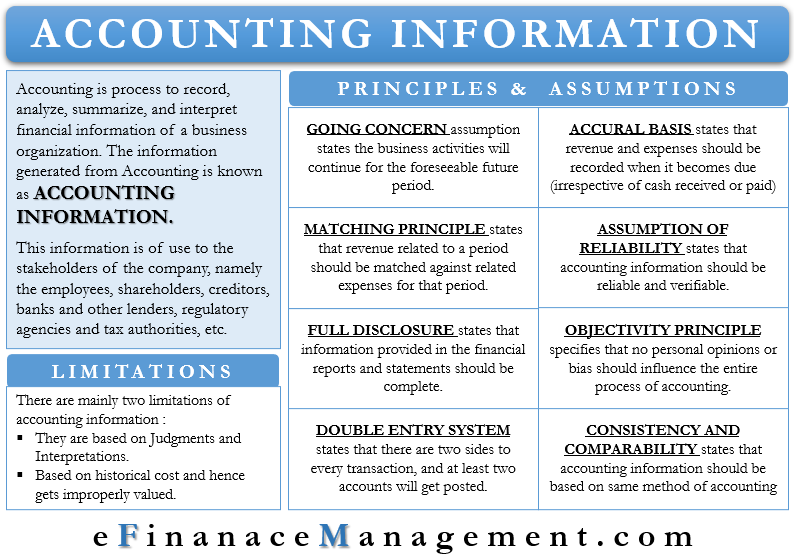

Accounting is the process of recording, analyzing, summarizing, and interpreting the financial information of a business organization. Accounting information thus generated is of use to the stakeholders of the company, namely the employees, shareholders, creditors, banks and other lenders, regulatory agencies and tax authorities, etc. It is the only way or language through which the organization can communicate with the internal and external world.

Accounting information is fed into an accounting information system that uses computers to process data. It records and tracks all the accounting activity of the business by making use of information technology systems and resources. The reports generated by the system are of use both internally within the company and externally for other stakeholders and users.

Main Guiding Principles and Assumptions

Going Concern Basis

Accounting information remains based on the principle that the company has an infinite life. The business activities will continue for the foreseeable future period. This assumption supports the valuation of assets based on the historical cost method, i.e., at their original purchase price or installation cost. It allows the company to charge depreciation regularly and avoid the impact of change in the value of assets to influence financial performance.

If we do not follow the going concern principle, assets valuation will happen at its current market value, assuming that the company can close operations anytime. And that may not reflect the actual value of the assets.

Accrual Basis of Accounting

Accounting reports should is prepared using the accrual basis of accounting, wherein revenue is deemed to be earned when the transaction takes place. And this is irrespective of the fact of whether and when physical cash or money is exchanged or not. Similarly, expenditure recognition happens when the company receives the goods or services. In other words, whenever the expense becomes due, it gets recorded irrespective of when the actual payment takes place.

Matching Principle

The idea of accounting is to correctly record all the financial transactions and ultimate determination of the income or profit and loss from the operations. Hence, it is necessary and preferable to account for all revenue and expenses pertaining to the same accounting period or pertaining to the income or costs recorded. If revenue has been recognized and recorded, then it becomes necessary that all the expenses for the period and cost of goods sold related to revenue are also recorded. (Read more about Matching Principle)

Assumption of Reliability

Accounting information should be reliable and verifiable. It would make it possible to authenticate the information and record and an independent audit thereof. It should be complete and should lead to a true and fair view of the financial standing and data of the company.

Full Disclosure

The information provided in the financial reports and statements should be complete. In other words, it should not misrepresent any facts or avoid disclosure of any material facts, or incorporate and misleading facts. It improves the credibility of the company amongst the investors, creditors, shareholders, and lenders.

Also Read: Accounting Principles

Objectivity Principle

The sole objective of accounting is to record the transaction to give a true and fair picture. Therefore, the accuracy of the data becomes of utmost importance. Moreover, while recording, no personal opinions or bias should influence the entire process. Because the moment personal opinions start interfering, the ultimate result and objective become an influenced one. Hence, it is a standard practice to maintain and keep all supporting evidence for all transactions to avoid such influence. And these can be in the form of and may include vouchers, receipts, invoices, quotations, approvals, measurement details, etc. All this increases the reliability of the records to a great extent.

Double Entry System or Balancing Equation

World over, commercial organizations mostly use a double-entry system of accounting for recording all the financial transactions. As per this system, there are two sides to every transaction, and at least two accounts will get posted. And these two sides are Debit and Credit. Moreover, for every entry or record, the total of both sides should match, should remain the same, or else there is an error.

Consistent and Comparable

Accounting information should be based on the same method of accounting over various accounting periods. In other words, frequent and year-on-year changes in the accounting system should not be there. Instead, a consistent methodology should be used. And for any material change, there should be a justifiable reason. And that should have been disclosed in the final reports and statements.

It should be possible to compare accounting information between the two companies. Reports should follow a consistent format over some time.

Also, the information flow should be proper and timely so that reports come out consistently. Delayed information can be harmful to both the company and the stakeholders, and profitable opportunities may get missed.

To achieve consistency and uniformity of reports and information across the companies, there are specific guidelines issued by each country. At a universal level, there are two types of guidance available – US GAAP and IFRS. Most of the states follow one of these guidelines.

How is Accounting Information used?

As we discussed in the opening para, accounting information is quite crucial and the only way to communicate to the world about the financial status of an entity. So, it has multi-dimensional usage – financial accounting, managerial accounting, and cost accounting. Moreover, at the user level, it is of use to the company, managers, investors, shareholders, lenders, creditors, etc.

Financial Accounting

Financial accounting primarily focuses on providing financial information to stakeholders and users outside the company. Companies listed on the stock exchange have to periodically file their financial statements and reports with the economic and regulatory body of the respective country. The general public can access these reports and use them for their analysis and other purposes.

The reports are made as per the framework provided by the Generally accepted accounting principles (GAAP), IFRS, or any other framework as deemed correct by the regulatory body.

To summarize the entire voluminous transactions of the whole year, usually, three important statements or financial reports are prepared:

Income and Expenditure Statement

It is also termed as Profit & Loss Account, which shows the final result of the commercial operations of the entity. In other words, it indicates whether there is a profit or loss and the quantum thereof. All the income and expenses that took place during the accounting period of the entity land up or flow to this statement. While routing this income and expenses to the income statement or profit and loss account, the accrual basis of accounting and the matching principle is kept in mind.

All the income remains on the right side of the statement, and all the expenses are on the left. After that, the cost of goods sold and all the expenses for the period are deducted from the total revenue. And if the revenue is more, it is the profit, and if the expenses are more, then it is a loss during that period.

Cash Flow Statement

Cash flow statement, as the name suggests, shows the movement of cash that happens in the company during the reporting period. It is the actual cash that the company receives and spends. The statement recognizes and is a combination of three types of cash flows: cash-flow generating from business operations, cash-flow generating from investing activities, and cash flow generating from financing activities.

Balance Sheet

The Balance-Sheet is the mirror image or picture of the financial strength and standing of the entity as on that particular date. Moreover, following the double-entry system, the total of the balance sheet on both sides should match.

There are details of liabilities on the left side of this statement. Those are shareholders funds, including reserves and surplus, and outside liabilities, including long-term loans, short-term loans, sundry creditors, and other liabilities. On the right side, there remain the details of the assets owned by the entity. And all that may consist of fixed assets, investments, inventory, cash and cash equivalents, sundry debtors, etc. While preparing this statement, addition or deduction for the net profit or loss happens from the equity.

Managerial Accounting

Managerial accounting reports are of use internally within the organization. Users of such statements are generally the management and the employees. Accounting information is the basis for preparing reports that are flexible in nature and format. Because these are used internally, also, they need not follow some accounting frameworks such as the GAAP.

Correct, timely, and complete accounting information is vital. Because these reports have to be prepared frequently and as the need arises. Business managers have to plan, control, and decide which they may require customized or specialized reports. They may need to do a cost-benefit analysis, check costs and expenses, find the correct pricing and break-even point of a product or evaluate the financial performance of different cost centers regularly.

Accounting information is the backbone of any organization. It can fail and be destroyed if accounting information and related systems are not available. Apart from fulfilling the above-stated uses, correct information is vital for other purposes too.

Coordination between Departments

A proper flow of accounting information between departments is a must for the successful closure of a business transaction. Information through appropriate channels and systems has to flow right from receiving an order to producing it by making requisite purchases of consumables and raw materials to making the sale and then finally realizing the payment for it.

All these departments can coordinate between themselves only when they receive uninterrupted information.

What are the Limitations of Accounting Information?

Accounting information is data that has its limitations. A few of them are:

Based on Judgments and Interpretations

The basis of accounting information is the judgment, estimates, and interpretations of the managers many times. Hence, it can be vulnerable, full of bias, and not always accurate. For example, if a product comes with a replacement guarantee of five years, how and when should the manager recognize a profit? Recording of sales and profit may have been done in the current accounting period. But it may come back as a return after some time. Therefore, it may be a loss for the company eventually after booking the profit for the same.

Improper Valuation

Such information is usually based on the historical cost principle and does not value assets at their fair market value. Thus, it becomes impossible to value a business correctly at any point in time.

Final Words

Recording every financial transaction through a well thought of and robust accounting system is extremely vital for business. Without this, it will be quite challenging to operate smoothly and correctly because these details are essential at every stage and for dealing with the outside world. Moreover, timeliness, reliability, transparency, and consistency are key to a sound system. An entity makes a decision every time based on these data and details; hence, if the data is accurate and proper, the effectiveness of the decision increases and vice versa.

Quiz on Accounting Information

This quiz will help you to take a quick test of what you have read here.

Detail information on accounting information is satisfactory.

No comment.

Thank you